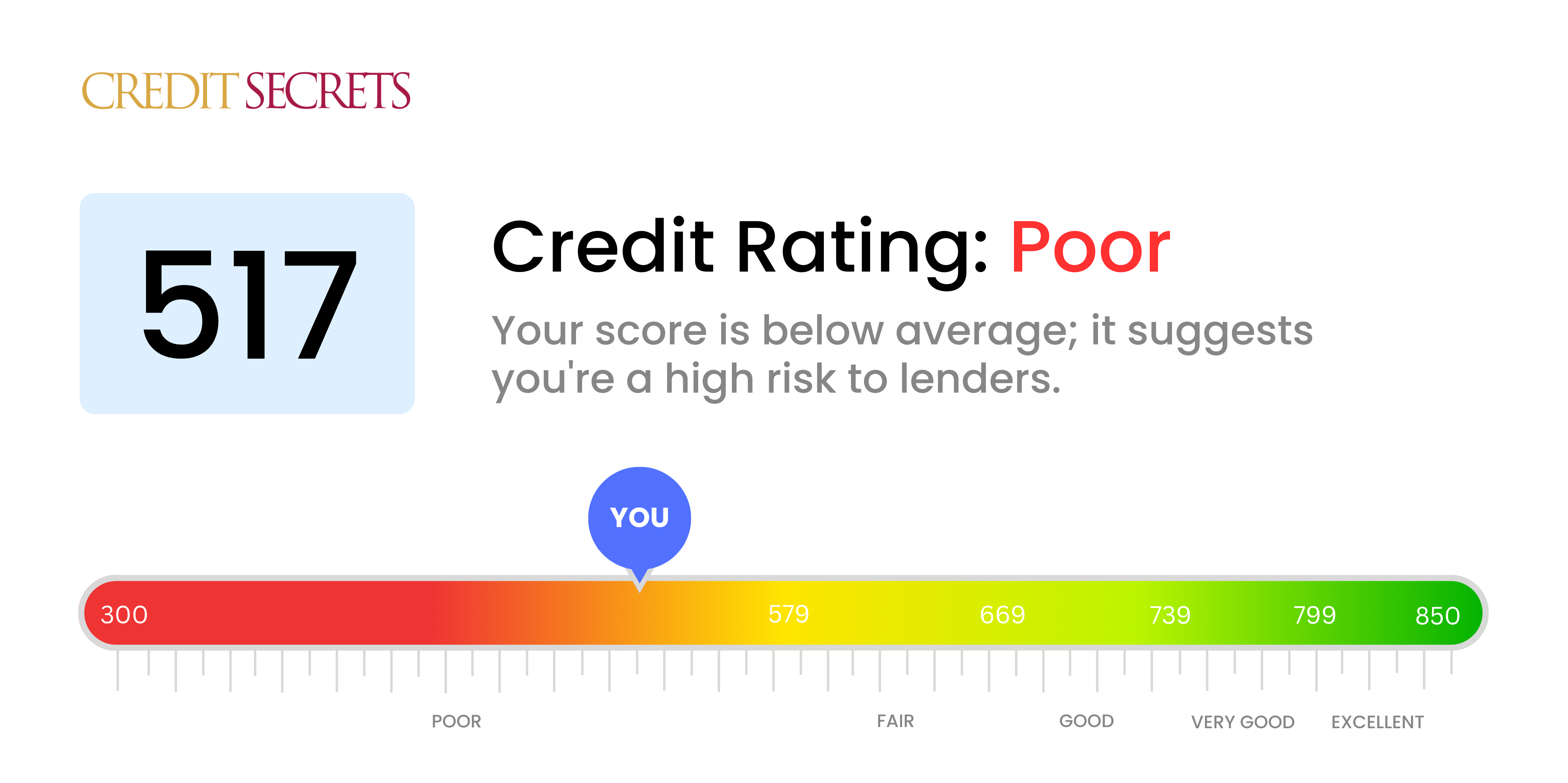

Is 517 a good credit score?

With a credit score of 517, you're currently landing within the 'poor' credit range. It's a tough place to be, but remember, it doesn't mean you're stuck here.

This lower score means you may face difficulties in getting approved for credit cards, loans, or mortgages, and if you do get approved, you may face higher interest rates. However, it's important to keep in mind that everyone starts somewhere, and there are steps you can take to start improving your credit right away.

Can I Get a Mortgage with a 517 Credit Score?

A credit score of 517 puts you in the 'poor' credit range. In such a scenario, you are unlikely to be approved for a mortgage. Lenders often consider a poor credit score as a sign of financial unreliability, rendering it risky to lend money. A credit score of 517 usually indicates past financial missteps, such as late payments, overutilisation of credit, or even default on loans.

However, don't be disheartened. There are alternative paths to homeownership, such as opting for a government-backed FHA loan that accommodates for lower credit scores, albeit potentially with a higher interest rate. Additionally, some lenders provide specially designed programs for individuals with low credit scores. You may also consider a co-signer for your mortgage. Continue working on improving your credit score and, with time, the door to a conventional mortgage can open up for you. Time, patience, and responsible financial behavior are key.

Can I Get a Credit Card with a 517 Credit Score?

With a credit score of 517, it's unfortunately unlikely that the average credit card application will be approved. This credit score typically signals to lenders a history of financial struggles or past mismanagement. This news can feel disheartening, but it's crucial to handle it with both a realistic and optimistic outlook. Recognizing your credit standing is the primary stepping stone towards your financial recovery.

With this credit rating, options may seem limited, but consider exploring alternatives such as secured credit cards. These cards require an upfront deposit that establishes your credit limit, and can be a stepping stone to improve your credit score over time. Prepaid debit cards might also be a feasible solution. Remember, these options may not offer an immediate fix, but they can potentially help you navigate towards better financial stability in the long run. However, be aware that the interest rates for any kind of credit available to someone with a credit score of 517 are likely to be on the higher end due to the increased risk factors recognized by lenders.

A credit score of 517 puts you in a challenging position when it comes to applying for a personal loan. This score is significantly below what most lenders consider when approving personal loans. Having a low score like this could be seen as a sign of financial risk, which makes it unlikely you'd receive approval from traditional lenders. It's a tough reality to face, but understanding your situation is the first step to addressing it.

While the typical personal loan may not be attainable right now, there are other options you could explore. Secured loans, which require you to provide collateral, could be a possibility. There are also co-signed loans, where someone with a higher credit score can back you. Another avenue is peer-to-peer lending platforms as they can sometimes be more accommodating with credit scores. However, remember that these alternatives might carry higher interest rates and more stringent terms, due to the increased risk to the lender that your lower credit score represents.

Can I Get a Car Loan with a 517 Credit Score?

Gaining approval for a car loan with a credit score of 517 might be difficult. This score lands in the subprime category, typically viewed by lenders as a sign of higher risk. Most lenders prefer credit scores over 660 for more favourable loan terms. Unfortunately, your 517 score may lead to you facing higher interest rates or possibly even having your loan application rejected. This is because, from the lender's perspective, a lower score indicates a higher risk of having trouble repaying the loan.

Despite this, having a low credit score does not entirely rule out the possibility of securing a car loan. Some loan providers do cater to those with lower credit scores. However, tread carefully - these types of loans often carry much higher interest rates. This rise in rate is a protective measure for lenders, accounting for the increased risk they take on. Despite the hurdles, with prudent examination of loan terms, it is still possible to secure a car loan. Remember, a difficult path today can turn into a smoother road ahead with careful planning.

What Factors Most Impact a 517 Credit Score?

A score of 517 indicates room for improvement, but at Credit Secrets, we'll help you understand the specific issues likely affecting your credit. Here are the likely factors:

Payment Record

Your payment history has a huge influence on your credit score. Late or missed payments could substantially lower your score.

How to Check: Scrutinize your credit report for any missed or late payments. Acknowledge these instances as they may be the primary reason for your current score.

High Credit Utilisation

Having a high balance on your credit cards compared to the available credit limit can negatively impact your score.

How to Check: Look closely at your credit card statements. If the balances are near their limits, work towards lowering them.

Short Credit History

Having a short credit history could be affecting your score negatively.

How to Check: Review your credit report to determine the age of your oldest and newest credit accounts, and the overall average age of all your accounts.

Limited Credit Diversity and New Credit

Having a limited mix of credit types, or opening several new credit accounts recently could potentially lower your score.

How to Check: Review your credit mix including credit cards, retail accounts, installment loans, and mortgages. Consider if you have been applying for new credit judiciously.

Derogatory Public Records

Public records like foreclosures, bankruptcies, or tax liens can seriously hurt your score.

How to Check: Inspect your credit report for any public records and address any listed discrepancies that need resolution.

How Do I Improve my 517 Credit Score?

With a credit score of 517, there is room for considerable improvement but don’t despair! Leveraging a blend of targeted strategies can help you revamp your credit score from its current state.

1. Revisit Outstanding Debts

It’s crucial to pay off or settle any outstanding debts as they can majorly hamper your credit score. Prioritize those with the highest interest rates and the longest periods of non-payment. Reach out to your lenders and discuss feasible payment arrangements.

2. Maintain Low Credit Utilization

Aim to keep your credit utilization ratio — that’s your credit balance in comparison to your credit limit — below 30%. By lowering the balance on your credit cards, you can incrementally but effectively increase your score.

3. Consider a Secured Credit Card

Obtaining a regular credit card might be a hurdle with your current credit score. Therefore, consider opting for a secured credit card. This requires an upfront deposit that acts as the credit limit for the account. Use this card wisely, making sure to pay off the full balance monthly to reinforce your creditworthiness.

4. Authorized User Status

If you can find a trusted individual with good credit willing to make you an authorized user on their credit card, this can potentially help your credit score. Ensure that the credit card company reports authorized user activity to credit bureaus.

5. Introduce Variety to Your Credit

A diverse assortment of credit types can enhance your credit score. After building a consistent payment pattern with a secured card, explore other credit options like credit-building loans or retail credit cards, managing them responsibly.