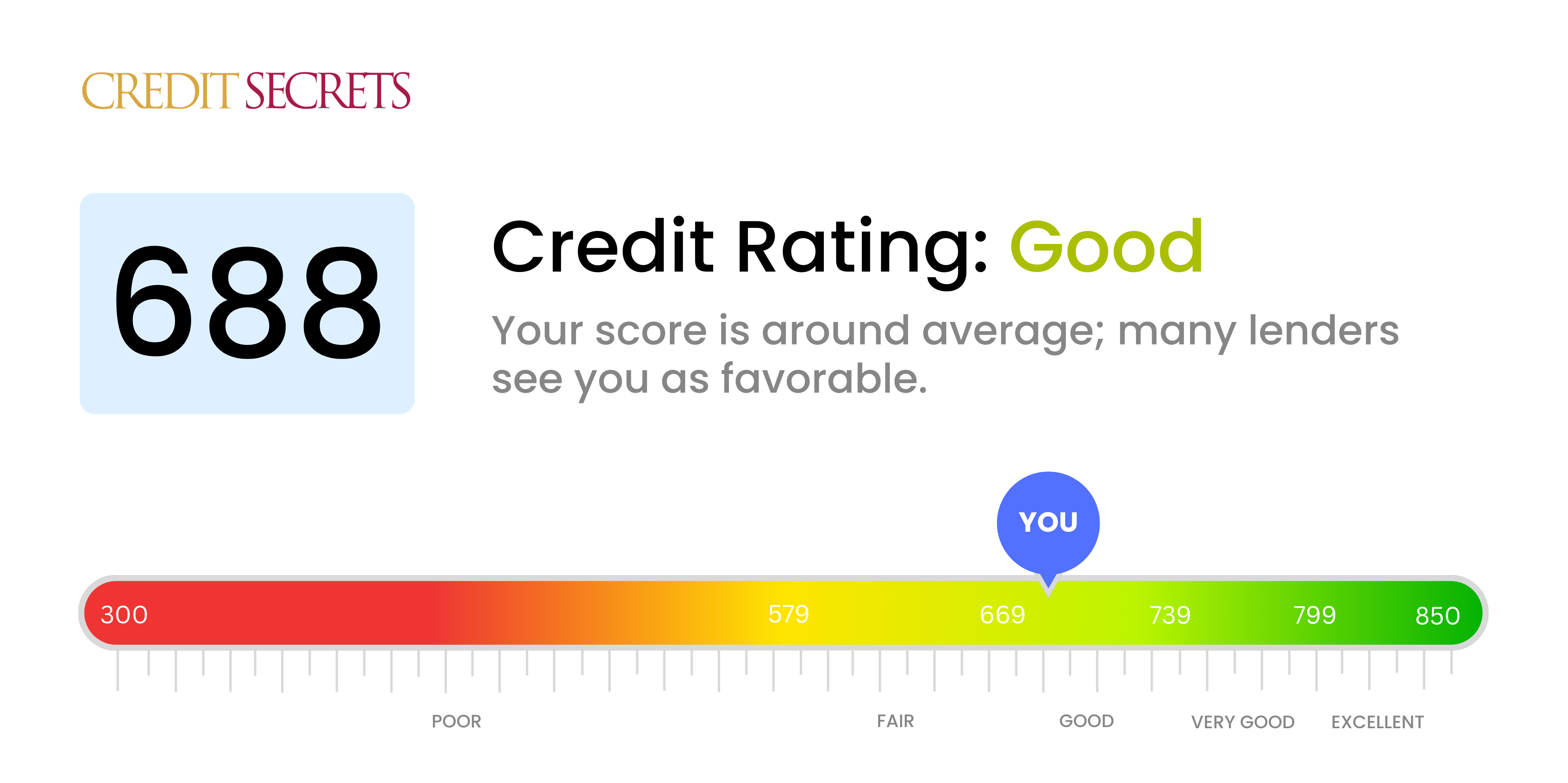

Is 688 a good credit score?

A credit score of 688 falls into the 'Good' category. This typically means that you are fairly responsible with your credit management, but there may be room for improvement to access even better financial opportunities and lower interest rates. Remember, every lender interprets credit scores differently, so continue implementing sound credit practices.

With a score of 688, securing loans or credit may not be too challenging, but the terms might not always be the most desirable. It might be worthwhile to take actions for boosting your score into the 'Very Good' or 'Excellent' range. With consistent effort and timely repayments, you can positively affect your credit health for more beneficial financing options in future.

Can I Get a Mortgage with a 688 Credit Score?

If you have a credit score of 688, there is a moderate chance of you being approved for a mortgage. This score is within the 'fair' range, which signifies that you have a fairly stable financial history, although there might still be some areas for improvement.

While a credit score of 688 isn't 'bad', keep in mind that higher scores often lead to better mortgage terms and interest rates. Mortgage approval isn't just about your credit score; lenders consider other factors like your job history, income, and the amount of debt you carry. Should you pass these factors, you can expect detail-oriented paperwork in the mortgage approval process, which may include tax returns, bank statements, and other income proofs. This process takes time, so be prepared for a couple of weeks, or even months, before getting your mortgage approved.

Can I Get a Credit Card with a 688 Credit Score?

With a credit score of 688, you might find yourself in an advantageous position to get approved for a credit card. This score, while not the highest, is often viewed as fair by most lenders, and they typically see you as a candidate willing to repay debts on time. It's important to remember that financial responsibility is key, and understanding your credit status is the first step to maintaining good credit habits.

Given your score, a variety of credit cards could be a good fit for your situation. If you're aiming to continue building your credit, considering a secured credit card might be a good strategy. This type of card requires a deposit, which will act as your credit limit. On the other hand, if you have demonstrated responsible use of credit in the past, you might qualify for cards with higher rewards, like travel cards. Remember, it's essential to compare interest rates and benefits to choose the card that best fits your lifestyle and financial goals. The journey to financial stability is ongoing and understanding your options is part of it.

A credit score of 688 falls in the fair range and while it isn't low, it isn't considered excellent either. This somewhat middle-of-the-road score may not always guarantee approval for a personal loan, but it does leave the door open with many lenders. It's important to realize though, you might not have access to the most favorable rates and terms available.

If you have a credit score of 688 and you're seeking a personal loan, you may need to shop around a little. Different lenders have different requirements, and some might be willing to work with your score. Remember, each application could impact your credit, so tread cautiously. You should also prepare yourself for potentially higher interest rates – these are used by lenders to offset their risk. Despite these challenges though, securing a personal loan is definitely not out of reach, you just need to take a careful, measured approach.

Can I Get a Car Loan with a 688 Credit Score?

A credit score of 688 is generally right on the bubble between fair and good. When applying for a car loan, lenders typically look for a score above 660 to offer better terms. A score of 688 might land you a loan, but be prepared for possibly higher interest rates compared to someone with an excellent score.

Keep in mind, though, that a credit score isn't the only factor lenders consider. They may also look at income, employment history, and other elements of financial stability. It's prudent to shop around for the best terms and rates. Remember, car purchasing isn't a race, but a journey. With a 688 credit score, you're already on the right track.

What Factors Most Impact a 688 Credit Score?

Grasping your credit score of 688 is key to improving your financial standing. There are several significant factors probably contributing to this score.

Credit Utilization

Influence from high credit utilization might be likely at this score, indicating excessive use of credit relative to your limits.

How to Check: Browse through your credit card statements. See if balances are close to or exceeding credit limits, ideally utilization should be less than 30%.

Payment Consistency

Your payment consistency might play a role in a score around 688. Regular, on-time payments enhance your score.

How to Check: Go through your payment records. Check if all payments have been conducted in a timely fashion, as late or missed payments can negatively impact your score.

Credit Mix

Lack of a diverse credit mix might be a factor with a score at this level. Having a variety of credit signals your ability to manage multiple accounts.

How to Check: Look over your credit report for the types of active credit you have, such as credit cards, auto loans, or a mortgage.

Recent Credit Inquiries

Too many recent credit inquiries is another possible factor influencing your score of 688.

How to Check: Review your report for hard inquiries. Excessive inquiries from lenders could indicate financial instability.

Potential Errors

Finally, mistakes on your credit report may also lead to a score of 688.

How to Check: Carefully read through your report. Highlight and dispute any incorrect items which might be dragging down your score.

How Do I Improve my 688 Credit Score?

With a credit score of 688, you’re on the cusp of moving from an average to a good credit rating. With a few prudent steps, you can certainly boost your credit health. Here’s what you should focus on:

1. Keep Your Credit Utilization Low

Your credit score is impacted by how much of your total available credit you’re utilizing. Aim to keep your overall credit utilization under 30% and even lower if possible. This may require paying down credit card balances and potentially seeking credit limit increases.

2. On-Time Payment History

Your payment history notably influences your credit score. Ensure all bills including utilities, credit cards, and loans are paid on time. Setting up automatic payments can be a helpful tool to ensure no payments are missed.

3. Avoid New Debt

Don’t apply for new credit accounts frequently. Each application can cause a minor drop in your credit score and several applications can add up. Unless necessary, try to limit such activity.

4. Monitor Your Credit Report

Regularly check your credit reports. This allows you to correct errors that may be harming your credit score and gives you an idea of what you’re doing right or wrong regarding your credit behavior.

5. Maintain Long Standing Accounts

The longer your accounts have been open, the better it is for your credit score. This highlights your ability to manage credit over the long-term – a key factor considered by lenders.