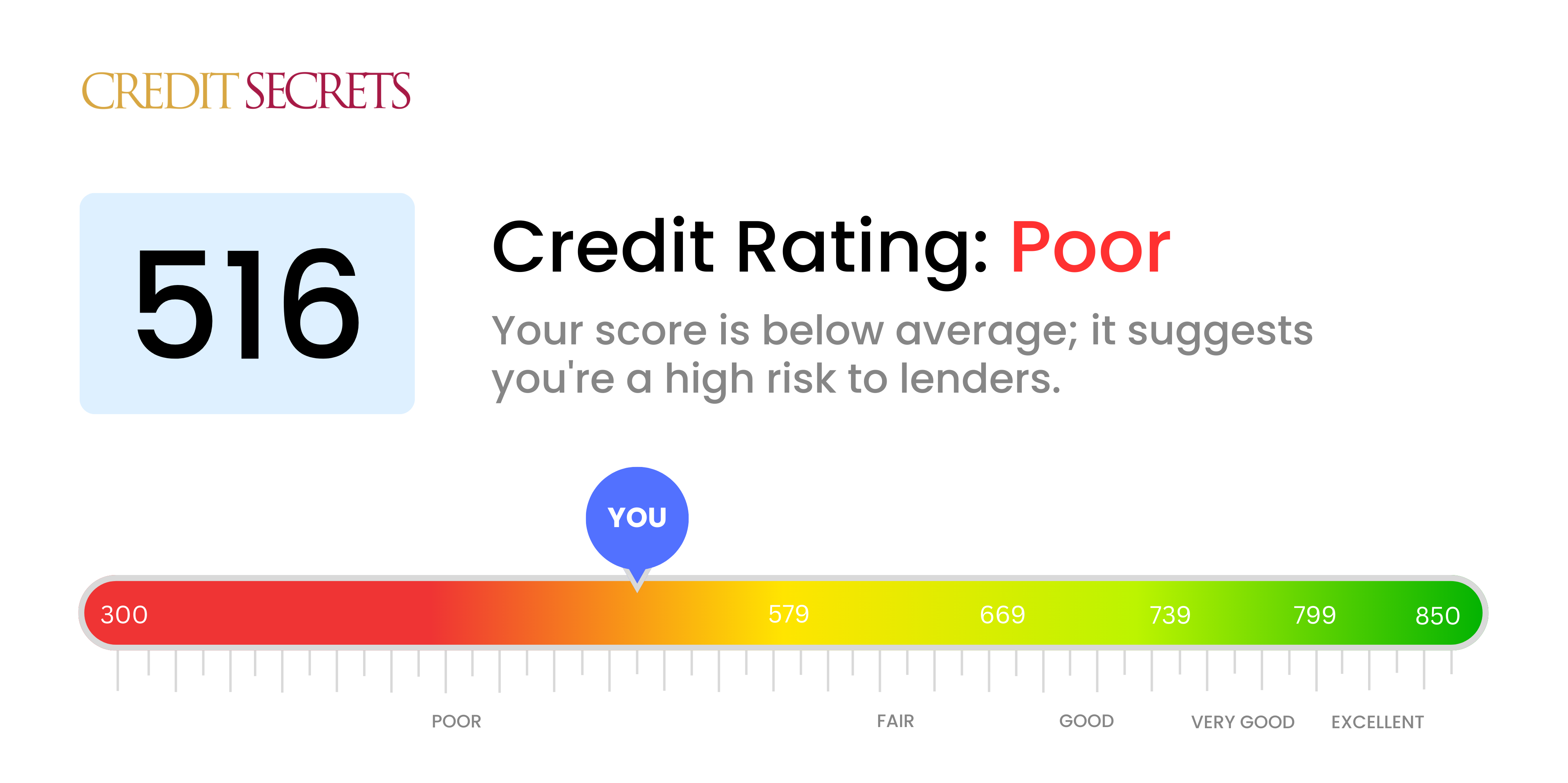

Is 516 a good credit score?

With a credit score of 516, you're currently classified in the 'poor' category. This often means you could face difficulties when seeking to take out credit cards, loans, or mortgages, and you may also be burdened with high interest rates when you can secure credit.

Remember, it's not the end of the road - a lower credit score just signals that you might need to focus on improving your financial habits. The good news is, with committed effort and good financial decisions, you have opportunities to improve that score and upgrade your financial prospects for the future.

Can I Get a Mortgage with a 516 Credit Score?

Having a credit score of 516 may present challenges when trying to secure a mortgage. Most financial institutions prefer scores within the range of 620 to 680 as a minimum when factoring loan approvals. A score of 516 signifies that there have been some past difficulties in managing credit, such as late payments or perhaps more significant issues like bankruptcy or foreclosure.

In spite of this, it's vital to remain hopeful and proactive. Begin by paying off any outstanding debts or recent late payments that may be pulling your score down. Keeping a consistent history of on-time payments moving forward can gradually improve your score. Some might also consider alternatives like a Federal Housing Administration (FHA) loan, which tends to have softer credit score requirements. Additionally, a larger down-payment could potentially compensate for a lower credit score when seeking mortgage approval. Remember, each step towards improving your financial health counts, and it all starts with informed decision-making.

Can I Get a Credit Card with a 516 Credit Score?

Unfortunately, a credit score of 516 does not typically qualify for traditional credit card approval. Despite this, it's important to courageously face financial realities with an unwavering dedication to achieving progress. This score suggests that there have been some financial hiccups or challenges in the past, but there's always room for improvement in the future.

Consider alternative options like secured credit cards. These require an initial deposit, which acts as your credit limit. This might be more accessible for you and can serve as a stepping stone in rebuilding your credit over time. Additionally, finding a co-signer with a stronger credit score or utilizing pre-paid debit cards are potential alternatives. It’s important to remember that these alternatives are not a magic fix, but rather tools to be used in your journey toward financial stability. Also, it's good to keep in mind that with a score of 516, any credit you do get is likely to come with higher interest rates, reflecting the increased risk for lenders.

With a credit score of 516, it can be a daunting task to secure a personal loan from traditional lenders. This score, significantly below the standard acceptable range, often indicates a heightened level of risk to lenders. Unfortunately, this might deter them from approving your loan application. It's a tough situation, but acknowledging the implications of your score on borrowing options is crucial.

Although traditional loans might seem out of reach, there are alternative pathways you could explore. One option is a secured loan, using collateral to guarantee repayment. Another route might be a co-signed loan, which involves someone with a better credit score co-signing the loan agreement. You could also consider peer-to-peer lending platforms, known for a more flexible approach to credit scores. Keep in mind, these options can come with higher interest rates or more stringent terms due to the lender's increased risk. Being informed about these aspects aids in making educated financial decisions.

Can I Get a Car Loan with a 516 Credit Score?

Having a credit score of 516 can present difficulties when seeking approval for a car loan. Usually, lenders like to see scores closer to 660 for the best terms. Unfortunately, a score of 516 is commonly categorized as subprime, which could affect the terms of your loan. This often means increased interest rates or the possibility of being denied a loan. This happens because lenders correlate a lower score with a higher risk, due to past credit history indicating potential repayment problems.

But don't lose hope. There are lenders who cater to those with credit scores like yours. However, remember that approval might come with higher interest rates as a protective measure for the lender against the increased perceived risk. Despite the higher rates, achieving your goal of securing a car loan is not impossible. Ensure to make a careful review of all terms before proceeding and stay optimistic, as there are opportunities available in your journey towards car ownership.

What Factors Most Impact a 516 Credit Score?

With a score of 516, it's crucial to understand and address the factors likely affecting your credit standing. Acknowledging these areas provides a clear path towards fortifying your financial future.

Neglected Payments

Payment inconsistency plays a significant role in credit rating. If you have past-due or defaulted payments, these are likely impacting your score.

How to Check: Analyze your credit report for evidence of late or unsettled payments. Consider if there were occasions when payments were not made on time.

Loan Balance

Carrying high balances on your loans can have a negative effect on your credit score. If you're maxed out on your credit limit, this could be a contributing issue.

How to Check: Look at your loan account details. Are the outstanding debts near or at their maximum? Strive to keep balances low to combat high credit utilization.

Credit History Duration

A brief credit history may have an undesirable effect on your score. The age of your oldest and newest accounts matters.

How to Check: Scrutinize your credit report to understand the lifespan of all your accounts. Reflect on whether you have commenced new accounts recently.

Type of Credits and New Accounts

Managing a diverse mix of credit types and handling new credit judiciously is key to achieving a good score.

How to Check: Examine your variety of credit accounts, such as credit cards, loans, etc. Ensure you're not applying for too much new credit at once.

Legal Judgements

Legal judgments like tax liens or bankruptcies can severely impact your credit score.

How to Check: Check your credit report for any existing legal judgments. Begin addressing those that require immediate attention.

How Do I Improve my 516 Credit Score?

A credit score of 516 falls into a category of less desirable scores; however, there are practical steps to initiate growth. Start on the path to a healthier credit score by following these recommendations:

1. Tackle Payment Delinquencies

Defaulted payments can severely impact your credit score. Start by settling any overdue balances promptly. Don’t hesitate to approach the creditor and arrange a manageable payment plan. Your primary focus should be erasing these faulty marks from your report.

2. Trim High Credit Card Balances

Surprisingly, how much you owe on credit cards versus your available credit limit can heavily influence your score. To raise that 516 score, try to lower balances to under 30% of your card’s limit. Push the envelope further by trying to keep balances at an ideal 10% or less. Focus first on cards that are closer to their limits.

3. Contemplate a Secured Credit Card

With a 516 credit score, obtaining an ordinary credit card might be a challenge. A secured credit card could be a practical solution. This card type requires a cash deposit, functioning as the maximum for your card. Make small, affordable purchases, and pay in full each month to demonstrate good payment habits.

4. Consider Becoming an Authorized User

Request to become an authorized user on the credit card of someone you know with better credit. Associating with their positive payment history can aid in lifting your score. Make certain that their card provider reports authorized user activities to credit bureaus.

5. Diversify Your Credit Types

Including a varied selection of credit types, such as a retail card or credit-building loan, can benefit your score. Open these accounts only after consistently showing good payment practices with your secured card. Balance management and regular payments on different credit types can encourage score improvement.