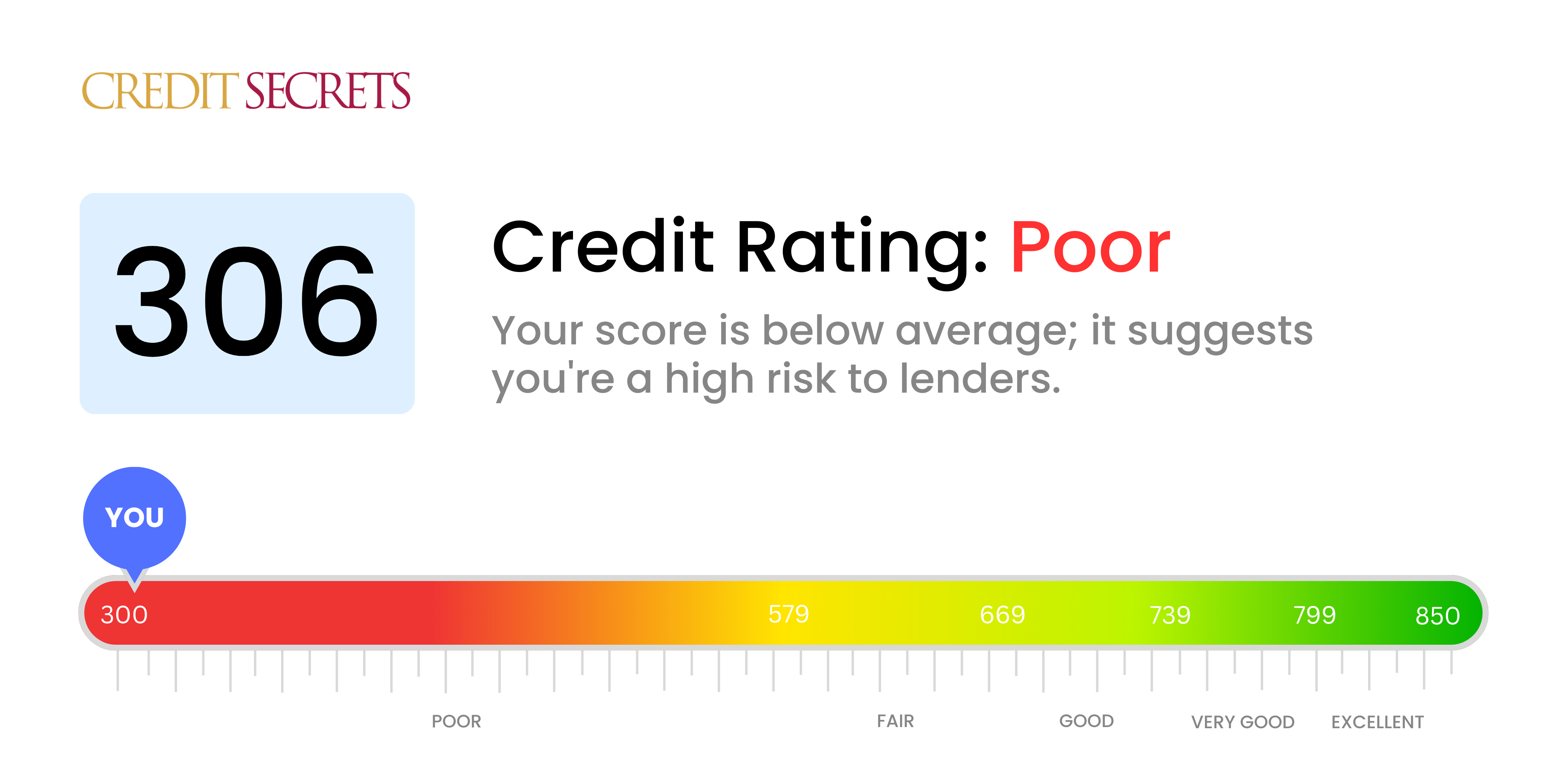

Is 306 a good credit score?

A score of 306 falls within the 'poor' credit score range. This is not ideal, indicating that you've had significant credit issues in the past, but remember, improving your credit score is always possible.

With a score of 306, you can expect higher interest rates and may face difficulties in securing loans or credit cards. Nevertheless, steps like reducing debt, making payments on time, and avoiding new debt can help you raise your credit score in the future. Always remember, change is possible and your current status isn't your final destination.

Can I Get a Mortgage with a 306 Credit Score?

Unfortunately, a credit score of 306 is not likely to be approved for a mortgage. It is remarkably lower than the customary requirement set by most lenders and can suggest a past filled with significant fiscal issues such as delinquencies or defaults. It's a tough situation to be in, but it's crucial to start taking steps to better your credit score right away.

It's an uphill climb from here, but it's significant to begin by addressing any outstanding debts that might be adversely influencing your score. Subsequently, start building a track record of punctual payments and wise credit use. This journey will require patience and commitment as credit improvement is a steady process. By dedicating consistent effort, you can steady your financial ship and may eventually achieve a mortgage-worthy score. Remember, it's not about quick fixes but long-standing change.

Can I Get a Credit Card with a 306 Credit Score?

A credit score of 306 is considered quite low by most lenders, and it may considerably limit your chances of getting approved for a traditional credit card. This is a tough situation indeed, and it's crucial to acknowledge it honestly and tactfully. Your credit score is a vital part of your financial health; recognizing where it stands is the key to improving it, albeit sometimes confronting uncomfortable facts.

Given the hurdles associated with such a low score, you might find it worth your while to consider alternative options such as secured credit cards. These types of cards requiring a deposit that matches your credit limit and can be easier to qualify for, plus they contribute towards rebuilding your credit over time. Other alternatives might include enlisting a co-signer or opting for prepaid debit cards. Although these options might not provide an immediate solution, they can be essential milestones on your path to better financial stability. Keep in mind that regardless of the credit form chosen, the interest rates are likely to be quite high due to the higher perceived risk by lenders.

Can I Get a Personal Loan with a 306 Credit Score?

Having a credit score of 306 presents significant challenges when aiming to secure a personal loan. Most traditional lending institutions see a score within this range as high-risk, making it less likely you'll find approval for a loan under standard conditions. Although it's a tough situation, it's crucial to understand what this credit score means for your borrowing ability.

In lieu of traditional loans, considering alternatives might be beneficial. Options such as secured loans where you provide collateral or co-signed loans with a trusted individual with better credit standing, can work. Peer-to-peer lending can also be explored, as they often have more lenient credit requirements. However, it’s important to remember these alternatives may come with higher interest rates and terms that might not be as favourable. This is due to the increased risk perceived by the lender, given the lower credit score.

Can I Get a Car Loan with a 306 Credit Score?

With a credit score of 306, getting approved for a car loan can be significantly difficult. Lenders commonly seek scores above 660, and a mark below 600 is frequently considered subprime. A score of 306 falls into this high-risk category, potentially resulting in higher interest rates or even a denied loan application. Why? A lower credit score translates to a higher risk for lenders, as it suggests you might have had trouble in the past with repaying borrowed money.

Yes, it may seem bleak, but your dreams of car ownership aren't shattered. Some lenders work specifically with people who have lower credit scores. Be aware, however, that the terms of these loans often come with steeper interest rates. This is a way for lenders to protect themselves from the perceived risk they're taking on. So, while it might feel like an uphill journey, securing a car loan isn't impossible. The key is to understand the terms clearly and proceed with caution.

What Factors Most Impact a 306 Credit Score?

Understanding a credit score as low as 306 is the first step in charting a course for financial recovery. The most significant factors to consider with such a low score are likely to include items such as defaulted loans, unpaid bills and potential bankruptcy filings. Let's break these down.

Defaulted Loans

When a loan is defaulted, this severely impacts your credit score. Review every line of your credit report to identify any defaulted loans.

Unresolved Hardship

Sometimes, a financial hardship like job loss or medical bills may lead to missed or late payments. These could be impacting your score.

Bankruptcy

Have you declared bankruptcy recently? A bankruptcy proceeding can drastically hurt your credit score. Check your credit report for any mention of such proceedings.

Credit Utilization

Credit utilization refers to how much of your available credit you're using. Are your credit cards maxed out? Review your credit cards and pay down balances where possible.

Public Records

Public records of financial issues can have a devastating impact on your credit score. These might include tax liens and bankruptcies. Investigate your credit report carefully for any public records.

Credit Inquiries

If you've been applying for a lot of new credit or loans, this could have a negative impact on your score as well.

Tackling these impacting factors can be your first step toward rebuilding your credit score and reclaiming a healthier financial life.

How Do I Improve my 306 Credit Score?

With a current credit score of 306, steps to improve will require care, patience, and consistency. The following strategies are particularly fitting for your credit score range:

1. Identify and Rectify Credit Report Errors

Take the time to thoroughly review your credit report as errors can significantly impact your score. You have the right to dispute any inaccuracies you find. Addressing these could lead to a significant boost in your score.

2. Attend to Outstanding Collections

Unresolved collections can deeply impact your credit score. Clear any collections in your name by negotiating a pay-for-deletion agreement with the collections agency. This means the agency agrees to delete the collection from your report once paid.

3. Apply for a Credit Builder Loan

At this score range, a Credit Builder Loan could be beneficial. Unlike traditional loans, these allow you to make payments prior to receiving the funds, establishing a record of on-time payments and boosting your score.

4. Leverage Installment Loans

Opt for an installment loan, such as a personal, auto, or home loan if possible. These can add diversity to your credit profile and demonstrate your ability to handle different credit types when paid responsibly.

5. Set up Automatic Payments

Setting up automatic payments where possible prevents missed or late payments from adversely affecting your score. This consistent track record of timely payments will gradually lift your score over time.