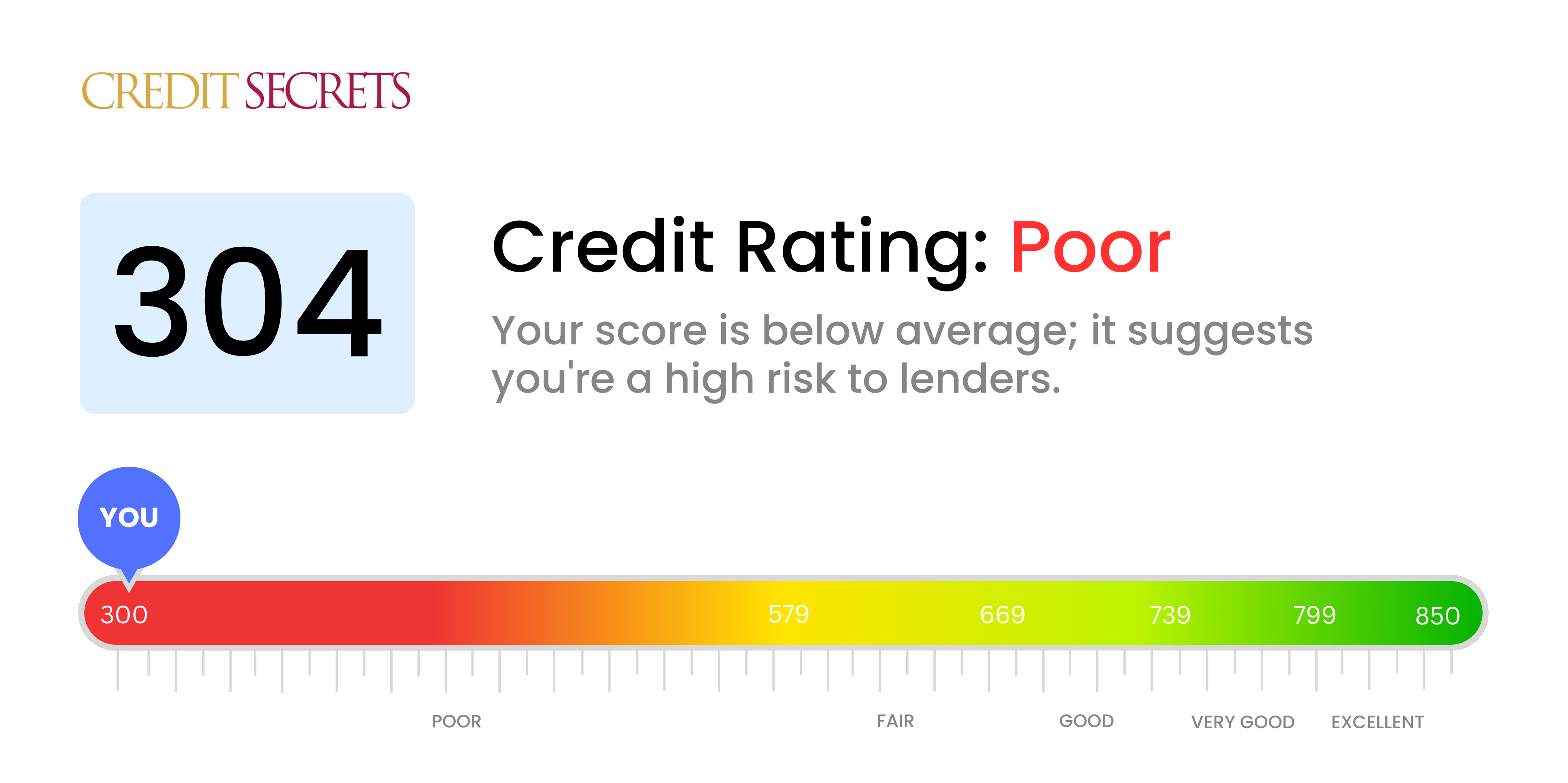

Is 304 a good credit score?

A credit score of 304 is considered a poor credit score. With this score, you can likely expect to face significant difficulties obtaining credit or loans, as lenders generally view individuals with poor credit as high-risk borrowers. Improving your credit score will be crucial in order to access better financial opportunities and achieve your goals.

Can I Get a Mortgage with a 304 Credit Score?

Can I Get a Credit Card with a 304 Credit Score?

With a credit score of 304, it is unlikely that you will be approved for a credit card. Lenders typically view this score as a reflection of financial difficulties or mismanagement in the past. Facing this situation can be disheartening, but it's essential to approach it realistically and seek ways to improve your credit.

Given the challenges associated with such a low score, you might consider alternative options like secured credit cards. These cards require a deposit that acts as your credit limit, making them easier to obtain and helping you rebuild your credit over time. Another option to explore is getting a co-signer or looking into pre-paid debit cards. While these alternatives won't instantly resolve the situation, they can serve as useful tools on your path to financial stability. It's important to note that credit options available to individuals with such low scores often come with significantly higher interest rates, reflecting the perceived higher risk to lenders.

Can I Get a Personal Loan with a 304 Credit Score?

Can I Get a Car Loan with a 304 Credit Score?

What Factors Most Impact a 304 Credit Score?

Understanding a score of 304 is crucial for improving your financial standing. Identifying the factors that may have contributed to this score can help you take targeted actions toward raising your creditworthiness. Remember, every financial journey is unique, and with the right steps, you can achieve your goals.

Payment History

Payment history is a significant factor in determining your credit score. Late payments or defaults may have played a role in your current score.

How to Check: Carefully review your credit report for any instances of late payments or defaults. Reflect on your payment habits and address any areas for improvement to make a positive impact on your score.

Credit Utilization

High credit card balances close to their limits can harm your credit score.

How to Check: Examine your credit card statements and assess whether your balances are near their limits. Aim to keep your balances low relative to your credit limits to show responsible credit utilization.

Length of Credit History

A shorter credit history can negatively affect your score.

How to Check: Review your credit report to see the age of your oldest and newest accounts as well as the average age of all your accounts. Consider whether you have recently opened new accounts, as that could impact your score.

Credit Mix and New Credit

Having a diverse credit mix and managing new credit responsibly are vital for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Additionally, consider whether you have been applying for new credit excessively, as that may negatively impact your score.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Thoroughly examine your credit report for any public records. If you find any items that need resolution, take appropriate steps to address them and improve your credit standing.

How Do I Improve my 304 Credit Score?

A credit score of 304 is considered very poor, but there is hope for improvement. With targeted actions, you can start building a better credit future. Here are the most impactful and accessible steps you can take at this score level:

1. Address Past-Due Accounts

If you have any accounts that are past due, it’s crucial to bring them current. Start by focusing on paying off the most overdue accounts first, as they have the greatest negative impact on your credit score. Consider contacting your creditors to negotiate a payment plan that works for you.

2. Reduce Outstanding Debts

High outstanding debts can weigh heavily on your credit score. Make it a priority to lower your debt balances by creating a repayment plan. Begin by tackling the debts with the highest interest rates or the smallest balances. Consistently paying down your debts will gradually improve your creditworthiness.

3. Explore Credit Repair Options

Consider leveraging credible credit repair resources available to you. Conduct thorough research to find reputable programs, like Credit Secrets, that provide guidance on improving credit scores. These programs can equip you with knowledge and strategies to make a positive impact on your credit standing.

4. Save for a Secured Credit Card

Though qualifying for a regular credit card may be challenging at this score level, you can still build credit by applying for a secured credit card. With a cash collateral deposit serving as your credit line, responsible use of a secured card can help you establish a positive payment history.

5. Patience and Consistency

Remember, improving your credit score takes time and perseverance. Stay committed to positive financial habits, such as making payments on time, maintaining low credit card balances, and avoiding new debts. Over time, these actions will demonstrate your creditworthiness and lead to a brighter financial future.

By following these steps and taking advantage of credit building programs like Credit Secrets, you can get on the path towards achieving your financial goals and improving your creditworthiness. The journey might not be easy, but with determination, you can turn things around. Start today and take control of your credit future!