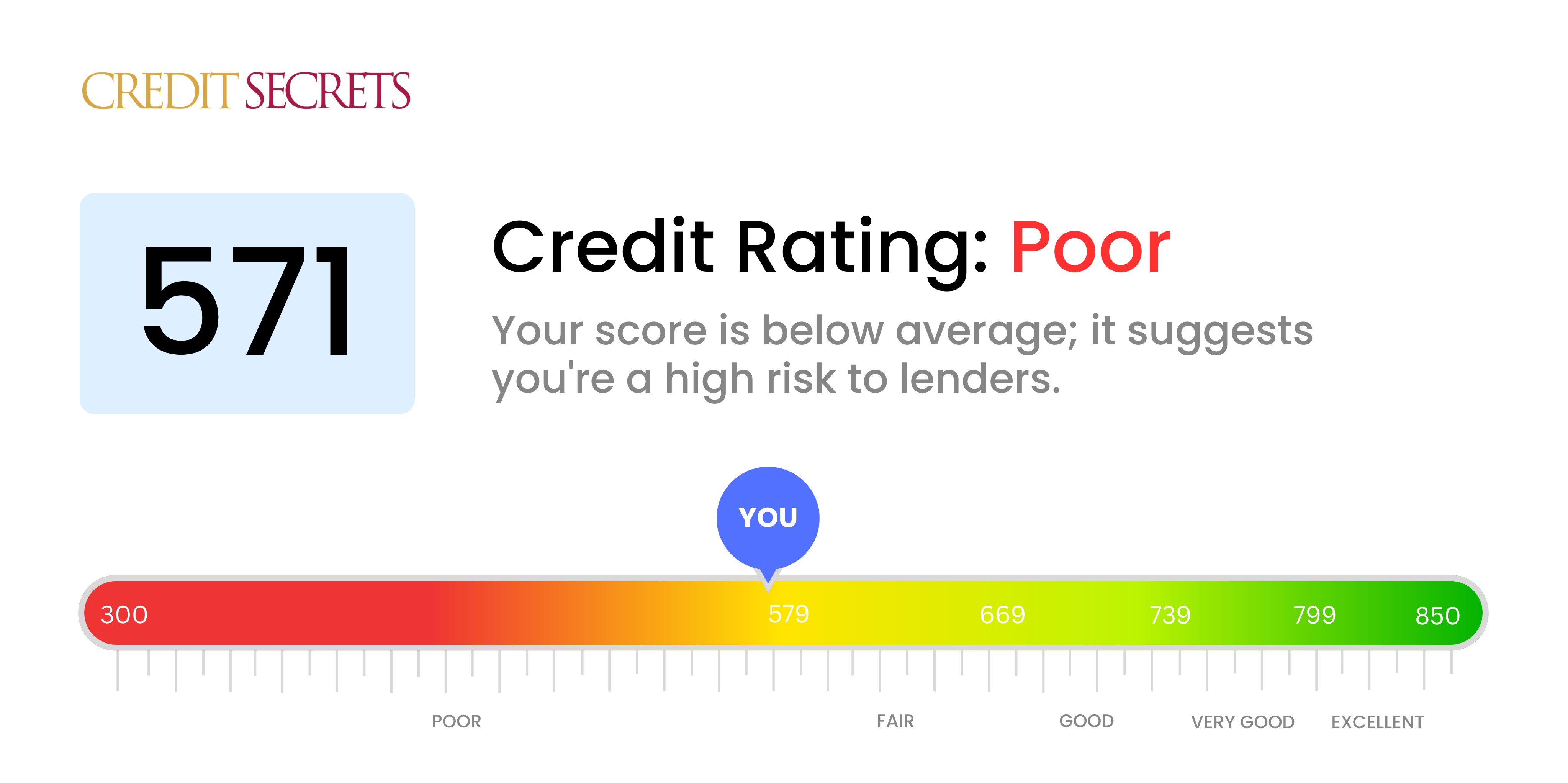

Is 571 a good credit score?

A credit score of 571 falls within the 'Poor' category. This means you may have some significant challenges when it comes to obtaining credit lines, getting favorable terms on loans, and gaining the trust of potential lenders. However, remember that the ability to improve your credit score always remains within reach.

It's likely you'll face higher interest rates and less favorable terms if you're approved for credit at all. Although these conditions may seem discouraging, improvements can be made. Consistent, long-term actions like timeliness in paying bills and keeping low credit balances could help gradually lift your score into a more desirable range.

Can I Get a Mortgage with a 571 Credit Score?

If your credit score is 571, securing a mortgage may prove a daunting task. This score is generally classed as "poor" and lies significantly below the average rating lenders usually seek for mortgage approval. Such a score can suggest a history of financial struggles, including late payments or financial mismanagement, which may deter lenders.

Though this may be a difficult time, it's not without hope. Alternatives to traditional mortgages are available, such as Federal Housing Administration (FHA) loans, that cater to individuals with lower credit ratings. FHA loans, for instance, may approve borrowers with scores as low as 500, given certain stipulations are met. However, it's important to note that lower credit scores might result in higher interest rates, so always weigh your options carefully.

And remember, today's financial situation doesn't have to be tomorrow's. There are many resources, such as Credit Secrets, that can help you gain control of your financial destiny and, over time, work towards achieving a healthier credit score.

Can I Get a Credit Card with a 571 Credit Score?

Having a credit score of 571 might make securing a traditional credit card approval tougher, but don't lose hope. Lenders may see this score as somewhat risky, and it may reflect past financial hiccups. The fact that you're looking at your credit score demonstrates your determination to improve your financial health. Remember, you're taking control of your situation, reflecting your commitment to positive progress.

With a 571 credit score, you might want to consider alternatives to traditional credit cards, like secured credit cards. Secured cards demand a deposit up front, which serves as your credit limit. This can provide an easier route to credit that can help you responsibly raise your score in time. Another suggestion would be to enlist a trusted individual to co-sign for a credit card or research pre-paid debit cards. Higher interest rates typically accompany these credit avenues to those with lower credit scores due to the perceived risk to lenders, so proceed with caution and make every payment on time to keep moving forward.

With a credit score of 571, convincing traditional lenders to approve a personal loan might be an uphill task. This score tends to raise red flags as it interpreted as a sign of high-risk lending. It doesn't portray a delightful scene, but likewise, it's important to still embrace this truth and what it suggests for your financial options.

Notwithstanding, you still have a few lanes to explore when traditional loans are not viable. Secured loans, for instance, which involve offering property or assets as collateral. Co-signed loans are another option, where you have a person with a good credit score standing in to guarantee the loan. Alternatively, there are peer-to-peer lending platforms that may work, as they might have more relaxed credit requirements. It's crucial, however, to note that these options tend to carry higher interest rates and may not offer the best terms due to the elevated risk assumed by the lender.

Can I Get a Car Loan with a 571 Credit Score?

If the credit score you're working with is 571, getting a car loan may be a tough road ahead. Looking at it from a lender's perspective, a score of 660 or above is more favorable. They see a score under 600, your 571 included, as somewhat subprime. In essence, this means because of previous payment patterns, you may be perceived as someone who might have some issues repaying loans.

But don't lose heart, your situation is not hopeless. There are lenders out there who cater to those with less-than-perfect credit scores. However, these loans may come with a heftier price: higher interest rates. The lenders do this to protect themselves from the potential risk of not getting their money back. Yet, with careful planning and a good understanding of the loan terms, getting that car loan isn't entirely out of reach. Always remember, where there's a will, there's a way.

What Factors Most Impact a 571 Credit Score?

For a credit score of 571, knowing the influential factors can help you navigate towards improving your financial standing. Each financial journey is unique and offers different lessons and opportunities for growth.

Payment Patterns

Maintaining a regular payment pattern significantly affects your credit score. Missed or late payments could be a crucial reason for your current score.

How to Check: Look into your credit report, searching for records of delayed or missed payments. Reflect on your payment habits in the past, as they impact your score.

Credit Utilization Ratio

Keeping high balances on your credit cards can negatively impact your score. If your credit card balance is close to the limit, it may be one of the main contributors to your score.

How to Check: Scrutinize your credit card statements to see if your balances are significantly high. Aiming to lower it can help improve your score.

Credit History Span

The duration of your credit history affects your credit score. A brief credit history may decrease your score.

How to Check: Review your credit report to determine the age of your oldest and newest credit accounts and the average duration of your overall accounts. The recent opening of new accounts might contribute to a negative score.

Variety in Credit and New Credit Architecture

Having a diverse range of credit and managing new credit efficiently contributes to a healthy credit score.

How to Check: Evaluate your current credit types, such as credit cards, retail accounts, and different loans, and consider if you are judicious in applying for new credit.

Public Records and Legal Judgements

Public records like tax liens or bankruptcies can cause significant damage to your score.

How to Check: Consult your credit report for any public records. Address and resolve any listed items that require attention.

How Do I Improve my 571 Credit Score?

With a credit score of 571, you are in the ‘poor’ credit category, but all is not lost. Here are straightforward steps tailored for your current credit situation that can help you ascend towards higher credit score ranges:

1. Set Up Payment Reminders

On-time payments have a significant influence on your credit score. To avoid missing payments, setup automatic payments or reminders. Regular, on-time payments can help increase your credit score over time.

2. Look Out for Incorrect Entries in Your Credit Report

It’s important to regularly review your credit report for errors. Incorrect late payments or charged-off accounts can damage your credit score. By law, you are entitled to a free report from each of the three major credit bureaus every year.

3. Apply for a Credit Builder Loan

Given your score, traditional loans may not be accessible. However, a Credit Builder loan is designed specifically to help improve your credit score. As you repay the loan, the lender reports these payments to the credit bureaus, aiding your credit history.

4. Limit New Credit Applications

Each time a lender performs a hard inquiry for a credit application, your score takes a small hit. Limiting new credit applications can prevent further decrease in your credit score.

5. Eliminate Small Debts

Paying off small balance accounts can show lenders you are committed to removing debt, which can positively affect your credit score.