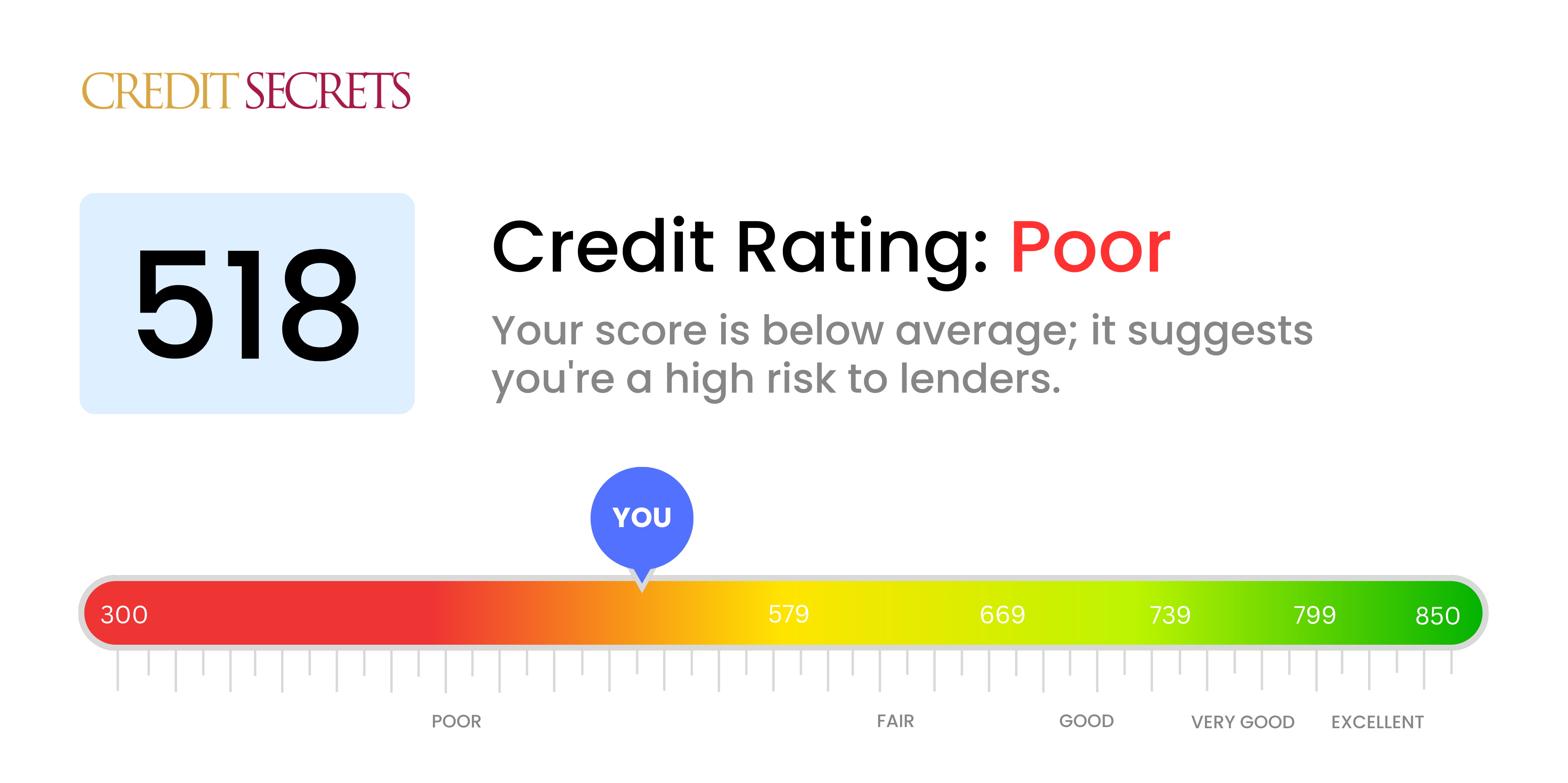

Is 518 a good credit score?

With a credit score of 518, your financial situation falls within the 'poor' credit range. This credit score is not ideal, but it's important to note that there's always room for improvement.

When applying for loans or credit cards, you might face higher interest rates or could be rejected entirely. It may also signify that you've had significant credit problems in the past. However, don't lose heart. Improving your credit score is a journey, and it starts by understanding where you are now. Knowledge is power in repairing your credit and achieving your financial goals.

Can I Get a Mortgage with a 518 Credit Score?

With a credit score of 518, the likelihood of you getting approved for a mortgage is unfortunately quite low. Most lenders look for credit scores in the higher 600s as a minimum requirement. This score reflects financial difficulties in your past, such as late or missed payments. This is a tough situation, but it's not the end of the road.

Take this as an opportunity to start improving your credit situation. Begin with addressing any outstanding debts which might be pulling down your score. Make it a goal to establish a more positive payment history. You can attempt to secure a mortgage backed by the Federal Housing Administration (FHA). Although it still requires a minimum credit score of 580, the FHA's backing can make it easier for those with poor credit to secure a loan. Lastly, consider 'rent to own' property options. It's a less conventional path but can sometimes be a work-around when traditional mortgages aren't accessible. Your path ahead may have hurdles, but remember, every step forward moves you closer to your financial goals.

Can I Get a Credit Card with a 518 Credit Score?

With a credit score of 518, prospects of obtaining a traditional credit card might appear slim. This low score is typically perceived by lenders as a risk, likely due to a record of past financial setbacks or difficulties. It's vital to recognize and accept this as part of your financial picture, even if it brings about the discomfort of acknowledging some harsh realities.

However, there are options available that could serve as alternatives. Secured credit cards, for instance, require an upfront deposit which then becomes your credit limit. Such cards are generally easier to acquire for individuals with low scores, and over time, they can contribute towards rebuilding your credit. Another possibility could include adding a co-signer to your application or using pre-paid debit cards. It's crucial to remember, though, these alternatives won't change your situation overnight, but they could be beneficial steps in your journey towards financial improvement. Be aware that, given your score, any credit product you may qualify for will likely have higher interest rates, reflecting the lenders' view of risk.

With a credit score of 518, it is unlikely that you would be approved for a personal loan through traditional lenders. This score, which falls far below the preferred range, indicates a high risk on behalf of the borrower. Frankly, this isn't the easiest situation for securing personal loans, but understanding what it means is essential. We can promise you this: although this score presents a challenge, it is by no means a dead end.

Options outside of conventional personal loans exist. Consider secured loans, for example. These need collateral but might be more attainable for individuals with lower credit scores. Co-signed loans, where another person with a more favorable credit score stands as guarantor, could also be an option. Other options include peer-to-peer lending, which can sometimes have less stringent credit requirements. Remember, these alternatives may carry higher interest rates and less ideal terms due to the increased risk incurred by the lender. Yet, they could present a valuable bridge on your path to improved credit.

Can I Get a Car Loan with a 518 Credit Score?

Setting your sights on a new car is an exciting prospect, but with a credit score of 518, it may present some hurdles. Lenders usually prefer to work with individuals who hold a score above 660 and any score below 600 is viewed as subprime. Your score falls into this riskier category, which could result in higher interest rates or a loan refusal. This is all down to the fact that a lower credit score represents a greater risk to lenders, with a history that might suggest difficulties with loan repayment.

However, it's important to know that a low credit score doesn’t cut off all hope of securing a car loan. There are lenders out there who are willing to work with those who have lower credit scores, though these loans tend to come with much higher interest rates. These elevated rates reflect the increased risk these lenders are taking on. Even though it might not be the smoothest road to travel, with carefully thought out decisions and a thorough understanding of the terms, a car loan is still feasible.

What Factors Most Impact a 518 Credit Score?

Understanding your score of 518 is the first step in your financial journey towards credit improvement. The factors that contribute to this score offer a roadmap for creating a more prosperous financial future. It's important to identify and tackle these elements.

Past Payment Behavior

Your payment history majorly impacts your credit score. Late payments or having accounts in collection could be the primary reasons for your score.

How to Investigate: Review your credit report diligently for any delayed or missed payments. Keep in mind that such instances could have brought down your score.

Credit Utilization Ratio

Maxing out your cards or keeping high balances can bring down your score. If your credit utilization is high, it may explain your score.

How to Evaluate: Check your credit card balances. Are they nearing their limit? Remember, a lower balance compared to your total limit can help boost your score.

Duration of Credit History

A shorter credit history may pull down your credit score.

How to Analyze: Consider the age of your oldest account and your newest one from your credit report. Reflect on whether opening numerous new accounts could have impacted your score.

Types of Active Credit

Maintaining a varied mix of loans and credit cards responsibly not only proves your creditworthiness but also supports a higher score.

How to Check: Look into your credit report for your variety of credit accounts. Evaluate if sparingly applying for new credit could improve your score.

Public Records

Public records such as bankruptcies or liens can hugely impact your credit score.

How to Check: Ensure to examine your credit report for any public records. If you find any, take steps to resolve them.

How Do I Improve my 518 Credit Score?

With a credit score of 518, you’re facing some challenges, but don’t lose hope. Swift, focused action can drive significant improvements. Here’s what can be most helpful regarding your current situation:

1. Bring Delinquent Accounts Up-to-Date

Any accounts you have that are in arrears should be your immediate concern. The ones that are most overdue should be tackled first as these harm your credit score the most. Consider establishing a repayment plan with your creditors.

2. Lower Your Credit Card Debt

If your credit card balances are high compared to your credit limits, it’s time to concentrate on reducing them. Keep them under 30% of the available credit at least, with a goal of eventually maintaining them below 10%. Begin with the cards with the highest utilization.

3. Think About a Secured Credit Card

Securing a standard credit card could be exceptionally challenging given your current score. However, a secured credit card, which requires a cash deposit, can work in your favor. Make sure to use it wisely; pay the complete balance each month to build a robust payment history.

4. Get Added as an Authorized User

Request a responsible friend or family member with robust credit to add you as an authorized user for their card. This could enhance your credit score by bringing their consistent payment history into your credit report.

5. Enhance Your Credit Portfolio

A diversified credit repertoire can add valuable points to your credit score. As soon as you’ve established a constructive payment record with the secured card, consider different forms of credit. Ensure they are managed responsibly.