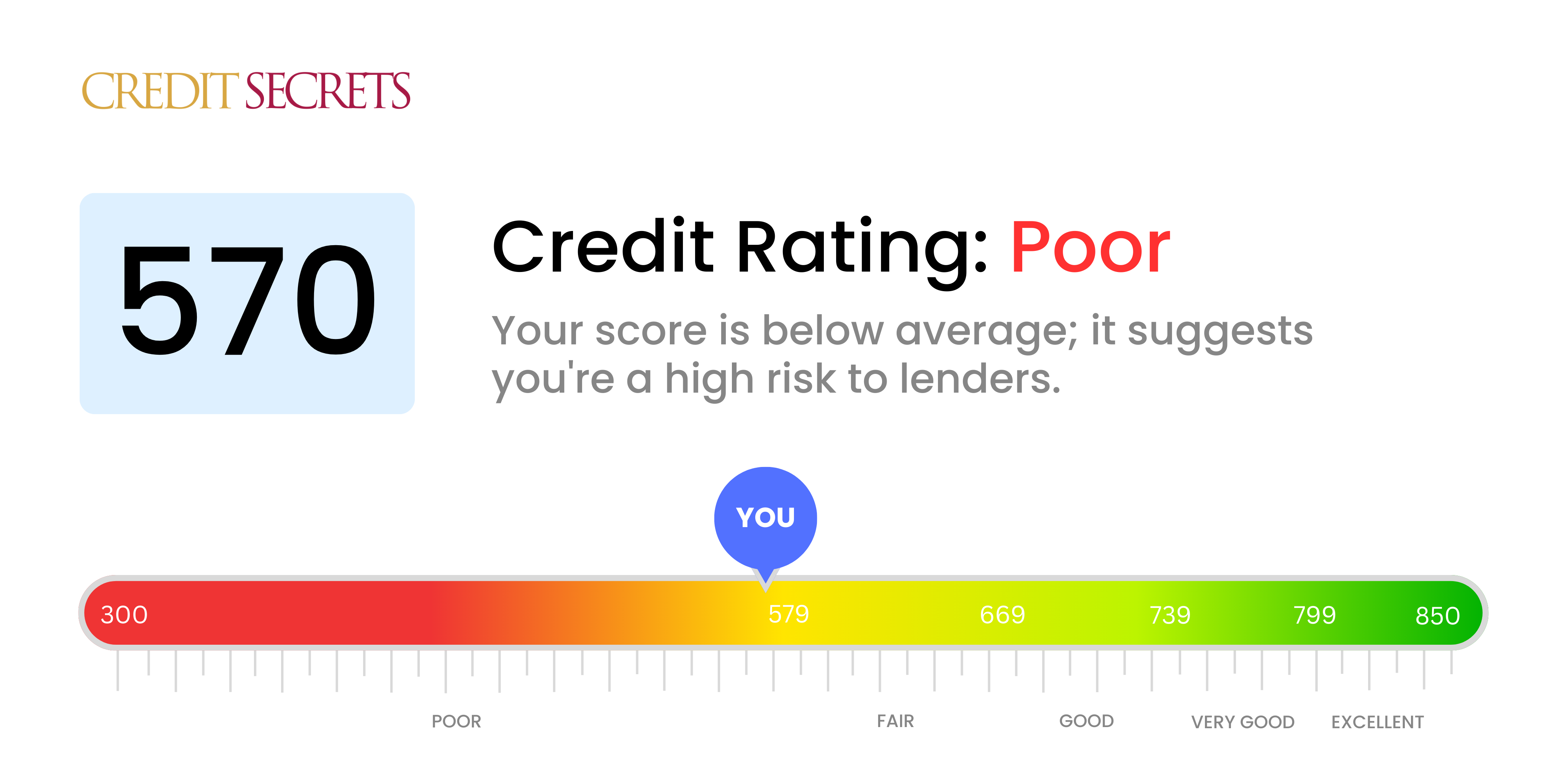

Is 570 a good credit score?

With a credit score of 570, it's clear that your financial health is not in the best shape. This falls into the 'Poor' category, showing that there's significant room for improvement. Though this score may limit your options when it comes to credit applications and interest rates, remember that you're not stuck with this score.

Even with a score of 570, there are proactive steps you can take to start rebuilding your credit. Repairing credit takes time, but with diligence and disciplined financial habits, you can work to improve your score. The important thing is to stay optimistic and dedicated to your financial journey - a better credit score is within your reach.

Can I Get a Mortgage with a 570 Credit Score?

Sadly, a credit score of 570 does not qualify as a good credit score in the eyes of mortgage lenders. It's below the minimum threshold required by most lending institutions. Consequently, approval for a mortgage with this score may be difficult. Bear in mind, a low score like this generally flags concerns about your previous credit repayments and debt management to potential lenders.

However, there’s still hope. You may want to consider alternatives or non-traditional lenders that specifically assist individuals with lower credit scores. Alternatively, government-backed loan programs such as an FHA loan may be more lenient with credit scores. Keep in mind though, these options often come with higher interest rates due to the perceived higher risk. Navigating your options could lead to an opportunity to secure a home loan, despite a less-than-ideal credit score. The key is to stay informed and diligent on your financial journey.

Can I Get a Credit Card with a 570 Credit Score?

With a credit score of 570, it may be tough to get approved for a traditional credit card. Lenders often view scores of this nature as high-risk, implying a history of financial difficulties or mismanagement. It's a tough pill to swallow, but recognizing your credit status is a crucial step towards financial improvement. Being informed means you're in a better position to make helpful decisions.

The reality of a lower score means that you might need to consider different routes to building credit. Secured credit cards are an option worth considering. These require a deposit that matches your credit limit. Secure cards can be relatively easier to get, and they can also help you build credit over time. Think about asking someone close to you to co-sign a credit card or exploring pre-paid debit cards as another alternative. While these options won't fix your score overnight, they are invaluable tools on the path to financial recovery. And bear in mind, any form of credit accessible to individuals with lower credit scores usually comes with significantly higher interest rates due to the higher risk towards lenders.

A credit score of 570 is unfortunately below what most lenders consider an acceptable risk for personal loans. This score may make it difficult for you to secure a standard loan. This is not an easy circumstance, but it's essential to understand what this score means for your borrowing options.

While receiving approval for a traditional personal loan may be tough, there are other alternatives. You could look into secured loans, which require an asset, like your car or home, as collateral. Co-signed loans are another route, where someone with a better credit score co-signs your application. Another option to consider are peer-to-peer lending platforms, as they sometimes have more flexible credit requirements. But, be aware that these alternatives can come with higher interest rates and less favorable terms, given the increased risk for the lender. Nevertheless, these are options that can provide you with the funds you need.

Can I Get a Car Loan with a 570 Credit Score?

With a credit score of 570, the path to obtaining a car loan may appear a bit challenging. Most lenders typically favor scores over 660 to offer more favorable loan terms. Scores below 600, like your 570, often fall into the subprime category. This could result in higher interest rates or even application rejection. This is because lenders see lower credit scores as a higher risk, reflecting possible struggles in repaying borrowed funds.

However, don't lose hope. A lower credit score doesn't make getting a car loan impossible. There are lenders who cater to those with lower scores. Be aware, though, these loans usually have much stiffer interest rates. The higher rates offset the risk lenders assume when offering these loans. It's a bumpy road, but with careful thought and understanding of the terms, a car loan is a possibility. So don't let your credit score discourage you, your car dream is still attainable.

What Factors Most Impact a 570 Credit Score?

In your financial journey, understanding a credit score of 570 is the first step towards improvement. Let us explore factors that are possibly holding your score at this level.

Payment History

Consistent late payments or defaults can pull down your credit score. This is likely a crucial element affecting your score of 570.

How to Check: Carefully scrutinize your credit report for any late payments or defaults. Look into recent instances of unforeseen delays or difficulties in making payments.

Credit Utilization Ratio

High credit utilization signals potential financial stress and may negatively impact your score. Your credit balance being close to the limit is likely a factor in your score.

How to Check: Review your credit card statements for balances relative to the limits. Aim to keep your balance lower than 30% of the credit limit.

Length of Credit History

A limited or short credit history could be influencing your current score.

How to Check: Check your credit report to determine the age of your accounts, ensuring that older, established accounts haven't been inadvertently closed.

New Credit and Credit Diversity

Too many new credit accounts or a lack of diverse credit types can hurt your score.

How to Check: Evaluate your credit report for the number of new accounts and the mix of credit types such as credit cards, retail accounts, installment loans, and so on.

Public Records

Public records such as tax liens or bankruptcies can negatively affect your score.

How to Check: Review your credit report for any public records. If any exist, address the situations promptly to start repairing your credit score.

How Do I Improve my 570 Credit Score?

With a credit score of 570, you’re embarking on a journey towards credit improvement and financial freedom. Here are the most actionable and key steps to consider at your current credit score level:

1. Prioritize Overdue Debts

If you’re dealing with overdue debts on your accounts, bringing these up to date should be your primary focus. The more overdue an account is, the greater its negative effect on your credit score. If you’re struggling to pay off these debts, consider contacting your creditor to discuss possible payment plan arrangements.

2. Manage Credit Utilization Ratios

High credit card balances, compared to your credit limit, can impact your credit score. Strive to lower your credit card balances to under 30% of your total credit limit, aiming for a long-term goal of less than 10%. Pay off the cards with the highest utilization rates first.

3. Consider a Secured Credit Card

Given your present credit score, a regular credit card may be hard to obtain. Contemplate applying for a secured credit card which requires a cash collateral deposit. By making small purchases and fully paying off the balance monthly, you will begin to establish a positive credit history.

4. Explore Authorized User Status

If a trusted person with good credit is willing to add you as an authorized user on their credit card, this could aid your credit score. Have them check if their card issuer reports authorized user activity to credit bureaus, as this can incorporate their positive credit behavior onto your credit report.

5. Broaden Types of Credit

The types of credit you hold also influence your credit score. Once your payment history improves with your secured card, look into other credit types such as credit builder loans or retail store cards. This diversified credit mix, with a strong payment history, can positively affect your credit score.