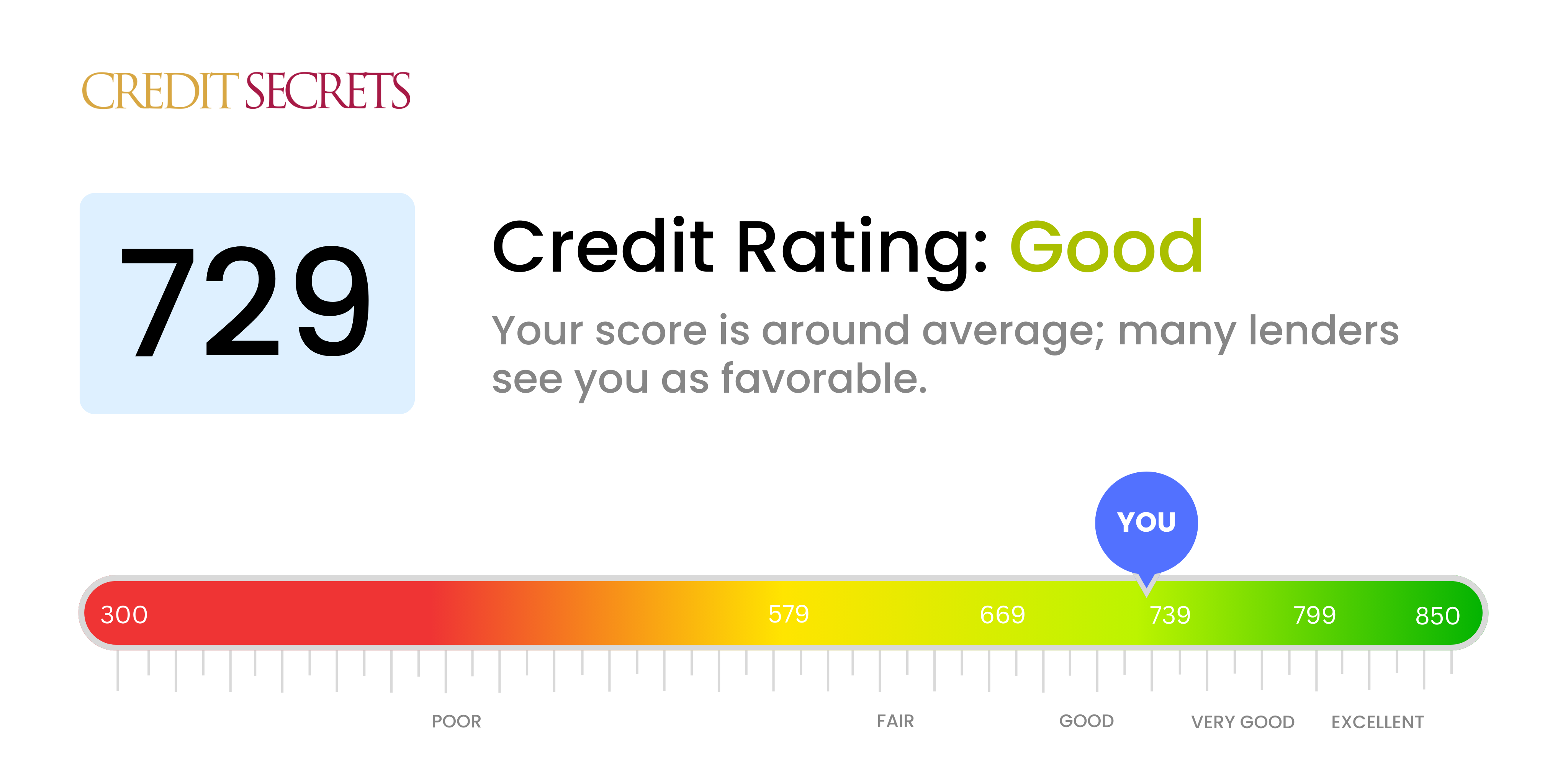

Is 729 a good credit score?

With a credit score of 729, you're on the cusp of having a 'very good' credit standing. Although it's not considered 'excellent', your score is solidly positioned in the 'good' category, signaling to lenders you are generally reliable when it comes to paying back your debts. Due to your good credit score, you can expect to be approved for most loans or credit cards, often with favorable interest rates.

Remember, consistency in your financial habits, like paying bills on time, can help nudge your score up towards the 'very good' range. Every point matters when it comes to credit scores, opening up even more financial possibilities for you. Keep up the good work and continue making smart financial choices!

Can I Get a Mortgage with a 729 Credit Score?

If you have a credit score of 729, you will likely be approved for a mortgage. This is a good credit score that suggests you have a history of responsible financial behavior. Most lenders view scores in this range as an indication of a reliable borrower, enhancing your chances of approval. However, be aware that this does not guarantee mortgage approval, as lenders also consider factors like income and employment.

The mortgage approval process typically involves submitting financial documents such as pay stubs and tax returns, which will be reviewed by underwriters alongside your credit score. Be prepared for this practice. In terms of interest rates, a strong credit score like 729 may help you secure more favorable terms. With lower interest rates, your overall mortgage cost can be significantly reduced in the long run. Nonetheless, it's crucial to shop around for the best mortgage terms and make sure such an obligation comfortably fits within your long-term financial plans.

Can I Get a Credit Card with a 729 Credit Score?

With a credit score of 729, you're likely to get approved for a credit card. This score is considered good and demonstrates a history of responsible credit management. Lenders see this score as an indication that you're a dependable borrower, which enhances your likelihood of approval of credit card applications. It's an encouraging situation, but it's crucial to remember that a good credit standing is something to maintain through continued financial prudence.

Because of your strong credit score, you may qualify for a variety of credit cards, including some with attractive rewards programs. Cards that offer travel rewards or cash back on everyday purchases could be a great fit for your situation. It's also possible to consider cards known for lower interest rates, which could save money in the long run in case you ever carry a balance. It's important to scrutinize each offer and weigh it against your personal financial habits and goals. Being judicious with your credit card choices can further bolster your financial growth.

With a credit score of 729, you're in a favorable position when it comes to applying for a personal loan. Lenders view this score as a solid indication that you are a responsible borrower and significant risk is not associated with your application. This healthy credit score often makes personal loan approval more likely and the application process smoother.

One important factor that you can anticipate as a result of your commendable credit score is the advantage of competitive interest rates offered by lenders. A higher credit score reflects well on your financial management and, as a result, lenders tend to offer personal loans at lower interest rates. This means you could experience savings on repayments over the course of your loan. Keep in mind, however, that each lender varies in their approval process and rate offerings, so you should thoroughly review the terms before finalizing your personal loan.

Can I Get a Car Loan with a 729 Credit Score?

A credit score of 729 is quite impressive and generally falls into the 'good' credit category. In most scenarios, this should make the process of securing approval for a car loan relatively smooth. Lenders tend to view such scores as signs of a dependable borrower, which bodes well in achieving favorable loan terms.

However, it's important to remember that a credit score isn't the sole deciding factor. While a score of 729 may put you in a favorable position, other aspects such as your income and debt-to-income ratio also play a role in the loan approval process. Nevertheless, having a good credit score can substantially improve your chances of securing a lower interest rate. This can prove advantageous by reducing the overall amount you'll end up paying for your car loan.

What Factors Most Impact a 729 Credit Score?

Understanding your credit score of 729 is an important step in refining your financial strategy. It's essential to know the elements that carry the most weight at this level to continue forward in your financial journey.

Credit Utilization

At a score of 729, your credit utilization might be influencing your score. Credit utilization makes up about 30% of your total score. It's the percentage of your total credit limit that you're using.

How to Check: Look at your credit card balances compared to their limits. If they are approaching their limits, your credit utilization may be high. Try to lower your balance to below 30% of your available credit.

Payment History

Your payment history could be another factor affecting your score. If you have any late payments, they may be draining points from your score.

How to Check: Go through your credit report, looking for any late payments or defaults. These could negatively affect your score.

Length of Credit History

Meanwhile, a relatively short credit history might be holding your score back from crossing the 'Excellent' threshold.

How to Check: Review your credit report to see the age of your oldest and newest accounts, and the average length of all your accounts.

New Credit

If you frequently apply for new credit, this can result in a slight dip in your score.

How to Check: Your credit report will reveal the frequency of your credit applications.

Credit Mix

The variety of credit types in your credit report can also affect your score.

How to Check: Inspect your credit report to find a variety of credit types, such as credit cards, auto loans, mortgages, and other installment loans.

How Do I Improve my 729 Credit Score?

A credit score of 729 is an impressive achievement on your financial journey. While already considered good, there’s still room for progress. Here are some steps specific to your credit score level that can help improve your situation:

1. Maintain Low Balance-to-Limit Ratio

Keeping your credit utilization ratio low is crucial. If you have any credit card balances nearing 30% of your credit limit or higher, work on reducing them. Aim for a ratio of less than 10% for a better score.

2. Keep Old Accounts Open

Length of credit history contributes to your score. So, don’t close any paid-off accounts. These aged accounts help to lengthen your credit history and can positively impact your score over time.

3. Review Your Credit Report Regularly

Even at this credit score level, monitoring your credit report is crucial. Mistakes do happen, and uncorrected errors could harm your score. Spot any inaccuracies early by reviewing your credit report regularly.

4. Diversify Your Credit

If your credit mix solely includes credit cards, consider diversifying. A responsible mix of different types of credit, such as installment loans, can demonstrate your ability to manage different types of credit and help increase your score.

5. Pay Bills on Time, Every Time

Paying bills on time is key to maintaining and improving your score. Even one late payment can negatively impact your credit score. Automate your bill payments to ensure you don’t accidentally miss a due date.