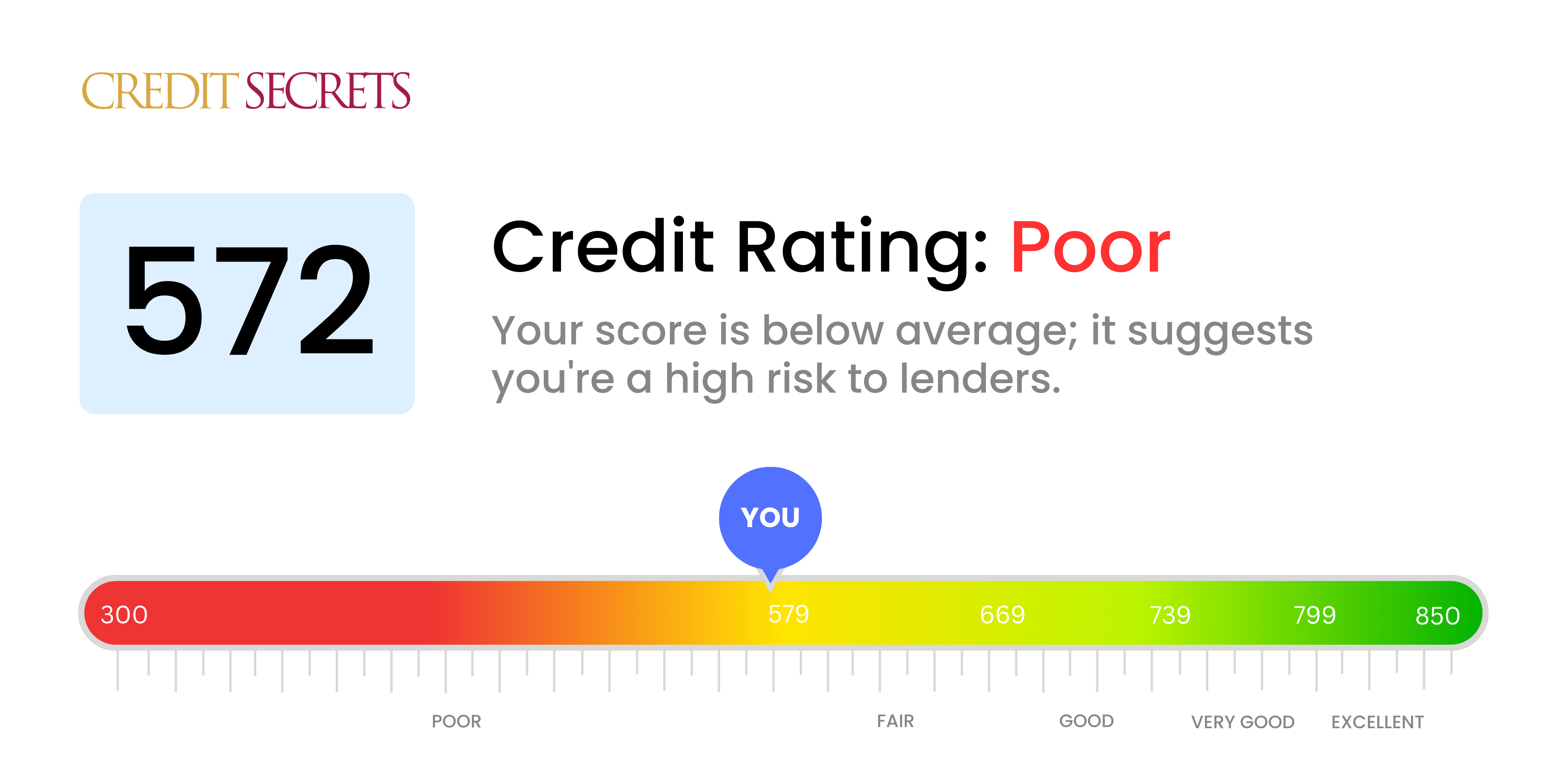

Is 572 a good credit score?

With a credit score of 572, your credit health is currently in the "poor" range. This may make achieving financial goals like securing loans or low-interest credit cards more challenging, but remember, this is not a permanent situation.

While you may currently confront higher interest rates or stricter lending terms, there are numerous actions you can take to boost your credit score over time. Regularly monitoring your credit, making payments on time, reducing your overall debt, and not opening too many new credit lines at once are some of these actions. Always remember, improvement is completely within your reach!

Can I Get a Mortgage with a 572 Credit Score?

Having a credit score of 572 puts your position slightly below the average level most lenders typically look for when applying for a mortgage. It might indicate few past hitches such as late payments or defaulting on credit card debts. While it isn't impossible to get approved with this score, it could be more challenging and may demand higher interest rates.

Do not get disheartened. There are numerous ways to navigate this. You may consider seeking mortgage options specifically designed for individuals with lower credit scores. Or, consider focusing on other factors that lenders consider such as income stability, debt-to-income ratio, and the size of your down payment. A larger down payment or a co-signer with a higher score could increase your chances of securing a loan. Although this might feel tough at the moment, remember you're taking the first steps to a better financial future.

Can I Get a Credit Card with a 572 Credit Score?

A credit score of 572 is typically seen as something of a problem zone by lenders when considering credit card applications. It's not the worst score, but it does suggest previous financial hiccups that may cause lenders to be hesitant. Navigating your financial journey with this score may be tough, but it's not impossible. Being aware of your credit standing is a vital early step in finding your path to financial success.

Bearing in mind the challenges linked to a 572 credit score, exploring alternatives like secured credit cards might be a wise move. These cards need a deposit equal to your credit limit. This makes them easier to acquire and can help improve your credit over time. Other possible routes might include seeking a co-signer or exploring pre-paid debit cards. These options aren’t quick fixes, but they can be great aids in working towards improved credit health. Be aware that interest rates on any credit you are able to acquire may be quite high, as your score indicates to lenders a higher level of risk.

Having a credit score of 572 might impose certain limitations when trying to secure a personal loan from traditional lenders. This score is usually considered subprime, which indicates a higher risk to the lender. This may result in your loan application being denied. Please understand that these are standard industry practices and do not reflect your personal worth or potential.

Being faced with a credit score in this region generally narrows your borrowing paths, but it does not entirely cut you off. There's still a possibility of considering alternatives such as secured loans that involve providing collateral or co-signed loans that engage another person with better credit. Peer-to-peer lending platforms could also be an option, but be aware that such alternatives often come with higher interest rates and less favorable terms due to the increased risk to the lender. Yet, these could serve as viable steps towards improving your financial future.

Can I Get a Car Loan with a 572 Credit Score?

Securing approval for a car loan with a credit score of 572 may prove to be a tough task. The reason being that most lenders are interested in credit scores above 660 for this kind of agreement. Scores that fall below 600 are typically labeled as subprime. In this case, your 572 score rests in this subprime bracket. Lower credit scores often signify a higher risk to lenders, indicating potential issues with repayment of loans in the past.

Yet, all hope is not lost. While it might be harder, it's not impossible to secure a car loan with this score. There are some lending institutions known for working with individuals who have lower credit scores. But, it's crucial to be aware that these options often come with high-interest rates to offset the perceived high risk. Though the journey may have a few more obstacles, obtaining a car loan is still a feasible goal. Just remember to look over the terms attentively and weigh the pros and cons before making a decision.

What Factors Most Impact a 572 Credit Score?

A credit score of 572 indicates room for improvement on your financial journey. Let's delve into the elements that may affect this score to help you rebuild your credit health. Failure to identify these elements prevents you from successfully repairing your credit rating.

Payment Record

Payment records heavily impact your credit score. Late payments or instances of non-payment significantly lower your score. How to Check: Examine your credit reporting for any late or defaulting payments. It may be your past payment habits affecting your credit ranking.

Credit Use Ratio

A higher credit use ratio can lead to a lower score. Using a high percentage of your available credit signals risk to lenders.How to Check: Check your credit card balance to understand your credit use ratio. A credit card balance close to the limit could be causing your score to drop. Aim to use less of your available credit.

Age of Credit

A shorter credit age could limit your credit score. How to Check: Look at your credit report to understand your credit age. Recently opened accounts may have affected your score.

Type and Number of Credit

Applying for substantial new credit within a short period and having a limited type of credit mix can affect your score. How to Check: Scrutinize your credit report for the types of credit and any recently established lines of credit. Too many new applications can lower your score.

Public Records

Public records such as relegations or tax liens can drastically influence your score. How to Check: Check your credit report for any public records. Dispute or resolve any items incorrectly listed to improve your score.

How Do I Improve my 572 Credit Score?

With a credit score of 572, you’re in the ‘poor’ range, but don’t worry, we have some practical strategies to help you boost your score:

1. Examine Your Credit Report

Request your free annual credit report and carefully review it for inaccuracies or discrepancies. Incorrect information can significantly affect your credit score. If you find any errors, dispute them with the respective credit bureau.

2. Pay Judiciously

Punctual payment of bills is crucial to improving your credit score. Make sure to pay off all your bills before the due date. Never forget, late payments can cause significant dings to your credit score.

3. Consider a Secured Loan

Qualifying for an unsecured credit card might be tough with your current score. A secured loan or a credit-builder loan could be an alternative to help you establish a record of on-time payments and improve your creditworthiness.

4. Trim Your Credit Utilization Rate

Tame your credit card balances. A lower credit utilization rate (your balance compared to your credit limit) boosts your credit score. Try to maintain a rate below 30%.

5. Authorized User Strategy

You might want to explore the option of being an authorized user on a trusted person’s credit card, with their permission of course. Ensure the card issuer reports to the credit bureaus. This strategy can help to enhance your credit score by adding their positive credit behaviors to your credit history.

Remember, improving your credit score takes time, so don’t be discouraged. By following these steps, you’ll be on the right path to a healthier credit score.