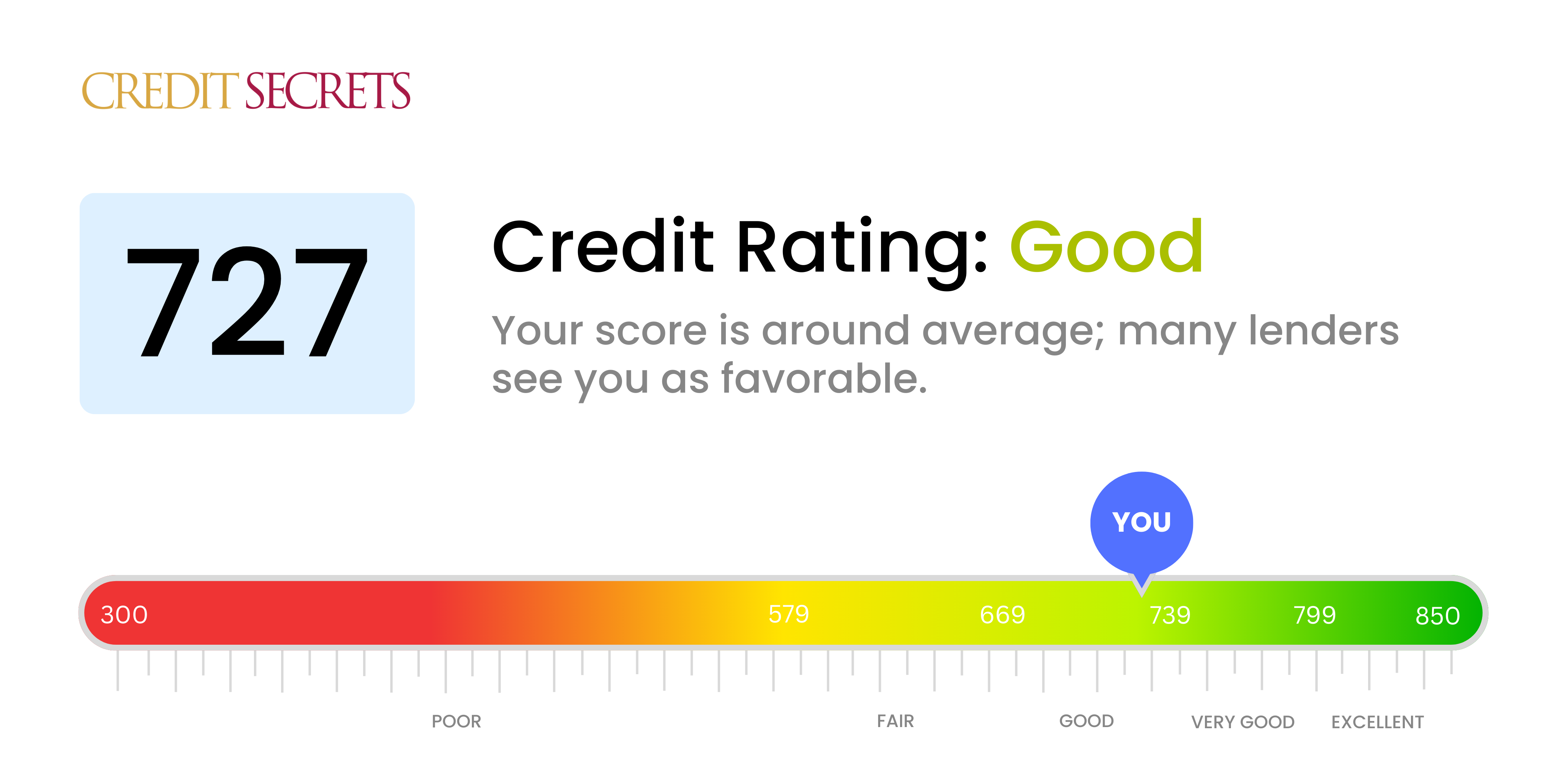

Is 727 a good credit score?

A score of 727 falls into the 'Good' category of credit scores. This means that your credit behaviors and history indicates responsible credit management which can make you appear favorable to lenders.

Most likely, you can expect better interest rates and terms than those with lower scores when applying for loans or credit cards. However, there's still room for improvement to get into 'Very Good' or 'Excellent' credit score ranges which can provide even better opportunities. Keep up the responsible credit management and you should see a rising trend in your score. Remember, patience and consistency are key in improving your credit score.

Can I Get a Mortgage with a 727 Credit Score?

A credit score of 727 is deemed good by most lenders, indicating a track record of responsible borrowing and timely payments. This places you in a strong position to be approved for a mortgage. While a score in this range doesn't guarantee approval, as lenders also consider other factors like income and debt, it significantly increases your chances.

During the mortgage approval process, you can expect an in-depth review of your financial health beyond just your credit score. Lenders will consider your employment history, income level, and existing debts. A solid credit score like 727 will likely qualify you for lower interest rates, which can result in thousands of dollars in savings over the life of your loan. Remember, being well-informed and prepared can make the mortgage application process smoother and more successful.

Can I Get a Credit Card with a 727 Credit Score?

If you have a credit score of 727, you are most likely going to be approved for a credit card. This score shows potential lenders that you’ve been responsible with your credit in the past. You are seen as less of a risk, which can make you more attractive to lenders. It's important though, to remember to remain vigilant with your finances, because every financial decision matters.

Bearing in mind your good credit score, you may want to consider premium credit cards, these cards often come with rewards like travel miles or cash back. However, do take time to fully understand the interest rates, any annual fees, and the terms and conditions attached to these premium cards before making a final decision. This is a great opportunity to make your credit work to your advantage and you have earned it through smart and calculated financial decisions. But all the same, keep the good habits going. Late payments or too much debt could negatively affect your credit score.

With a credit score of 727, you are certainly in good standing when it comes to personal loan approval. This score is viewed favorably by lenders as it indicates a healthy credit history, implying that you are a responsible borrower. This positive impression increases your likelihood of securing a personal loan. It's important to remember, however, this doesn't guarantee approval as lenders look at multiple factors beyond just your credit score.

The process might include rigorous credit checks and verification of your income sources. You should also expect variations in interest rates as they are often determined by your credit score, among other things. Lower interest rates typically favor those with higher scores, hence, having a 727 credit score can likely result in reduced interest costs for you. Despite these favorable outcomes, it's crucial to carefully review the terms of any loan you consider, to ensure it fits your financial situation.

Can I Get a Car Loan with a 727 Credit Score?

With a credit score of 727, better opportunities to secure a car loan are definitely in your favor. This credit score is generally well-regarded by lenders, indicating responsible credit management and a decreased likelihood of defaulting on repayments. It is typically a ticket to favorable loan terms, as it sits comfortably within the prime lending spectrum.

While seeking a car loan, this score will likely lead to a smoother purchasing process. Interest rates at this credit score level can be reasonably attractive and competitive. But, remember to inspect loan terms meticulously, regardless of your seemingly advantageous credit score. It's always significant to thoroughly understand every detail. Though your score provides a solid footing in the auto loan market, make sure you're getting the best deal available for your unique circumstance.

What Factors Most Impact a 727 Credit Score?

Grasping what a credit score of 727 means is a crucial step towards achieving your financial objectives. This score is seen as good, but it’s affected by several elements. Deciphering these elements can assist you in understanding your financial path.

Payment History

Your payment history has a significant bearing on your credit score. Make sure payments haven't been missed or are late. This sort of record can hamper your score.

How to Check: Peruse your credit report thoroughly. Note any late or forgotten payments, these could have drawn down your score.

Credit Utilization

Your credit utilization rate, or the amount of credit you're using compared to your total credit limit, affects your score. Aim to keep this rate low.

How to Check: Analyze your credit card balances. If they're close to your limits, it might be pulling your score down. Strive to keep these balances as low as possible.

Length of Credit History

A limited credit history might be impacting your score. A more extensive history generally reflects better on your score.

How to Check: Look through your credit report. See how old your accounts are – both the oldest and youngest ones, and the average age of all accounts. If your history is extensive, it may buoy up your score.

Credit Mix

A diverse credit mix, displaying your ability to handle different types of credit, can influence your score positively.

How to Check: Evaluate your credit mix. Do you have various types of credit accounts (like credit cards, retail accounts, and loans)? A diverse credit mix might be boosting your score.

Public Records

If your public records reflect bankruptcies or unpaid taxes, it may be detrimental to your score.

How to Check: Your credit report includes your public records. Resolve any outstanding issues that could be weighing down your score.

How Do I Improve my 727 Credit Score?

A credit score of 727 is a good starting point, but there’s always room for enhancement. Here are tailored steps you can take to further boost your score:

1. Regular Credit Card Review

Analyze your credit card statements regularly. This can help you understand your spending habits and subsequently control them. Also, check for any mistakes or fraud that could potentially hurt your score.

2. Increase Credit Limit

Request an increase in your credit limit from your credit card issuer. This doesn’t mean increasing your spending, rather it decreases your credit utilization ratio which helps to up your score.

3. Installment Loans

While you already may have credit cards on your report, diversifying your credit can help. Responsibly managing an installment loan, like an auto or personal loan, can illustrate your ability to handle different types of credit, boosting your score over time.

4. Pay More Frequently

Instead of making a single payment towards your credit card balance each month, consider making multiple, smaller payments throughout the month. This method helps to keep your credit card balance consistently low, which reflects positively on your credit report.

5. Avoid Hard Inquiries

Only apply for new credit when necessary. Too many hard inquiries in a short period can negatively impact your score. Remember, it’s about demonstrating responsible credit use, not accumulating unnecessary credit lines.