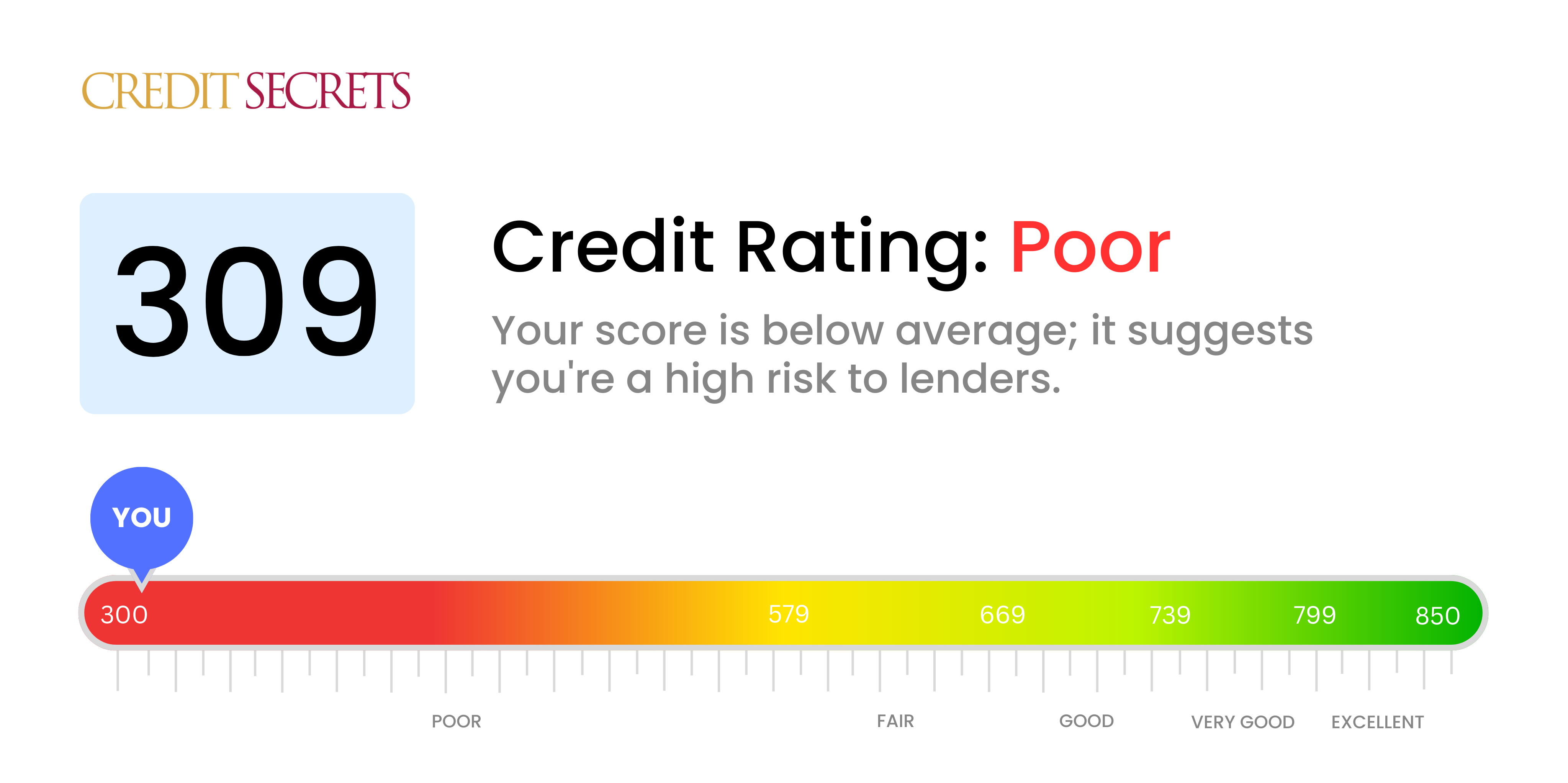

Is 309 a good credit score?

A credit score of 309 is considered to be a poor rating. With such a score, you might find it challenging to get approved for credit cards or loans and, if you do get approval, you'll likely face higher interest rates. However, this isn't a permanent situation, and there are steps you can take to improve it over time.

When dealing with a low credit score, it's crucial to know that it's not the end of your financial journey. There's always room to grow, and many ways to adjust your financial habits to empower your score. With the right knowledge and processes in place, it's entirely possible to raise that score and improve your financial future.

Can I Get a Mortgage with a 309 Credit Score?

Unfortunately, with a credit score as low as 309, you're unlikely to be approved for a mortgage. Most lenders require a higher score, generally around 620 or more. This lower score can indicate you've faced some serious financial issues, like missed payments or defaults, which lenders see as riskier.

Despite this setback, remember that there are still options available to you. For instance, you could begin to save for a larger down payment. This could make you a more attractive candidate to lenders as it decreases their risk. Or, you could look into federally backed loan programs, which tend to have more lenient credit requirements. With some strategic planning, you can turn your financial situation around. It may take time and patience, but with determination, it's possible to improve your credit score and increase your chances of securing a mortgage in the future.

Can I Get a Credit Card with a 309 Credit Score?

With a credit score of 309, getting approved for a traditional credit card may seem out of reach. This score is seen as high risk by most lenders, indicating a history of financial difficulties. It's a tough spot to be in, but acknowledging your credit situation is the first step towards improving it. Realism and understanding are crucial as you embark on this path towards better financial health.

Given the barriers linked to a low credit score like yours, it may be beneficial to explore other credit options. Secured credit cards, for instance, require a deposit that doubles as your credit limit. This sort of card can be easier to get and can assist in boosting your credit score gradually. You might also want to consider getting a co-signer or utilizing prepaid debit cards. Remember, these options won’t turn things around immediately, but they are practical tools to aid in your journey towards financial stability. Keep in mind, any form of credit that you may qualify for with your current score will likely come with comparatively high interest rates, due to the increased risk lenders perceive.

Can I Get a Personal Loan with a 309 Credit Score?

With a credit score of 309, the chances of being approved for a conventional personal loan are unfortunately quite low. Lenders typically perceive this score as highly risky, making it unlikely for them to extend a loan to you. While this situation can feel discouraging, it's essential to understand the implications of this credit score for your borrowing possibilities.

However, there are some alternate avenues you might explore. Secured loans, which involve providing collateral, or co-signed loans, where an individual with a healthier credit record vouches for you, are potential options. You might also consider peer-to-peer lending platforms, which can sometimes have more flexible credit requirements. Keep in mind that these alternatives often carry higher interest rates and may have less favorable loan terms, reflecting the increased risk taken on by the lender.

Can I Get a Car Loan with a 309 Credit Score?

Regrettably, with a credit score of 309, securing approval for a car loan may pose a significant challenge. Most lenders prefer a score above 660 for approving readily and providing favorable loan terms. Anything under 600 falls in the subprime category, which raises obstacles, and your score of 309 fits squarely in this group. This presents a higher risk to lenders, suggesting that there may have been previous issues with repaying borrowed money.

However, it's critical not to lose hope completely. Some lenders work specifically with those who possess lower credit scores. Be aware, though, these loans generally carry substantially higher interest rates due to the increased risk lenders perceive. But by being thoughtful about your approach and thoroughly understanding the loan terms, the prospect of achieving a car loan isn't entirely out of reach. Remember, despite a rocky start, the journey towards financial stability is one step at a time.

What Factors Most Impact a 309 Credit Score?

Understanding a credit score of 309 is key to initiating your path toward financial growth. Let's dive in and unravel the factors likely contributing to your current score. Remember that every credit score tells a unique story and there are always opportunities for growth.

Payment History

One of the prime contributors to your credit score is your payment history. Late payments or defaults likely play a significant role in your current score.

Checking: Investigate your credit report for any missed or late payments. Reflect on your payment habits, as delayed payments could have harmed your score.

Credit Use

Your credit utilization also significantly impacts your credit score. If you're excessively using your available credit, it could be the reason behind your current score.

Checking: Analyze your statements. Are your credit balances too close to the limits? It’s beneficial to keep your balances low relative to your credit limit.

Credit History Length

A short credit history may be a factor influencing your score negatively.

Checking: Refer to your credit report to evaluate the length of your credit history. Have you recently opened new accounts?

Credit Diversity and New Credit

Possessing a mix of credit types and handling new credit judiciously is vital for a healthy credit score.

Checking: Assess your credit portfolio. It should ideally include a mix of credit cards, retail accounts, installment loans, and mortgage loans while also keeping new credit applications to a minimum.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score, especially such a low one.

Checking: Check your credit report for any public records. Resolve any listed items that may need attention.

How Do I Improve my 309 Credit Score?

With a credit score of 309, it’s understandable if you’re feeling defeated. However, with the right steps and dedication, improvement is within reach. Here are some suggested strategies for your situation:

1. Prioritize Outstanding Debts

Heavy debts could be significantly impacting your credit score. Focus on identifying your outstanding debts and creating a practical repayment plan. Aim to pay off the debts with the highest interest rate first, to reduce the amount of money you owe over time.

2. Apply for a Secured Credit Card

Access to regular credit at this score may be challenging. A secured card, backed by a cash deposit you make upfront, could provide a way to build positive credit history. Ensure you make regular, on-time payments and maintain a low balance.

3. Add an Authorized Use

You can potentially boost your credit score by becoming an authorized user on a responsible friend or family member’s credit card account. However, ensure the account in question has a long history of timely payments and a low credit utilization rate.

4. Check Your Credit Report for Errors

Mistakes in your credit report could exacerbate your case. Obtain your free annual credit report, and go through it diligently for any inaccuracies. Make sure to dispute any errors you find with the respective credit bureau.

5. Responsible Use of New Credit

Once you start seeing improvement in your credit score, apply for a retail credit card or a credit builder loan. Making small, manageable charges and promptly paying them off can help demonstrate creditworthiness.