Ways to Get Out of Debt: 15 Simple Tricks to Get Out & Stay out Of Debt

We have an interesting relationship with debt. We all hate being in debt, but we can’t resist being in debt. We simply love to hate debt.

Sadly, recent official data show that most Americans are not happy financially. For example, it was just announced that only 39% of people could comfortably cover an unplanned $1,000 emergency.

Recently, the statistics from the Fed showed that credit card debt and household debt are at a record high while delinquencies are rising. At the same time, the number of people reporting debt-related stress and depression is increasing.

Here are the 15 ways to stay out of debt as recommended by money experts.

Living Within Your Means

We all want the best things in life. We want the best cars, the best houses, the best smartphones, and the best accessories. However, the truth is, not all of us can comfortably afford all these things.

As you start your career, I recommend that you take time to examine your finances, and draw a line about the things you cannot afford.

Create Shopping Lists and Stick to them

A shopping list is a simple thing, yet we mostly never use it. Research shows that people who create and stick to their shopping lists are often better spenders of money. Without a shopping list, you will often find yourself buying things you don’t need.

An excellent way to start is to use mobile apps like Evernote and Google keep to add items to your list. You can also use voice assistant tools like Amazon Echo and Google Home to do this.

Talk about Money

How many times do you and your partner sit down and talk about money?

Experts advise couples to hold meetings regularly where they discuss their financial position. In these meetings, they should be honest with one another and talk candidly about their financial goals.

If they have debt, they should talk about how to trim them and how to avoid getting in debt again. When possible, they should involve a financial expert and even their children.

Use Budgeting Apps

Budgeting is an important method to avoid overspending. Sadly, of all the people who create budgets, only a small number of people follow them.

You can solve this by using the freely available budgeting apps such as Mint, Bucket, and Spending Tracker.

After creating a monthly budget, you should direct your bank to deduct the extra funds and put them in a fixed account.

Read About Money

Reading about money will help you get the perspectives of money experts and people who have been there, done that. As a start, I recommend the following books: Debt-Free For Life by David Bach, The Wealthy Barber by David Chilton, and Debt-Free Forever by Gail Vaz Oxlande.

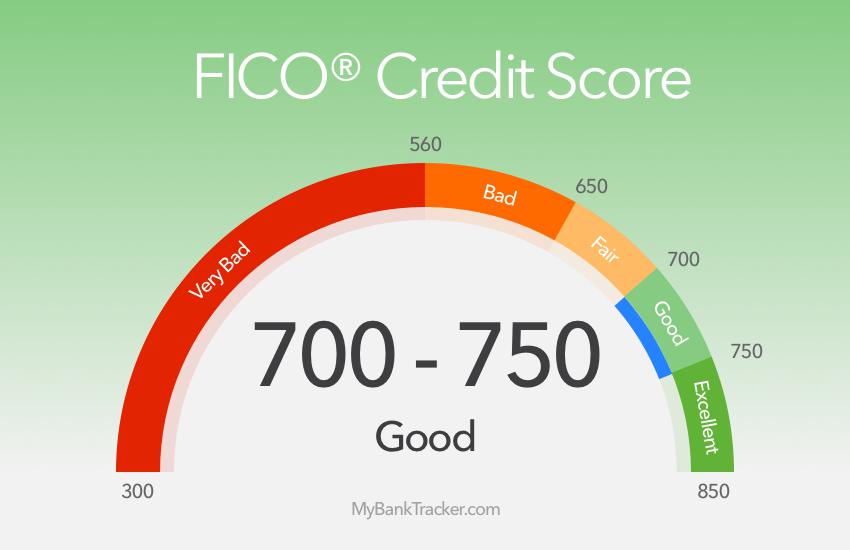

Maintain Good Credit

The reality of debt is, while we hate it, we will always need it. Therefore, maintaining good credit will help you get access to cheaper funds faster. It will also help you live a stress-free life. To achieve this, you need pay all your debt on time, apply for a secured credit card, and get a co-signer.

Stop Being in Denial

A common issue we experience is when people are not ready to accept that they are in financial trouble. As a result, they continue adding to their debt with hopes that they will pay the money.

In reality, you can’t solve a problem that you have not admitted to. Therefore, the earlier you accept that you have a problem and that you need help, the better it is for you.

Always Pay Up

Any time you borrow money, ensure that you pay it back. A common problem is where people borrow money from micro-lending platforms like Affirm or from their friends, and then forget to pay up.

Ultimately, these funds will add up and put you in financial trouble. Therefore, always pay back all the money you borrow and confirm with your lender.

Consider Debt Consolidation

If you have multiple loans from different companies, you can consider debt consolidation. This is where you take one loan to pay off the other loans.

Doing this will make it easier and cheaper for you to pay back your debt. On average, you can save hundreds of dollars when you consider this option.

Save to Buy

When buying an item, say a car, you have two options. Either you can get a car financing to pay for the car, or you can save money to pay for it in full. The former option is always more expensive than the latter.

Unless you really need an item, I recommend that you take your time to save for it without getting into debt. Doing this will not expose you to any risks.

Get an Accountability Partner

If you believe you have a problem with money, you should get an accountability partner. The partner should be a close confidante who knows you well, and who is not afraid to tell you the truth.

Ideally, you will always talk to your accountability partner when you want to buy something expensive.

Once Out, Stay Out

After struggling to get out of debt, you should now strive to stay out. Once your credit score starts improving, you might be tempted to take more debt. Before you fall into a trap, you should talk to your accountability partner or financial planner.

Listen to Stories about Debt

An old saying tells us that experience is the best teacher. In your financial life, the experience of other people will be your best teacher. Fortunately, there are many ways to listen to these stories. I recommend that you subscribe to podcasts like Oprah’s SuperSoul Conversations, Planet Money, Death Sex, and Money, and The Dave Ramsey Show.

Think Outside the Box

Even when you are trying to stay out of debt, you should live your life to the fullest. You can live a debt-free life by thinking outside the box. For example, instead of spending a thousand dollars on a brand new iPhone, you can wait until its prices drop.

Also, instead of depending only on your job, you can build something on the side. You can become a writer, a designer, and even a part-time Uber driver.

Thinking outside the box will help you make extra income and live a debt-free life.

Give up some Luxuries

To live a financial-satisfied life, you must be willing to make some sacrifices. For example, instead of always ordering take-out food, you can cook. Instead of leaving your spare room empty, you can share it with a paying stranger. Instead of paying for cable, you can use the cheaper Amazon Prime Video, and instead of paying a gym membership, you can do home-based exercises.