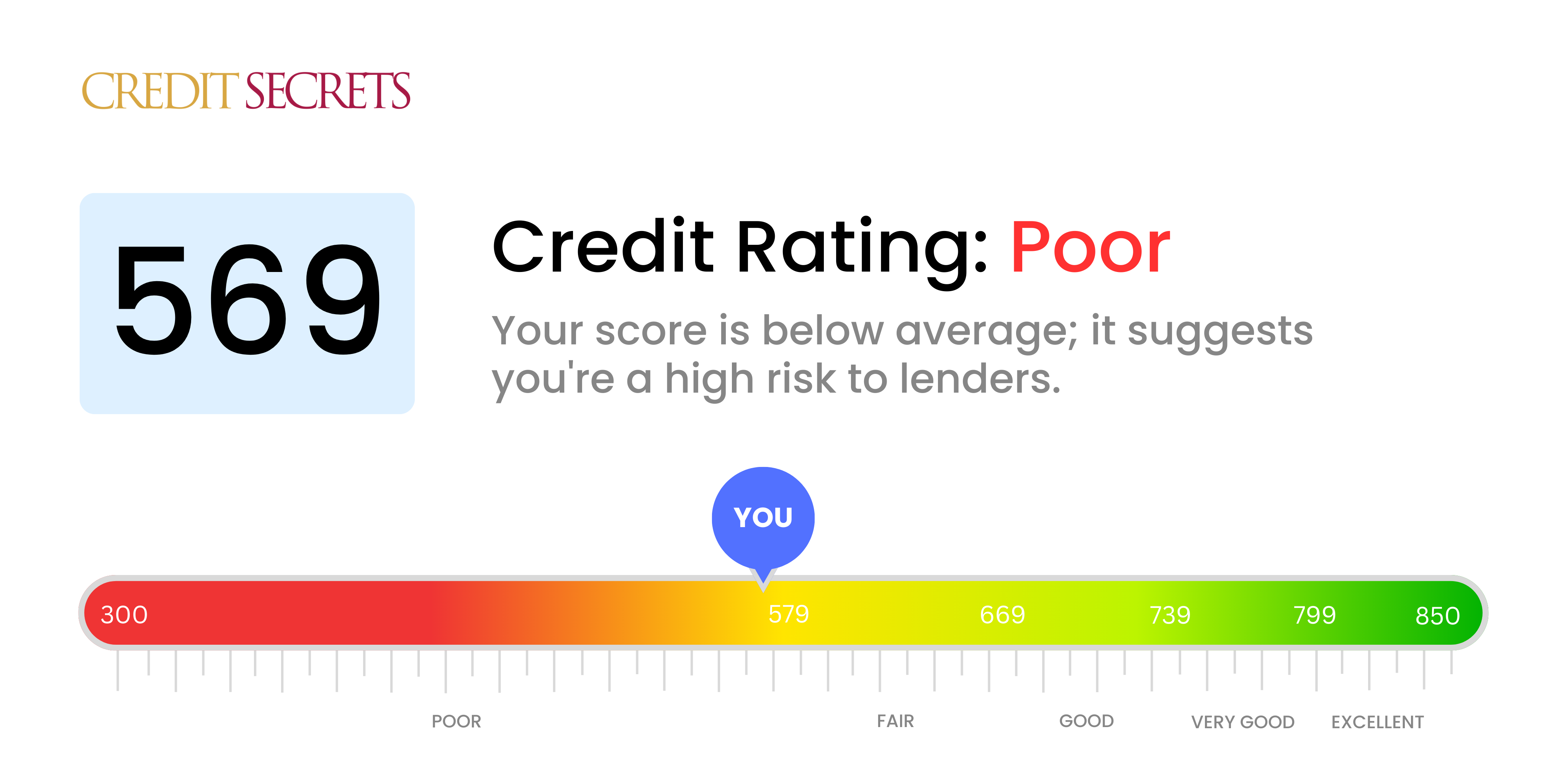

Is 569 a good credit score?

With a credit score of 569, you fall into the 'Poor' credit score range, but don't be disheartened. Although getting credit may be more challenging, remember, there are always steps you can take to improve this score and better your financial future.

At this score level, traditional lending institutions might view you as a high-risk borrower, meaning loan approval might be tougher and interest rates may be higher for any credit that you do acquire. However, not all lenders use the same criteria, some consider other factors along with credit score, so it's not an absolute lifeline.

Having a credit score of 569 should motivate you to devise a plan to improve it. Many have moved up from this score, and so can you with diligence and a thorough understanding of credit management. Keep in mind that raising your credit score is a journey and every step towards improvement makes a difference.

Take advantage of tools that Credit Secrets provides to start this journey with confidence. Today is an opportunity to begin that upward trend on your credit score!

Can I Get a Mortgage with a 569 Credit Score?

Regrettably, with a credit score of 569, getting approved for a mortgage may be a considerable challenge. This score falls below the threshold that most lenders typically require for mortgage approval. The figure implies a past of financial complications, perhaps in the form of late payments or loan defaults, that lenders may view as a risk.

It is indeed a tough situation to be in, but don’t lose hope. As a concrete first step, act promptly to resolve any existing debts that are negatively impacting your score. Additionally, strive to establish a reliable payment history and sensible credit usage habits. Alternatives might include considering a smaller loan, or saving for a larger down payment to reduce the risk for the lender. It's vital to remember that elevating your credit score isn't an overnight process, but with consistent dedication, you can enhance your prospects for future credit applications. Keep faith in your financial journey.

Can I Get a Credit Card with a 569 Credit Score?

With a credit score of 569, the reality of attaining a conventional credit card might be hard. This score typically signals to lenders a higher risk level, potentially denoting past financial obstacles or credit mishandling. It's certainly not ideal, but it's beneficial to tackle this situation with sober acknowledgment and understanding. Recognizing your credit standing is a critical initial step towards financial recovery, albeit the facts may be difficult to digest.

Your opportunities for obtaining traditional credit might be slim with this score, but don't be disheartened. Exploring other avenues, like secured credit cards, could be beneficial. These cards necessitate a deposit, which becomes your credit limit and are often easier to get. You might also want to consider a co-signer or perhaps a pre-paid debit card. It's important to understand that these aren't instant fixes, but they can be instrumental in the journey towards monetary stability. Also, be aware that interest rates for credit options, if available, can be noticeably higher with such a score due to the enhanced risk perceived by lenders.

Regrettably, a credit score of 569 is considered relatively low by the standards of most traditional lenders. This score signifies a heightened risk to lenders who might hesitate to approve a personal loan due to this rating. The situation might seem discouraging, but it's important to be aware and accept what a credit score of this level means for your borrowing possibilities.

When traditional avenues for personal loans aren't an option, alternate solutions like secured or co-signed loans might be a consideration. Additionally, peer-to-peer lending platforms can be a viable choice, even with their somewhat softer credit requirements. Bear in mind, though, that these alternatives often entail higher interest rates and less accommodating terms due to the amplified risk to your lender. Yet, these options could provide a stepping stone towards improving your financial health. Keep your financial goal in mind as you explore these avenues.

Can I Get a Car Loan with a 569 Credit Score?

With a credit score of 569, you might find acquiring a car loan to be tougher than expected. Lenders usually prefer scores over 660 to offer agreeable terms. Unfortunately, a score below 600 falls into the subprime category and your 569 score meets this criteria. This suggests to lenders a more significant risk as it indicates a history of potential repayment troubles.

Despite these hurdles, don't lose hope. While mainstream lenders might be hesitant, there are other providers that offer loans to people with lower credit scores. Bear in mind, however, that such loans often carry much higher interest rates because of the increased risk lenders associate with lower scores. It's important to scrutinize all the terms and understand them clearly before signing anything. Your dream car might still be obtainable, even if the journey to get there might have a few speed bumps!

What Factors Most Impact a 569 Credit Score?

Deciphering a score of 569 is the first step in your journey to improving your financial health. Understanding the contributing factors to this score can lead you down the path to better financial decisions. This journey is personal, full of lessons and growth opportunities.

Payment Consistency

Regular on-time payments heavily impact your score. Missed or late payments can be a significant reason for your current score.

What to Do: Inspect your credit report for any delayed or missed payments. Instances of haphazard payments can lower your score severely.

Credit Spending

The total amount of credit you're using, compared to your credit limit, can affect your credit score. If you’re consistently close to your credit limit, this may explain your score.

What to Do: Look through your credit statements. If your balances are high in relation to your limits, make an effort to reduce them.

Credit History Duration

A shorter credit history can lower your score.

What to Do: Check your credit report to determine the age of your oldest and newest accounts, and the average age of all your accounts. Consider if you've opened new accounts recently.

Credit Variety and Recent Activity

Possessing various types of credit and managing new credit responsibly can positively affect your score.

What to Do: Evaluate your credit types like credit cards, installment loans, retail accounts, and mortgages. Think about how frequently you've applied for new credit recently.

Public Records

Public records such as tax liens or bankruptcies can heavily influence your score.

What to Do: Check your credit report for any public records or pending issues that need resolution.

How Do I Improve my 569 Credit Score?

A 569 credit score is categorized as low, but through thoughtful financial steps, you stand a good chance of elevating it. Below are timely and impactful measures specific to your current credit standing:

1. Tackle Outstanding Debts

Top on your list should be resolving any outstanding obligations. Prioritize debts that are considerably overdue, as they weigh heavily on your credit score. Engage your creditors in discussing a feasible repayment plan if you’re struggling.

2. Minimize Credit Utilization Ratios

High credit card balances compared to your credit limit can drastically lower your credit score. Aim to manage your credit card balances to be less than 30% of your limit, with an ultimate goal of 10%. Begin by cutting down the balances on credit cards with the highest usage rates.

3. Consider a Secured Credit Card

At your current credit score, it might be challenging to get a regular credit card. Think about a secured credit card instead, where a refundable deposit will determine your credit limit. Make sensible purchases and clear the balance each month to develop a commendable payment history.

4. Seek to be an Authorized User

If you have a close acquaintance with a healthy credit score, ask them to include you as an authorized user on their credit card. This could boost your credit score through their established positive payment habits. Check that the credit card issuer reports authorized user activity to credit bureaus.

5. Broaden Your Credit Diversity

Having a diverse set of credit accounts could help enhance your credit score. Once you’ve demonstrated responsibility with a secured card, consider other credit types—for instance, a retail credit card or credit builder loan—and manage them effectively.