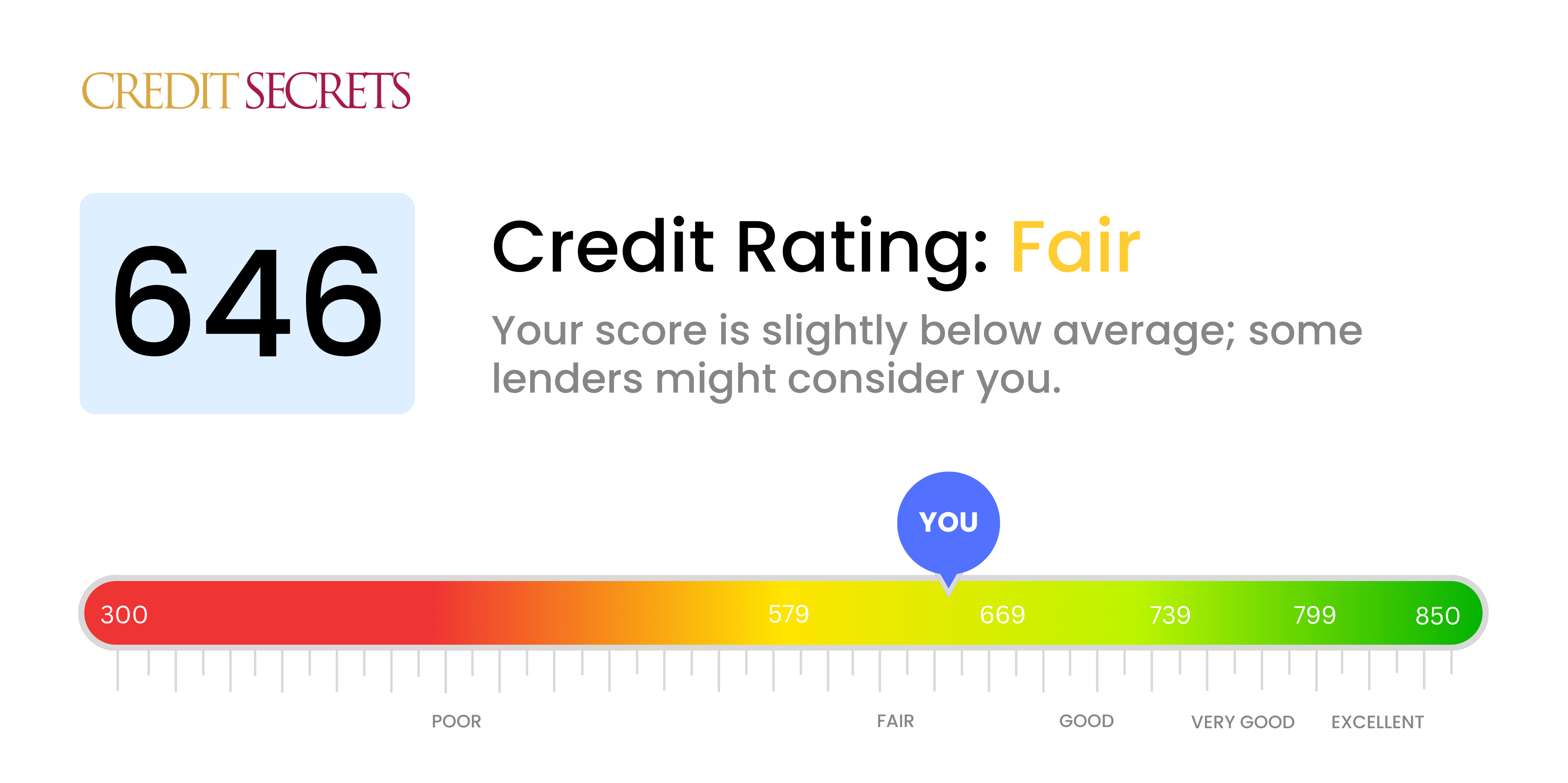

Is 646 a good credit score?

Unfortunately, a credit score of 646 is rated as fair, not reaching the threshold for a good credit score. With a score in this range, you might find some lenders are hesitant to give you credit or may charge higher interest rates due to the increased risk perceived.

However, don’t be discouraged. This is absolutely an area you can improve in. By making regular on-time payments, keeping your credit balances low, and avoiding new debts, you can progressively enhance your credit score and move towards a stronger financial future. Remember, credit recovery takes time, but every step forward is progress.

Can I Get a Mortgage with a 646 Credit Score?

With a credit score of 646, mortgage approval might be challenging but it's not impossible. Lenders typically prefer credit scores that are over 700, as it indicates a responsible credit use and less risk for them. Your credit score might be seen as borderline and hinge towards a higher risk, but it's not defined as bad. Keep in mind, the credit score can impact the interest rate you will be offered.

Nevertheless, don't lose hope. Some lenders may be willing to work with you, especially those who take other factors into account, like employment history and income. Additionally, federal-backed mortgages might be an option, as they sometimes have more relaxed credit requirements. Start by exploring all your options and have a clear and realistic financial plan. Although a higher score certainly comes with more opportunities, remember, with patience and timeliness, your scoring situation can be improved. So, keep head high and be optimistic about your financial future.

Can I Get a Credit Card with a 646 Credit Score?

Having a credit score of 646 may put you in a delicate spot, but it's not a total brick wall when it comes to credit card approval. This score is perceived by numerous lenders as slightly risky. It might signal past monetary hiccups or a relatively recent initiation into credit usage. Despite this, it's essential to confront your financial stance with honesty but also with hope.

You might face slightly higher interest rates due to perceived risk from lenders. However, it's still possible to obtain certain types of credit cards, including secured cards. These cards can be acquired easier and require a deposit that functions as your credit limit. They can be helpful tools that gradually assist in boosting your credit score. In some cases, it might be wise to consider adding a trustworthy co-signer to your card, or maybe explore the realm of pre-paid debit cards. Remember, these solutions will not rectify your credit overnight, yet they serve as practical steps towards achieving a healthier credit landscape.

If you have a credit score of 646, it may be challenging to secure approval for a traditional personal loan. Lenders might deem you a risk due to this score and may be hesitant to offer loans. While it might be a hard pill to swallow, understanding the implications of your credit score can help you explore realistic alternatives and proceed accordingly.

There are alternative routes to consider if a traditional personal loan is out of reach with your current credit score. Look into options like secured loans, which require collateral, or peer-to-peer lending platforms, which can sometimes have more generous credit requirements. You may also investigate co-signed loans, where another individual with a better credit score pledges to pay back the loan if you can’t. Nevertheless, please keep in mind that such alternatives often carry higher interest rates and less agreeable terms, alluding to the increased risk perceived by the lender.

Can I Get a Car Loan with a 646 Credit Score?

If your credit score is sitting at 646, you might be feeling a little uncertain about your chances of being approved for a car loan. Though not ideal, it's important to remember that this isn't a firm 'no'. Most lenders generally prefer a score of 660 or higher when considering automotive loan applications, so you're not far off.

The simple reality is, with a score of 646, you could encounter slightly higher interest rates as your score places you in a bit of a riskier category for lenders. But don't be dismayed, this isn't a dead end. There are lenders who cater specifically toward individuals with credit scores in your range. Be mindful though, their interest rates can often bit a bit more on the higher side. It's their way of balancing the risk they're taking on. So while looking for car loans may require a little extra due diligence on your part, remember, obtaining that loan isn't out of reach.

What Factors Most Impact a 646 Credit Score?

Understanding your credit score of 646 is an important stepping stone towards enhancing your financial performance. To effectively boost your score, you must first decipher the relevant factors impacting it. Every credit journey is personalized and presents unique opportunities for growth and learning.

Payment History

Your payment history plays a significant role in shaping your credit score. Exhibit of late payments or any default on past debts could be bringing down your current score of 646.

How to Check: To verify, examine your credit report for any late or missed payments. Try to recall if you've been tardy on some payments in the past - these could be responsible for the current state of your score.

Credit Utilization Rate

Your score may be affected if your credit utilization ratio is high. If you're consistently near or over your credit limit, this could be hindering a better score.

How to Check: Review your credit card statements to see if your balances are consistently close to the allowable limits. Strive to maintain lower balances relative to your credit limits.

Depth of Credit History

Having a short credit history might be affecting your score negatively.

How to Check: Check your credit report for the duration of your oldest and newest accounts and the average age of all your accounts. Think about whether you have been opening new accounts frequently.

Credit Mix and New Credit

A good credit score can be affected by the diversity of your credit types and how responsibly you handle new credit.

How to Check: Evaluate the different types of credit you hold, the likes of credit cards, retail accounts, installment loans, and mortgage loans. Also consider if you've been diligent with new credit applications.

Public Records

Public records such as bankruptcies or outstanding tax liens could be dramatically reducing your score.

How to Check: Scan your credit report for public records. It's essential to take urgent corrective measures, where necessary, to fix these negative impacts.

How Do I Improve my 646 Credit Score?

With a credit score of 646, you’re not too far off from the ballpark of a good credit segment. Specific measures can help make the situation brighter. Let’s look at the most beneficial and applicable actions you can take:

1. Regularly Monitor Your Credit Reports

Identity theft or errors can drastically affect your credit score. Regularly check your reports from all three major credit bureaus to ensure the information is accurate and up-to-date. Mistakes can be disputed and corrected, which may boost your score.

2. Aim for Lower Credit Utilization

Your credit utilization rate should ideally be below 30%. This can be achieved by keeping your balance low or increasing your credit limit. Evidence of financial discipline can lead to a rise in your credit score.

3. Maintain Older Credit Accounts

Length of credit history contributes towards your credit score. While it’s natural to consider closing unused credit cards, keep your oldest accounts open and in good standing to show a longer credit history.

4. Make Timely Payments

Timely payment of bills factors significantly into your credit score. Ensure your monthly obligations such as utility bills, credit card payments, and loan installments are paid on time, every time. Set up automatic payments to avoid missing them.

5. Piety Towards Installment Loans

If you have an installment loan such as a mortgage or an auto loan, regularly and punctually paying it down is viewed favorably by credit scoring models. Continuing to do so should help improve your score.