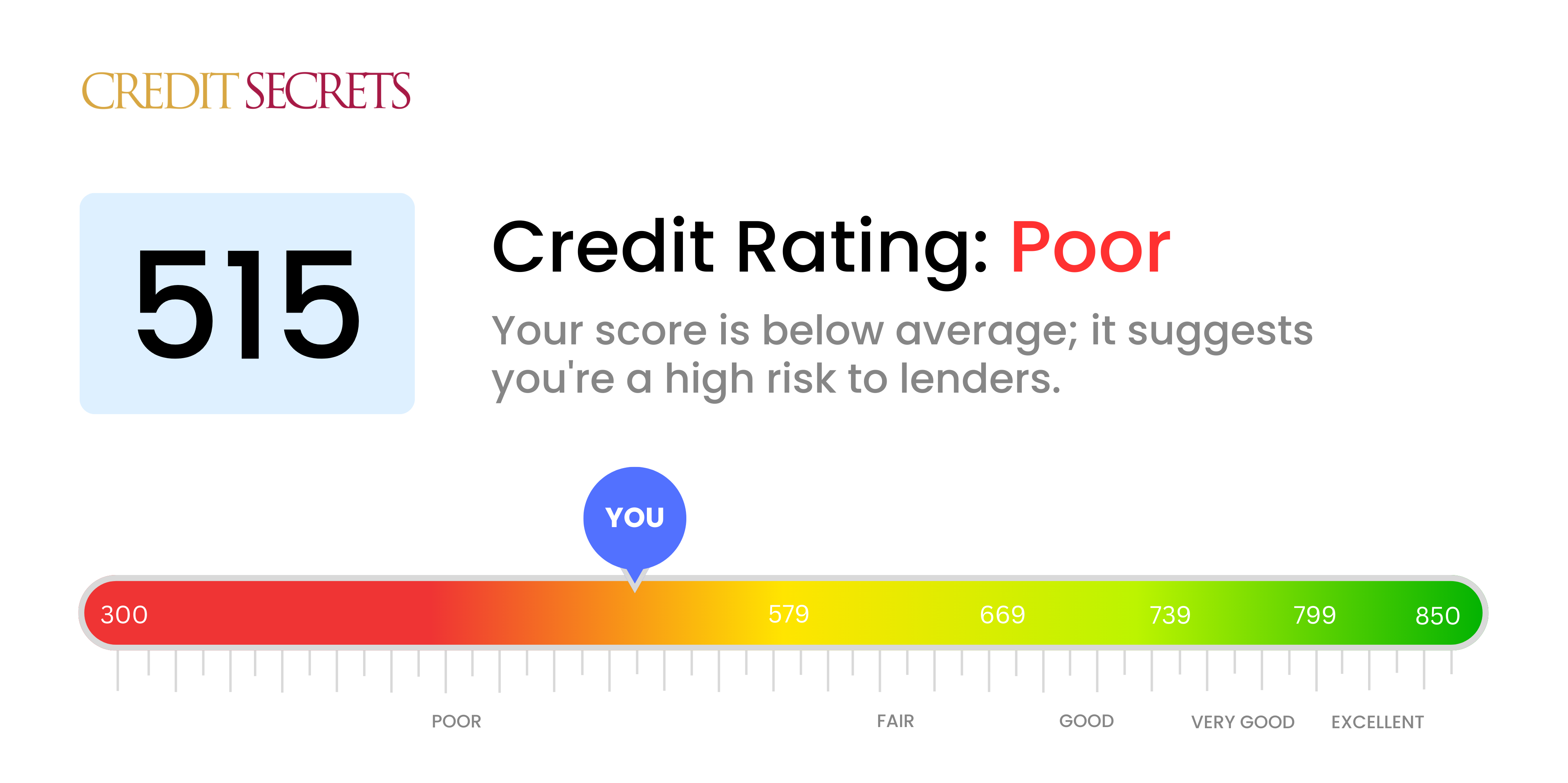

Is 515 a good credit score?

Having a credit score of 515 positions you in the 'Poor' range. This is not ideal, as it might cause potential difficulties in getting approval for loans or credit cards, with lenders often viewing you as a high risk.

But worry not, it's not the end of the road - you can gradually raise your score. With some careful planning and diligent steps such as paying your bills on time, keeping your credit balances low, and not applying for new credit haphazardly, you can lift your score to a healthier range.

Can I Get a Mortgage with a 515 Credit Score?

A credit score of 515 may pose some significant challenges when applying for a mortgage. This score is well below the threshold that many lenders typically look for, which can make it hard for you to get approved. This rating usually signals a history of financial hiccups, such as late payments or defaults on loans. This, in turn, can cause potential lenders to view your mortgage application as a high-risk proposition.

While this might seem like an uphill climb, it's not impossible to reach your homeownership goals in the future. One of the ways forward could be looking into alternatives, such as FHA loans, which normally have more lenient credit score requirements. However, it's important to note that these types of loans may come with higher interest rates and additional insurance costs. Another solution might be to join forces with a co-signer who has a higher credit score, although this can have serious implications for them if you're unable to make payments. Considering these paths can open more options for you, beyond the traditional mortgage process.

Can I Get a Credit Card with a 515 Credit Score?

Having a credit score of 515 can make it rather difficult for you to be approved for a mainstream credit card. This score is perceived by lenders as being risky, suggesting past financial troubles or perhaps not-so-perfect management of finances. Nevertheless, acknowledging where your credit standing is, is the first step towards turning things around, even if it may seem like a hard pill to swallow.

At this point, exploring other possibilities such as secured credit cards could be beneficial. These cards require a security deposit, which becomes your credit limit, and can be a stepping stone towards rebuilding your credit realistically and sustainably. In addition, options like enlisting a co-signer or utilizing pre-paid debit cards could be alternatives worth considering. While these alternatives won't miraculously improve your credit situation overnight, they can definitely help pave the way towards better financial stability. However, it's essential to keep in mind that the interest rates associated with credit offerings available to those with scores like 515 are generally higher, reflecting the higher risk lenders perceive.

With a credit score of 515, acquiring a personal loan from traditional lenders might be a steep climb. This credit score is quite below the desired range, signifying a higher degree of risk to potential lenders. While these circumstances might seem less than ideal, acknowledging this reality is a necessary step towards looking at alternative solutions.

While the usual lending avenues might be quite restrictive at this point, other borrowing options could help fill the gap. You could explore secured loans using tangible assets as collateral or seek the aid of a co-signer with a better credit score. Another alternative could be peer-to-peer lending platforms, known to be a bit more accommodating in terms of credit requirements. One noteworthy aspect is that these alternatives could come with higher interest rates and not-so-friendly terms owing to the associated lending risk seen with your credit score.

Can I Get a Car Loan with a 515 Credit Score?

There's no easy way to say it, with a credit score of 515, the path to getting approved for a car loan is often tough. This score falls into the 'subprime' category that lenders use, which means it's below what they generally consider acceptable. Typically, anything below 600 is seen as high risk, and they prefer scores above 660. Because of your score, you might face some hurdles like higher interest rates or even denial of the loan application. This is because a lower score suggests to lenders that there could be trouble repaying the loan.

However, don't lose hope just yet. While daunting, it's not impossible. There are specific lenders who cater to people with lower credit scores. Keep in mind that these loans may come with steep interest rates, a necessary caution that lenders take because of the risks involved. Even if the journey feels like an uphill battle, remember that with careful planning and understanding of the loan terms, securing that car loan is not entirely out of your reach.

What Factors Most Impact a 515 Credit Score?

Grasping your score of 515 is an important step towards better credit. By addressing critical aspects that may have led to your current score, you can work towards enhancing your financial health. Everyone's financial journey is different, offering myriad chances for improvement and knowledge gain.

Payment History

An important part of your credit score is your payment history. If there are instances of missed or late payments, this might be a significant factor pulling down your score.

How to Check: Go through your credit report to examine for any late payments or unpaid debts. Acknowledge any cases of default or late payments that might have impacted your score adversely.

Credit Card Utilization

An above-average credit card utilization can negatively impact your credit score. If you're consistently near or over limit on your cards, this could be a crucial influencer.

How to Check: Look over your credit card records. If the balances are continually close to the maximum limit, it might be time to reconsider your credit usage habits.

Duration of Credit History

A relatively short credit history might be contributing to your score of 515.

How to Check: In your credit report, observe the age of your oldest and most recent credit accounts as well as the average duration of all accounts. Evaluate if you have opened any new accounts recently.

Type of Credit and Fresh Credit

A healthy balance of diverse types of credit is crucial. Also, how you manage new credit plays a pivotal role in shape your credit score.

How to Check: Review the different types of credit accounts you have, like credit cards, retail accounts, loans etc. Assess if you've been prudent about applying for fresh credit.

Public Records

Public records, such as insolvencies or tax liens, can majorly impact your credit score.

How to Check: Scrutinize your credit report for any public records. Address these issues promptly for score improvement.

How Do I Improve my 515 Credit Score?

With a credit score of 515, you’re in a challenging credit range, but there are specific steps you can take to start enhancing your score.

1. Rectify Delinquent Accounts

Eliminate any late or missed payments by tackling overdue accounts including loans and credit cards. The longer they stay unpaid, the greater the damage to your score. Negotiate with your creditors, if possible, to establish a payment scheme that works for you.

2. Prioritize High-Interest Debts

Target debts that carry the highest interest rates. Reducing these ensures you pay less over time and have more funds to allocate to other debts, which could aid in decreasing your overall credit utilization.

3. Consider a Secured Credit Card

In your current credit situation, obtaining a standard credit card might be tough. An option is a secured credit card, backed by a cash deposit that acts as your credit limit. Make in-budget purchases and pay off the card each month to demonstrate responsible credit use.

4. Request to be an Authorized User

Being an authorized user on a trusted person’s credit card could make a difference. Their dependable repayment habits will reflect positively on your credit history. Make sure the card issuer reports authorized user activities to credit bureaus.

5. Expand Your Credit Types

Once you’ve established reliable payment habits with your secured card, consider diversifying your credit. Adding a mix of credit, such as a credit builder loan or a store account, can help enhance your score – just always manage them responsibly.