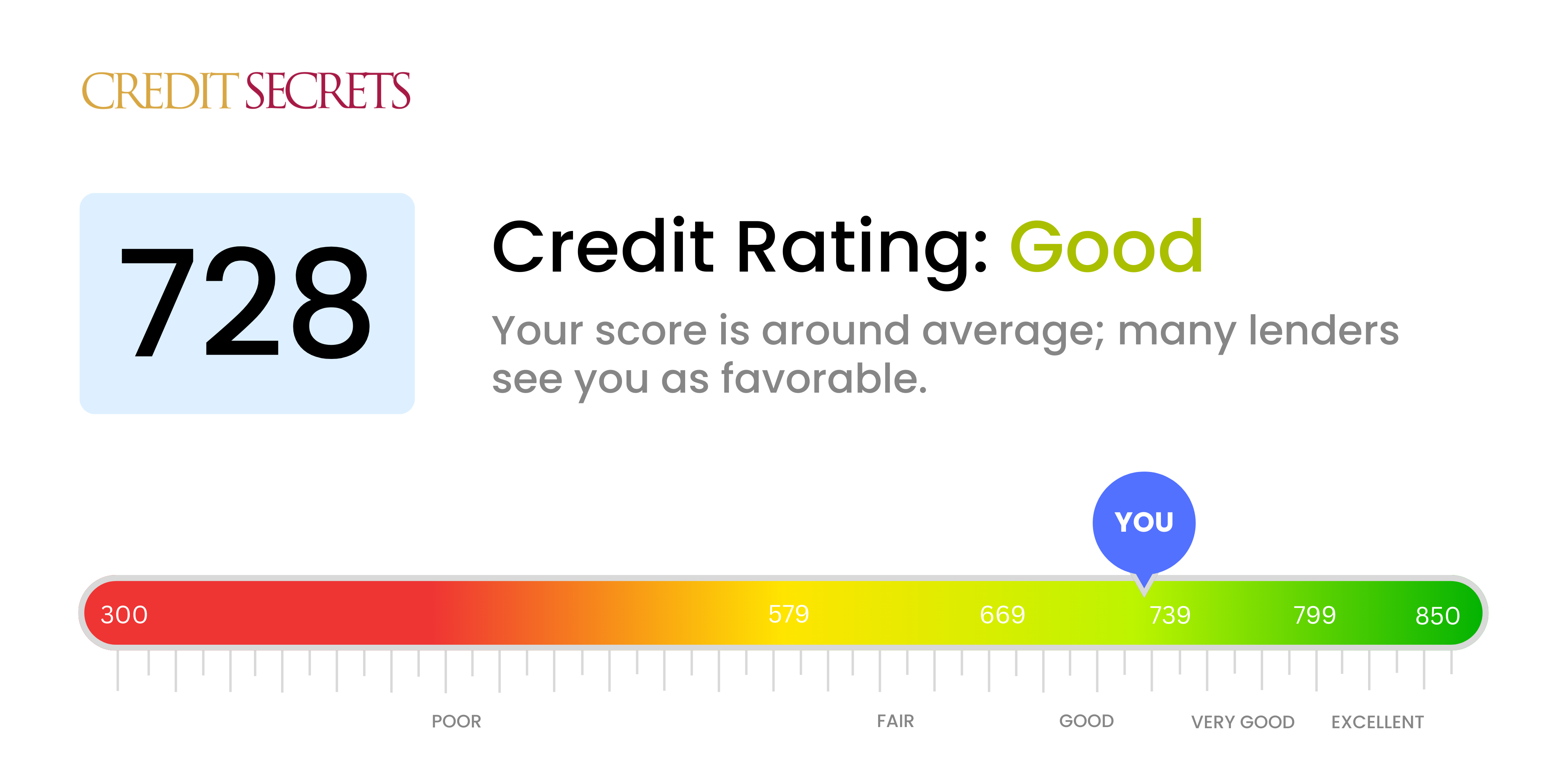

Is 728 a good credit score?

Your credit score of 728 falls into the 'good' credit bonus range. This typically means you have been generally responsible with your credit, but have some room for improvement. You'll likely qualify for most loans and credit cards, but might not get the very best interest rates.

Because the score is quite close to the 'very good' category, some minor adjustments and financial decipline could help lift your score. Being mindful of maintaining debt levels low, and ensuring prompt bill payments, can slowly assist in lifting your score into a higher credit category. With this credit score, you have a solid base to build on.

Remember, everyone's credit journey is unique and progress takes time. Stay determined and continue making smart credit moves to open up more financial opportunities for yourself in the future.

Can I Get a Mortgage with a 728 Credit Score?

With a credit score of 728, it appears you are in a favourable position to be approved for a mortgage. This score reflects a history of reliable fiscal behavior, which lenders look for when evaluating mortgage applications. However, please bear in mind, a credit score is just one component of your financial profile and additional factors may come into play.

As you proceed through the mortgage approval process, it's worth noting that the interest rate you receive may also be influenced by your credit score. A higher credit score usually leads to more favourable interest rates, which can result in significant savings over the life of your mortgage. Although you are likely to be approved based on your credit score, you should understand that lender's terms and conditions can vary, and it's always wise to shop around for the best deal. Remember, the goal is not just approval but also securing a rate that feels manageable for you in the long run.

Can I Get a Credit Card with a 728 Credit Score?

Having a credit score of 728 places you in a favourable position to be approved for most credit cards. This score is seen as a sign of dependable financial behavior, much to your credit. It can open up a variety of options for you. However, be mindful of your choices and pick a card that matches your lifestyle and financial goals.

You may be eligible for premium cards that come with rewarding features like travel rewards or cash back. But remember, these types of cards often come with high annual fees, so ensure the benefits outweigh the costs. Also, note that the interest rates can vary. Thus, while it's a good rule to always pay your balances in full each month, it can be particularly important with these prime cards. Secured or starter cards can oftentimes be overlooked, yet they can provide lower interest rates and less stringent terms. Above all, use your credit responsibly to maintain or even improve your current score.

With a credit score of 728, you're in a strong position for loan approval. In financial institutions' eyes, a credit score like yours indicates reliability and timely repayment of debts, making you a good candidate for personal loans. This score suggests you're a reasonable risk and have a history of responsible credit management.

As you navigate the loan application process, you can expect lenders to offer you competitive interest rates due to your solid credit score. However, remember that while a robust credit score significantly boosts your chances of approval, other factors are at play too such as your income, outstanding debts, or employment status. Getting the best terms also hinges on comparing offers from various lenders. Keep these considerations in mind when you're ready to apply.

Can I Get a Car Loan with a 728 Credit Score?

Having a credit score of 728 suggests a responsible history of borrowing and repaying. This is good news when it comes to applying for a car loan. Most lenders prioritize credit scores above 660 and your score comfortably meets this standard. This sort of quality score indicates a lower risk for lenders, implying a better likelihood of consistent and timely loan repayments.

As a potential car buyer with a credit score of 728, the car purchasing process will likely be smoother for you. With a score like this, lenders might offer you more favorable interest rates as it reduces their potential risk. You can reasonably expect to encounter a variety of loan options, but as always, it's critical to review the terms of any loan before signing. Remember, a higher credit score like yours can truly make a positive difference in the auto loan process so take full advantage of this financial standing.

What Factors Most Impact a 728 Credit Score?

A 728 credit score is a good starting point towards achieving your financial goals. With some dedication and insight, you can adapt your financial behavior strategically to enhance your score even further. Remember, each credit journey is distinct and brimming with potential for growth and progress.

Credit Card Balances

One of the most influential factors at this score might be your credit card balances. Steep balances can adversely affect your score.

How to Check: Take a look at your credit card statements. If your balances are high, it's likely impacting your score. Aim to restrain your balances as low as possible compared to your credit limit.

Recent Credit Applications

Applying for multiple lines of credit in a short time can cause temporary damage to your credit score.

How to Check: Revisit your recent financial activities. If you’ve been applying for a lot of new credit, this could be affecting your score. Try to pace your credit applications over a longer timeframe.

Credit Diversity

Your credit mix - or different types of credit you have - can influence your credit score. Having a balanced mix is advantageous.

How to Check: Analyze your different credit accounts. Aim for a mix that includes credit cards, installment loans, and other credit products.

Undetected Errors

Mistakes on your credit report can pull down your score.

How to Check: Scrutinize your credit report for any errors or discrepancies. If you find any, take steps to rectify them.

As you take steps to optimize these factors, you'll be on your way to boosting your credit score and attaining your financial aspirations. Stay committed and patient - progress takes time.

How Do I Improve my 728 Credit Score?

A credit score of 728 falls into the category of a good credit rating, but there are still valuable steps you can take to further improve your score. The following are the most sensible and impactful actions for someone at your score level:

1. Monitor Your Credit Report

Regularly review your credit report for any inaccuracies or inconsistencies. Contact the respective credit bureau as soon as possible to correct any errors, before they have a chance to affect your score negatively.

2. Keep Credit Card Balances Low

Even with a solid score, maintaining low balances on your credit cards is crucial. Aim to keep your credit utilization below 30% of your credit limit on all cards, keeping it even lower at about 10% for the best results.

3. Positively Manage Your Credit Accounts

Do not open new credit card accounts too frequently, as each application can potentially result in a small drop in your score. Only apply for new credit when necessary.

4. Be Consistent with Payments

Even one missed or delayed payment can significantly impact your credit score. Set up automatic payments or reminders to ensure every bill is paid on time. Your consistent payment history will reflect positively on your credit report.

5. Nurture Credit History

A lengthier credit history can boost your credit score, especially if it includes a consistent record of timely payments. Try to keep your oldest accounts open and in good standing to demonstrate a longer length of credit history.