6 Easy Ways To Make Your Money Start Working For You

If you’ve ever read Robert Kiyosaki’s book, Rich Dad, Poor Dad, (one of the best-selling business books of all time) you know one of his key themes in the book is about letting your money work for you.

Here are six easy ways to achieve this without having to break your bank account.

Buy One Bitcoin and Forget It

What does this chart make you feel?

If you didn’t get into bitcoin early enough, this chart is heartbreaking. I get that.

The good news is, according to some very. smart. people. it is nowhere near too late to get into bitcoin.

The simplest way in, is for you to buy one bitcoin and forget it. Here is the reason.

In Bitcoin, there are two sides. There are those people – like Jamie Dimon – who believe that bitcoin is a bubble that will eventually collapse under its own weight.

On the other hand, there are people who believe that bitcoin is worth much more. Wences Casares – a director at PayPal – believes that Bitcoin could even get to $1 million.

So, if you buy one bitcoin today, it will cost you about $5,600. If Jamie Dimon’s fears become true, the biggest loss you will make will be your initial $7,200. However, if Wences’ argument becomes true, your $7,200 will turn to $1 million without you doing anything.

“But wait Jay! I don’t have $7200 to invest right now!”

That’s ok! because you don’t have to buy a whole Bitcoin: “Just like all fiat currencies can be broken down into cents, 1 BTC can be broken down into smaller units all the way to eight decimal places: 0.00000001 BTC”

Using the same argument, you can also create a diversified portfolio of cryptocurrencies like Ethereum, Ripple, and Dash which are examples of some of the “alternate” cryptocurrencies available on exchanges like Bittrex.

If you’re looking to buy Bitcoin the easiest place to get started is Coinbase.com

But before you do, make sure you understand how to keep your cryptocurrency safe from hackers and thieves.

IMPORTANT: Investing in cryptocurrencies is extremely risky, and the markets are currently very loosely regulated. Do your own due diligence and research before investing in anything

Invest in Real Estate

It won’t cost you much. Believe me.

Traditionally, to invest in real estate, you needed to have two crucial things: prime land, and money. A lot of it. You also needed to go through a bureaucratic process, from one office to another.

Today, you don’t need to do any of that. This is because technology has made it easy for anyone to invest in assets that were hard to do in the past.

Several platforms that help people pull resources together to build a building have been developed. My favorite one is a company called Fundrise which pioneered the model.

Using FundRise, investors from all United States can contribute as little as $500 each to develop a piece of land and watch their investment grow.

Already, the company has received and invested more than $1.4 billion in private real estate deals. The company has also attracted more than $55 million of venture capital.

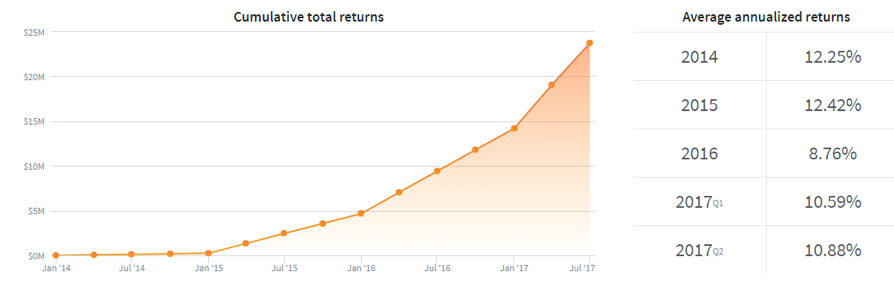

Returns have been good too as you can see.

Source: Fundraise

Quick Tips

- Before you invest in Fundrise, you should compare it with other similar companies which include: Realty Mogul, Realty Shares, Patch of Land, and PeerStreet.

- You can even diversify your money across several similar companies.

- Do you due diligence by ensuring the company you invest with does what it says it does. See whether it is regulated. You don’t want to be in another Madoff-like situation.

Give Loans to People and Businesses

Again, this seems like a really difficult thing to do. How will you find the people or companies to lend money to? How will you evaluate them? What will you do if they default?

Truth is, all this is not hard. (In the past, it was)

This is because there are many technology-powered companies that makes all this very easy that you can do it within minutes.

One of my favorite platforms in this is LendingClub, a company listed in the New York Stocks Exchange.

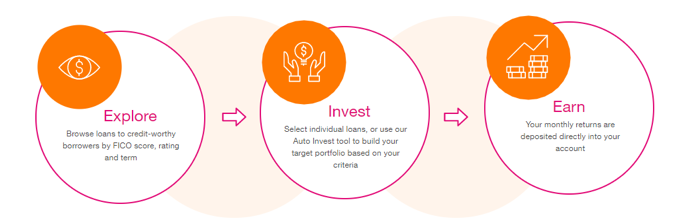

The idea behind these peer to peer market places is simple. People and businesses are in need of capital and banks can be hectic. So, they make it easy for businesses and people to get the funds that they need without having to go to a bank. As an investor, you earn interest the same way banks do.

Using the platform, you can invest as little as $25 and see your money grow.

What’s better? You are not alone. Many American banks – who feel threatened by these companies – also provide their capital to them.

LendingClub is not the only company offering these services. There are others like Prosper, SoFi, Upstart, and OnDeck among others.

Using these platforms, you can make between 4% to 10% returns per year.

Quick tip.

Before you invest in a peer-to-peer marketplace, please do your research. I also recommend that you invest in P2P companies that are public like LendingClub, OnDeck, and Prosper. This is because these companies are mandated by law to release several disclosure documents. They also offer investor conference calls where they are asked questions that might be of interest to you.

Invest in Startups

Startups are disrupting all sectors in the United States. Uber has disrupted the traditional taxi businesses. Airbnb is disrupting the hotel industry while Tesla is disrupting the vehicle industry.

For these startups to grow, they need capital. A lot of it.

This is where you get in. Using technology, you can be a venture capitalist like Chris Sacca and Bill Gurley of Benchmark even when you don’t have a lot of money.

Companies like SeedInvest, MicroVentures, and WeFunder offer platforms that let you invest in vetted, early and late-stage companies with as little as $100.

These companies remove three main bottlenecks for ordinary investors. First, they find companies that have the potential of succeeding. Second, they enable investors to pool capital and invest in one company. This means that you don’t need to have a lot of money to invest in the next Facebook. Third, they let you track how your investment is doing.

To me, MicroVentures is the best of the three platforms. Its past investments include companies like Facebook, Twitter, and Pinterest among others.

Remember that not all startups you back will succeed. In fact, in all venture capital firms, the investments that don’t work are usually more than those that work out fine.

For example, a seasoned group of investors like KPCB and Throve Capital invested more than $118 million in a juicing company called Juicero. After launching its $400 juicer, Juicero was shut down after Bloomberg exposed the company for creating a product that was not needed.

Another good example is Theranos which had raised about $686 million and got to a valuation of $9 billion before it was exposed for being a fraud.

To succeed in all this, you need to conduct intensive research on companies you want to invest in and diversify your portfolio among many quality companies.

Automate Your Investments

You’ve probably seen the lavish lifestyle showcased by top hedge fund managers. If you have not, I recommend you to watch this YouTube video.

Truth is, hedge funds have a broken fee system that allows them to make money even when they don’t perform well. They take 2% of the assets and then take a 20% incentive fee from the profits they generate. Therefore, a hedge fund manager with $10 billion in assets under management, is sure of making $200 million a year.

In addition, not all of us can afford investing in a hedge fund because mostly they serve high-net worth investors and pension funds.

This is where robo-advisors come in.

Robo-advisors are firms that take money from individual and allocate them in diversified portfolios based on the individual’s risk appetite. Good thing about these advisors is that they don’t charge people a lot of money and you can invest as little as $10.

Some of the best robo-advisors are Motif Investing, WealthSimple, Wealthfront, Betterment, and Ellevest among others.

Today, these platforms have raised hundreds of millions of dollars from venture capital firms. In return, they have raised billions of dollars from investors.

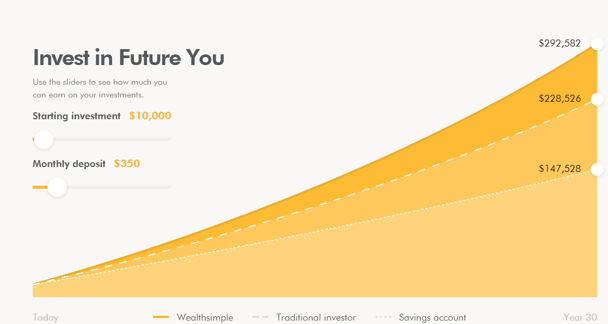

Consider the chart below from WealthSimple.

Please note.

These companies are significantly new in the industry. They have not been tried and tested especially in difficult market environment. Therefore, diversify your funds across several companies and do your due diligence before you put your money in any of the company.

Also, in robo-advisors, you should consider companies like Acorns that bring an interesting angle in investing. Acorns – and several other companies – allow you to invest your spare change. For example, if you had $50 and you decide to buy a dress worth $45, Acorns allows you to invest the $5. If you make this a habit, in a long time, you will start seeing your money grow.

ETFs

Do you want to invest in the stock market but don’t have the time or expertise to do so? If the answer is yes, a low-cost ETF can be a good option for you.

To many, an ETF is a jargon but in reality, it is a very simple concept. An ETF is an asset class that tracks a basket of stocks, commodities, or even currencies. For example, an ETF like the VanEck Vectors Gold Miners ETF (GDX) tracks the movement of companies that mine gold.

Investing in ETFs is different from investing in individual stocks because of its diversification. This means that by buying an ETF like GDX, you are buying a diversified group of companies.

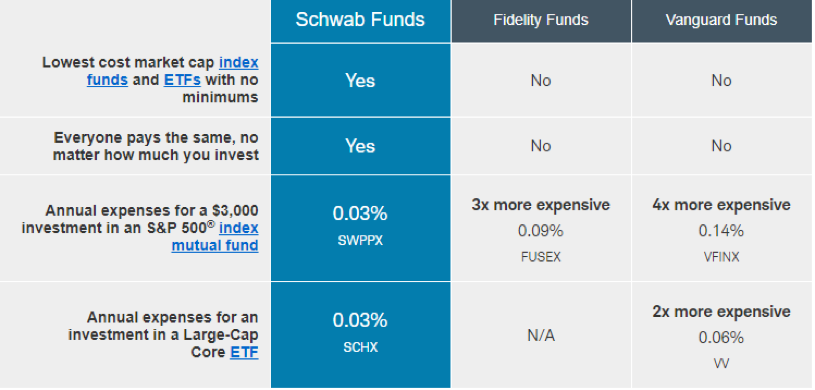

You can buy ETFs from your traditional broker like Charles Schwabb and Fidelity.

However, technology has made it possible for you to bypass the fees that these traditional companies charge. As shown below, the fees can be huge.

You can bypass these fees by using modern brokerage firms like Robinhood and Stash. Robinhood charges no fees per trade while Stash charges investors a monthly fixed fee of $5.

The unique thing about the platforms and strategies I have shared above is that they don’t need you to spend a lot of money. Also, after investing, you will not need to do anything apart from tracking your investment.

If you’re looking to learn how to improve your credit and increase your purchasing power dramatically…

…Then this may be the most important decision you’ve ever made