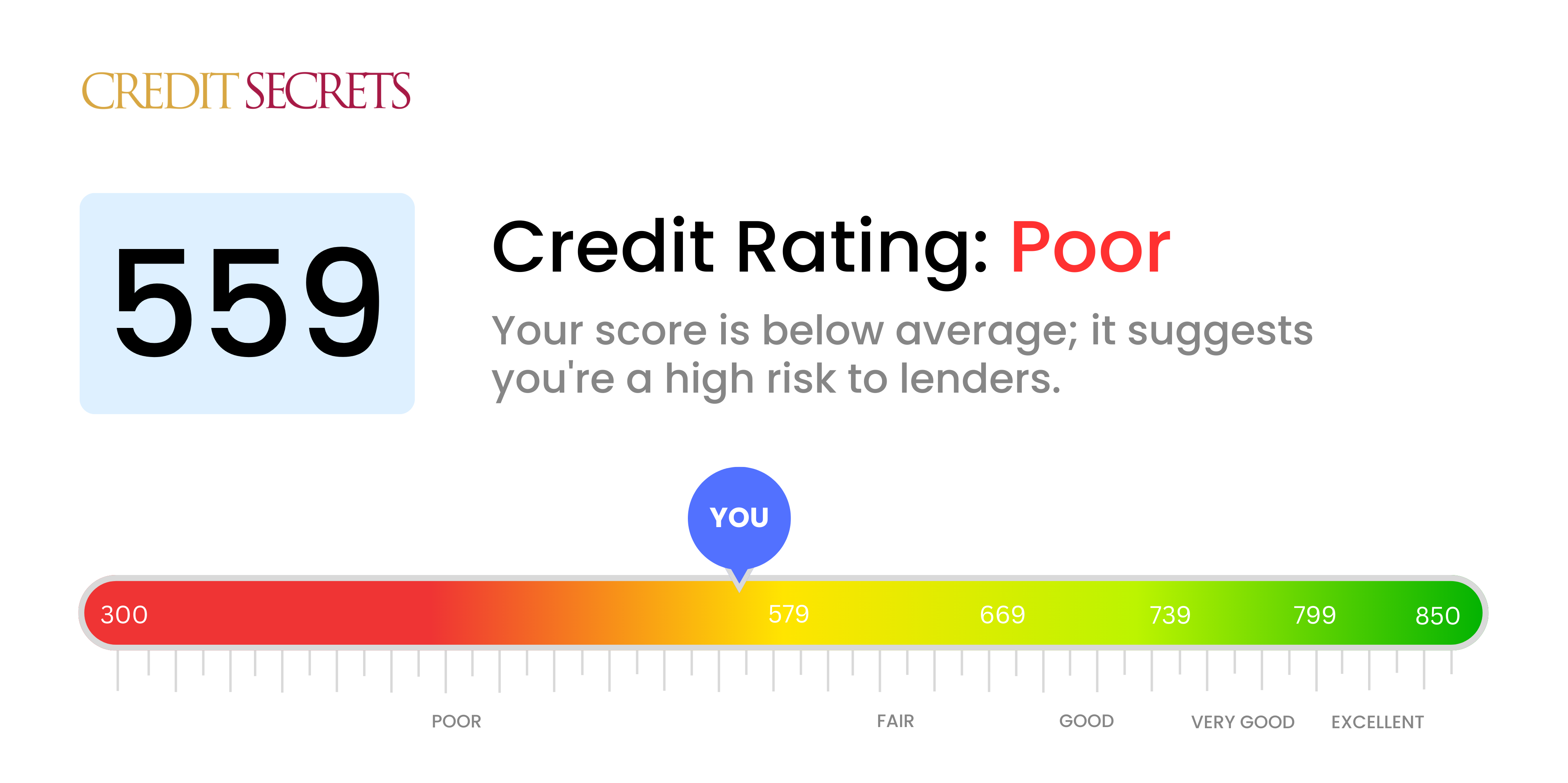

Is 559 a good credit score?

Your credit score of 559 is classified as poor under typical credit rating guidelines. Having a score in this range may indicate to lenders that you're a higher risk for loans, potentially leading to higher interest rates or denial of credit.

There's absolutely a silver lining here though. With some focused effort and smart decisions, you can likely improve this score over time. Helping yourself to more favorable financial outcomes is entirely within your reach, so don't be deterred by your current situation.

Can I Get a Mortgage with a 559 Credit Score?

With a credit score of 559, it is unlikely you will be readily approved for a mortgage. This score falls below the general lender thresholds, indicating a past with financial struggles such as late payments or outstanding debts.

This situation may feel disheartening, but it's not the end of the road. Some options that can assist in your goal of homeownership include government-backed loans that cater to individuals with lower credit scores. Often called subprime loans, these alternatives typically come with higher interest rates due to the increased risk for lenders. Another alternative could be working towards a larger down payment to offset your lower credit score. Remember, these options should be regarded sensibly as they also carry their own risks and costs. This is a journey, and while it might be a challenging one, moving forward with informed and thoughtful decisions can lead you toward your goals.

Can I Get a Credit Card with a 559 Credit Score?

Having a credit score of 559 can be a significant obstacle when applying for a traditional credit card. Creditors might see this as a risky score, indicating past financial hiccups or challenges in handling money. This situation might seem tough, but viewing it clear-eyed is the first significant stride toward improving your financial circumstances, even if it means acknowledging some hard realities.

Because getting approved for a regular credit card can be difficult with a 559 credit score, looking into alternatives like secured credit cards, which demand a deposit setting your credit limit, might be beneficial. They can be less challenging to attain and help rebuild your credit gradually. Options including finding a co-signer or reflecting upon pre-paid debit cards might be useful too. While these options may not provide an immediate solution, they are constructive steps on the path to financial stability. Be mindful that any type of credit accessible to someone with a 559 score will likely carry higher interest rates due to the increased risk perceived by lenders.

Having a credit score of 559 is understandably challenging. This score falls significantly short of the standard range that most lenders use to determine approval for personal loans. It's important to acknowledge that to most lenders, this score indicates a higher degree of risk, making it arduous to obtain a traditional loan.

Despite this current predicament, other pathways exist. Secured loans, which require collateral, or having someone with a stronger credit score co-sign the loan, might be viable alternatives. Peer-to-peer lending platforms could provide another option, as they are sometimes more flexible regarding credit score requirements. However, it's vital to bear in mind that these paths typically involve higher interest rates and less favorable terms due to representing a heightened risk for the lender. Nonetheless, exploring these alternatives could be a key step towards reaching your financial goals.

Can I Get a Car Loan with a 559 Credit Score?

Having a credit score of 559 means getting a car loan might be more difficult. Most lenders prefer applicants to have a credit score of at least 660, and your score is considered to be in the subprime range. This could mean you face higher interest rates or even get turned down, due to the risk lenders associate with lower scores. Your history suggests potential struggles in managing repayments, and it's lenders' way of protecting their investments.

Not to fret, there are still options available for those with lower scores. Although it might be a bit tougher, there are lenders who are willing to work with those carrying subprime scores. However, these loans typically come with notably higher interest rates. It's crucial to weigh all your options and read the terms and conditions thoroughly. Despite the slight obstacles, a car loan is still something you can consider.

What Factors Most Impact a 559 Credit Score?

Understanding your score of 559 is a crucial step towards achieving better financial health. Several factors could be contributing to your current score and recognizing these will enable you to rectify them and assist in boosting your credit.

Debt Amount

The amount of debt you have is a significant factor in determining your credit score. If you have high debt relative to your income, it could be negatively affecting your score.

How to Check: Detail your debts, including loans and credit card balances. A higher debt to income ratio might be adversely impacting your score.

Credit History Length

A relatively short credit history can lead to a lower credit score. This is because longer credit histories provide more data and demonstrate more financial stability.

How to Check: Inspect your credit report for the age of your oldest and newest accounts, and the average age of all your accounts. If your credit history is short, this might be a factor.

Payment History

Your payment history significantly impacts your credit score. Late payments or a high rate of missed payments can lead to a lower score.

How to Check: Go through your payment history for any late or missed payments. Failing to pay on time can hurt your score, and it would be beneficial to develop a consistent payment history.

New Credit

Applying for a lot of new credit in a short period can also lead to a lower score, as it can present you as a higher risk to lenders.

How to Check: Assess your recent credit applications. Numerous credit inquiries in a short period might be damaging your credit score.

Credit Card Utilization

Keeping your credit card balances high could be negatively impacting your score. Lowering your credit card utilization can improve your credit score.

How to Check: Review your credit card statements. If your balances are near the limit, it may be hurting your score.

How Do I Improve my 559 Credit Score?

With a credit score of 559, you’re in a troublesome financial range but don’t worry – things can improve from here. Check out accessible and impactful ways you could boost your score:

1. Get a Handle on Late Payments

Handling late accounts can have a big impact. Prioritize those overdue payments, getting them up to date as soon as possible. Don’t hesitate to discuss possible repayment plans with your creditors. This approach could help lessen the impact on your credit score.

2. Watch Your Credit Card Usage

Another area to focus on is your credit card usage. High balances compared to your credit limits can negatively affect your score. Make sure to keep your balances below 30% of your total available credit. Pay particular attention to the cards with the highest balance-to-limit ratios.

3. Contemplate a Secured Credit Card

At a credit score of 559, obtaining a regular credit card may be tough. In this case, a secured credit card could be beneficial. With this, your deposit equals your credit limit. Use this wisely to build a good credit reputation.

4. Explore Authorized User Status

One option could be to become an authorized user on a credit card of a close friend or family member with a good credit history. It can influence your credit score positively, but remember to verify if the credit card issuer reports authorized user activity to credit bureaus.

5. Vary Your Credit Types

Having different types of credit can boost your score. Once you’ve shown responsibility with a secured card, consider diversifying with a credit builder loan or retail card to further improve your credit.