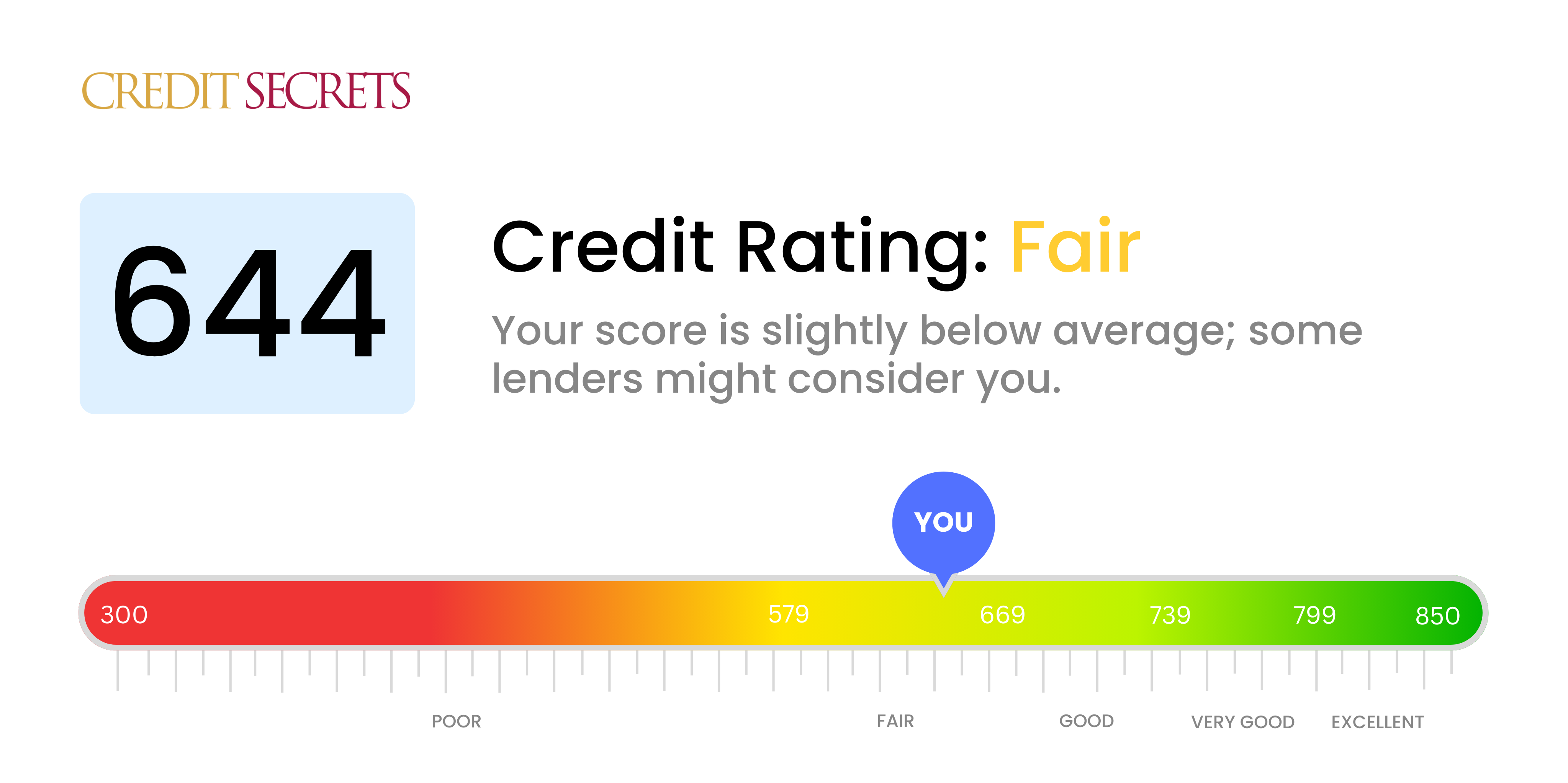

Is 644 a good credit score?

With a credit score of 644, your score falls into the 'Fair' range. While this isn't the lowest tier, it indicates that you may encounter some difficulties when applying for loans or credit, and you may face higher interest rates compared to those with higher scores.

While you may not have the best available terms and conditions, you still have opportunities for credit approval. It is also essential to note the potential for improvement - staying consistent in paying your bills on time, keeping your credit balances low, and being mindful of how many new accounts you're opening can help increase your score. Remember that you have the power to improve your credit score and attain better financial opportunities.

Can I Get a Mortgage with a 644 Credit Score?

With a credit score of 644, securing a mortgage could be a bit of a challenge. Most mortgage lenders look for a score of 660 or higher, but don't lose hope. It's not necessarily an automatic disqualification, but it might make the process a bit more demanding and result in higher interest rates.

Why is this the case? A credit score of 644 falls into the 'fair' category, which is seen as a moderate risk to lenders. They may question your ability to meet monthly mortgage payments based on this score. Mortgage lenders may also offer you less favorable terms such as higher interest rates or requiring a larger down payment.

There are alternatives available for someone with a score in this category. Certain home loan programs catered to individuals with fair credit or first-time homeowners might be options worth exploring. On the bright side, having a clean history of timely payments and a stable income can potentially offset a lower credit score. Keep striving to build up your credit as it will open up more opportunities in the future.

Can I Get a Credit Card with a 644 Credit Score?

With a credit score of 644, you might find that obtaining a typical credit card could pose some challenges. This score might be perceived by lenders as a fair credit rating, meaning there may have been some past hiccups with your credit history. However, it's fundamental to remember that recognition of your current financial standing is a crucial step towards a healthier financial future.

In light of your credit score, you'd potentially be a good candidate for cards designed specifically for individuals with fair or average credit scores ratings. There are credit cards on the market that cater to this category and you might want to explore those. Starter cards, or lower-tier rewards cards, could be beneficial to start improving your score while also gaining some benefits. Secured cards, which involve a deposit that becomes your limit, might also be a good option. The interest rates for these types of cards tend to be slightly higher due to the perceived risk by financial institutions. However, timely repayments and responsible credit utilization can aid in migrating towards better credit standings. Always remember, your current situation is not permanent, but just a pit stop on your financial journey.

With a credit score of 644, your chances of receiving approval for a personal loan may not be as high as they could be. As hard as it may be to hear, this score sits just below the threshold that many traditional lenders prefer when making their decisions. They may perceive a score of 644 as carrying a certain level of risk, which could impact your ability to secure a loan on customary terms.

Although the mainstream path may seem blocked off, remember that many other options exist. Secured loans using a valuable asset as collateral, and co-signed loans with the help of a strong-credit acquaintance, are both potential routes. Peer-to-peer lending platforms might also offer more flexibility. That said, it's vital to take note that these alternatives generally carry higher interest rates and stricter terms, since they pose a greater risk for lenders. These challenges are nothing more than obstacles, and obstacles can be overcome.

Can I Get a Car Loan with a 644 Credit Score?

With a credit score of 644, you might find yourself facing some hurdles while seeking approval for a car loan. Most of the lenders favor credit scores above 660 for prime interest rates, and anything below that can put you in a less favorable bracket. Considering your score, you belong to this less favorable category which could lead to higher interest rates or even potential loan denial. This is primarily because a lower credit score can suggest a higher risk for lenders, exhibiting potential issues with repaying loans from past experience.

Don't be overly worried, though. A credit score of 644 isn’t a full stop on your path to car ownership. Some loan providers are inclined to work with individuals holding slightly lower credit scores. However, remember to tread carefully here, as these loans could have considerably higher interest rates to compensate for the heightened perceived risk. Yes, the journey may be a bit tricky, but with a bit of caution and careful scrutiny of loan terms, getting a car loan can indeed be a reality.

What Factors Most Impact a 644 Credit Score?

With a score of 644, you're positioned to elevate your financial standing and it’s crucial to understand the components that affect your score. Identifying these factors is a vital step towards financial wellness. Let's examine them carefully.

Payment History

Inconsistent or delayed payments can account for a significant decline in your credit score. Each case of a missed or late payment affects your score.

How to Check: Acquire your credit report and look for any late or missed payments. Reflect on any instances of delayed payments, as these are typically detrimental to your score.

Credit Utilization

Credit utilization is the ratio of your outstanding credit balances to your credit limit. A high credit utilization ratio may impact your score negatively.

How to Check: Evaluate your credit card statements to identify if you're nearing your credit limits.

New Credit Applications

Frequent applications for new credit can signal anticipated financial strain to lenders, who may question your ability to manage debt.

How to Check: Evaluate your most recent credit inquiries. Reduction in the number of new credit requests can help improve your score.

Credit Mix

Your ability to manage different types of credit, including installment loans, credit cards, and mortgages, contributes to your overall credit score.

How to Check: Review your credit report for a variety of credit types. Diversifying your credit can improve your score.

Account Age

A shorter credit history can lower your score. Creditors often prefer to see a longer, positive credit history.

How to Check: Verify the age of your credit accounts by analyzing your credit report. An older, well-managed credit account can uplift your score.

How Do I Improve my 644 Credit Score?

With a credit score of 644, you rest on the threshold of poor and fair. While your positioning could be worse, there’s substantial room for improvement. The following concrete steps outlined are specifically selected to help lift your score from its current standing:

1. Check Your Credit Report for Errors

It’s crucial at your score level to scrutinize your credit report for any inaccuracies or inconsistencies. Any errors you spot can be disputed to potentially boost your score.

2. Prioritize Payment History

Commit to paying every bill on time, every time from now on. A consistent payment history is instrumental in your credit score calculation. Create reminders or set up automatic payments to help.

3. Strategic Debt Repayment

Focus on steadily reducing your overall debt. Target your high-interest debts first or implement the snowball method tackling smaller debts initially helps to keep the momentum up.

4. Keep Credit Utilization Low

Credit utilization ratio counts for around 30% of your score. Aim to keep your credit balances below 30% of your available credit limits.

5. Apply for New Credit Sparingly

Too many hard inquiries can negatively impact your score in the short term. Only apply for new credit when truly necessary.

Please note, these changes aren’t instantaneous but demonstrating ongoing financial responsibility will gradually improve your score.