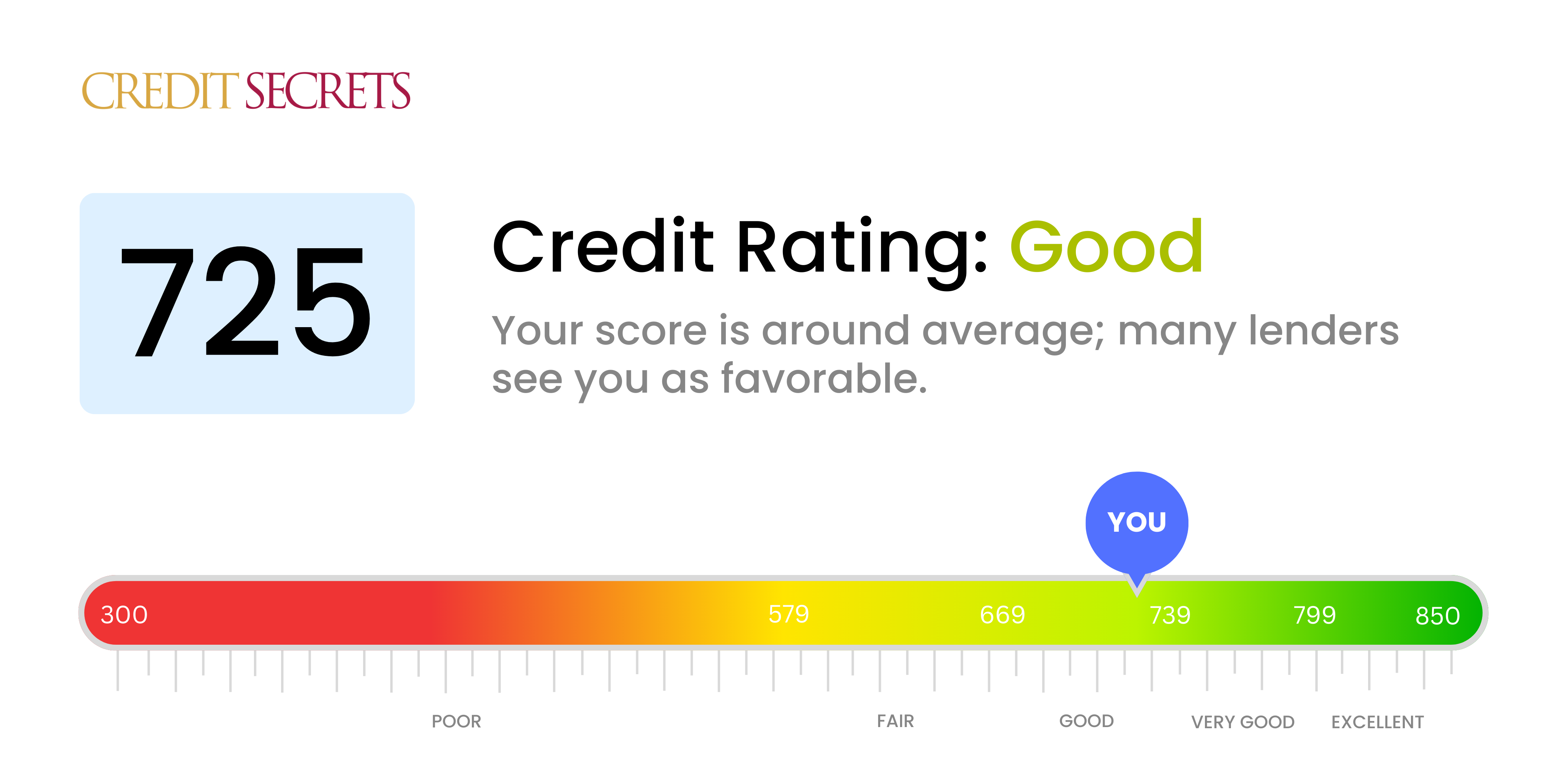

Is 725 a good credit score?

With a score of 725, your credit standing falls into the 'Good' category. Though it's not in the 'Excellent' or 'Very Good' range, it still shows potential lenders that you are generally responsible with your credit and have a lower risk of not meeting your financial obligations.

Having a credit score of 725 can possibly enable a relatively smooth lending process with moderate interest rates. However, a push towards optimizing your credit habits could elevate your score into the 'Very Good' or even the 'Excellent' range, offering you access to even better loan terms and interest rates in the future.

Can I Get a Mortgage with a 725 Credit Score?

With a credit score of 725, you are well placed to be approved for a mortgage. This score indicates responsible handling of credit, with timely payments and limited debt. The majority of lenders view a credit score in this range as a positive marker of creditworthiness, increasing the likelihood of mortgage approval.

As you navigate the mortgage approval process, keep in mind that a high credit score, like yours, typically results in lower interest rates. This is because lenders see you as a low-risk borrower. However, your credit score is just one of the many factors that lenders take into account while making their decision. So, it's vital to keep other aspects of your financial health in check too, such as maintaining a steady income and managing other debts responsibly. Continue on your path of sensible credit use, and your dream of homeownership stands within reach.

Can I Get a Credit Card with a 725 Credit Score?

With a credit score of 725, your chances of being approved for a credit card are quite good. This score often indicates a history of responsibly managing credit and making payments on time. It's certainly a positive situation to be in, however, it is also important that you handle it with care. The right decisions at this stage could help you strengthen your financial foundation even further.

As for the type of credit card that would best fit your situation, you may want to consider a card that offers rewards or high cash back rates. Premium travel cards or cards with generous reward programs could be beneficial. These types of cards often require good to excellent credit scores, making them a suitable choice for someone with a 725 credit score. Carefully consider the interest rates and terms before making a decision. Remember, while a high score increases your chances for approval, it still doesn't guarantee it. Stick to your financial goals and select a card that lines up with your needs.

With a credit score of 725, it is likely that a personal loan application will be viewed favorably. This score is considered good by most lenders, indicating that you're a responsible borrower who is likely to repay the loan. Therefore, you stand a good chance of approval for a personal loan. However, remember that loan approval also depends on other factors like income and employment stability.

The application process typically involves a review of your credit report and income sources. With a good credit score like yours, you can usually expect better loan terms and more competitive interest rates. This is because the lender regards you as low risk. Keep in mind, however, that even with a good credit score, it's crucial to read the loan terms carefully and ensure you understand the total cost of the loan, including the interest and any potential fees.

Can I Get a Car Loan with a 725 Credit Score?

With a credit score of 725, you have a solid financial standing that should put you in a favorable position when applying for a car loan. Lenders generally categorize anything above 700 as good credit, and this means that your score of 725 puts you on solid ground when it comes to being approved for a car loan. Remember, lenders use credit scores to assess your risk as a borrower, and a higher score suggests you have a reliable history of responsibly managing and repaying debt.

When it comes to interest rates, keep in mind that a good credit score, like yours, is likely to attract lower rates due to lesser perceived risk. When purchasing your car, the finance department of the dealership or other auto lenders will view your 725 credit score positively, possibly making you eligible for appealing interest rates and better loan terms. While each lending situation is unique, your good credit score is a crucial piece of the puzzle to get into the car of your dreams.

What Factors Most Impact a 725 Credit Score?

Understanding your 725 credit score is a valuable step towards enhancing your financial health. Recognizing the factors that shape this score will provide a pathway to your financial objectives. Each financial journey is distinct, filled with unique challenges and rewards.

Payment History

Your payment history can greatly influence your credit score. Any late payments or overdue amounts could be bringing your score down.

How to Check: Scrutinize your credit report for any outstanding amounts or missed payments. Consider any instances where you were unable to make payments in time.

Credit Utilization Ratio

The degree to which you're utilizing your credit limit could be affecting your score. If your existing balances are high compared to your overall limit, this could be hindering your score.

How to Check: Inspect your credit card balances. If they are high compared to your total limit, plan towards reducing them.

Length of Credit History

The duration of your credit history can also impact your score. A lack of long-standing accounts may be slowing your progress.

How to Check: Assess your credit report focusing on the age of your oldest and newest accounts. Reflect on any recently opened accounts.

Types of Credit

Having a diversified credit portfolio and showing responsible new credit usage are vital components of a healthy credit score.

How to Check: Assess the variety of your credit accounts, including credit cards, personal loans, and other lines of credit. Evaluate your recent credit applications.

Credit Inquiries

Hard inquiries on your credit report can temporarily decrease your score. These are often made by lenders when you apply for new credit.

How to Check: Review your credit report for recent hard inquiries. Understand the reasons for these inquiries and whether they were necessary.

How Do I Improve my 725 Credit Score?

A credit score of 725 is good, however there’s always room for improvement. Let’s focus on the most impactful steps you could take to further elevate your credit score from this point:

1. Keep Your Credit Utilization Ratio Low

Your credit utilization, or the amount of your credit limit you’re using, heavily influences your score. Aim to keep your utilization under 30%, and ideally, under 10%. Be mindful of making large purchases that could spike this ratio, and consider making multiple small payments throughout the month to keep it in check.

2. Consistently Pay All Bills on Time

Ensure all your bills, not just credit cards and loans, are paid on time. Late payments could hurt your credit score, so set up automatic payments or reminders to avoid missing any payment deadlines.

3. Do Not Close Old Credit Accounts

Closing old credit accounts, particularly those with a positive payment history, could lessen your credit history length and possibly lower your score. Unless there’s a compelling reason, like high annual fees, keep these accounts open and use them occasionally to maintain activity.

4. Limit Hard Credit Inquiries

Too many hard inquiries, like those from applying for new credit, can lower your score. Limit your new credit applications and only pursue those which you are reasonably confident you’ll be approved for.

5. Regularly Monitor Your Credit

Stay ahead by frequently reviewing your credit reports. Look for any inaccurate information that could be unfairly lowering your score and dispute any errors you find with the respective credit bureau.