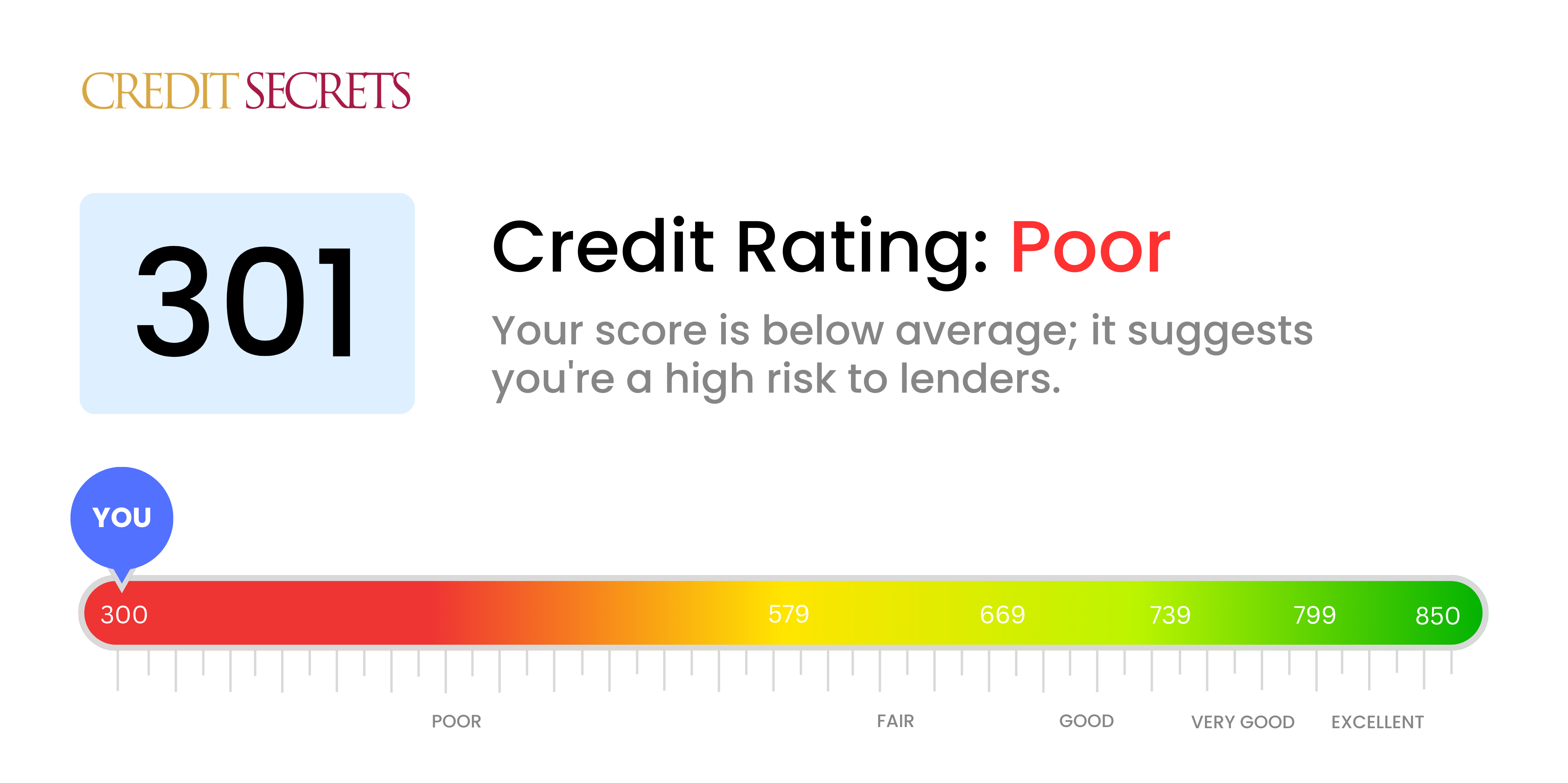

Is 301 a good credit score?

Based on a credit score of 301, this is considered a poor credit score.

With a credit score of 301, it is likely that you may face some challenges when it comes to obtaining credit or loans. Lenders may consider you a higher risk and may be hesitant to approve your applications. Building a solid credit history and improving your score will be essential to achieving your financial goals.

Can I Get a Mortgage with a 301 Credit Score?

Can I Get a Credit Card with a 301 Credit Score?

With a credit score of 301, it is highly unlikely that you will be approved for a traditional credit card. This score is considered very low and indicates a history of financial challenges or mismanagement. While this may be disheartening, it is essential to confront the reality of your credit situation in order to make positive changes.

Given the difficulties associated with such a low score, it's important to explore alternative options. One potential solution is a secured credit card, which requires a deposit that acts as your credit limit. While these cards may not offer the same benefits as traditional cards, they can be easier to obtain and can help rebuild credit over time. Another option to consider is finding a co-signer or using pre-paid debit cards as viable alternatives.

It's crucial to keep in mind that credit options for individuals with low scores often come with higher interest rates. This is because lenders perceive a higher risk in lending to individuals with lower scores. While this may seem discouraging, by taking steps to improve your credit, you can ultimately qualify for more favorable credit card options in the future.

Can I Get a Personal Loan with a 301 Credit Score?

Can I Get a Car Loan with a 301 Credit Score?

With a credit score of 301, it's important to approach the car loan process with cautious optimism. It's likely that obtaining approval for a car loan will be difficult, as lenders generally look for higher credit scores to offer favorable terms. A score below 600 is often considered subprime, which may lead to higher interest rates or even loan denial. This is because a lower credit score represents a higher risk to lenders, indicating potential repayment challenges.

However, a low credit score doesn't mean the end of your car purchasing dreams. Some lenders specialize in working with individuals who have lower credit scores. It's important to be aware that these loans often come with significantly higher interest rates. These increased rates serve as a safeguard for lenders, mitigating the perceived risk they're taking. While the journey may have its hurdles, with careful consideration and exploring the loan terms, securing a car loan is still achievable.

What Factors Most Impact a 301 Credit Score?

Understanding a score of 301 is crucial for mapping out your journey toward financial improvement. Identifying and addressing the factors contributing to this score can pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Payment history has a substantial impact on your credit score. If there are late payments or defaults, this could be a key contributing factor.

How to Check: Review your credit report for any late payments or defaults. Reflect on any instances of delayed payments, as these could have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are near their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are the balances close to the limits? Aiming to keep balances low compared to the limit is beneficial.

Length of Credit History

A shorter credit history can influence your score negatively.

How to Check: Review your credit report to assess the age of your oldest and newest accounts and the average age of all your accounts. Consider whether you have recently opened new accounts.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are essential for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you have been applying for new credit sparingly.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Examine your credit report for any public records. Address any items listed that may need resolution.

How Do I Improve my 301 Credit Score?

A credit score of 301 is considered very poor, but don’t lose hope. With targeted steps, you can start your journey towards credit improvement. Here are the most impactful and accessible strategies for your current score:

1. Address Delinquent Accounts

If you have any accounts that are past due, it’s crucial to bring them current. Prioritize paying off the most overdue accounts first, as they have the most significant negative impact on your credit score. Reach out to your creditors to negotiate a payment plan if necessary.

2. Pay Down Credit Card Balances

High credit card balances relative to your credit limit can have a significant impact on your credit score. Aim to reduce your credit card balances to below 30% of your credit limit, with a longer-term goal of keeping them below 10%. Start by paying down the cards with the highest utilization rates.

3. Explore Secured Credit Cards

Given your current score, qualifying for a regular credit card might be challenging. Consider applying for a secured credit card that requires a cash collateral deposit serving as the credit line for the account. Use it responsibly, making small purchases and paying off the balance in full each month to build a positive payment history.

4. Become an Authorized User

Ask a close friend or family member with good credit if they would be willing to add you as an authorized user on their credit card. This can potentially improve your credit score by incorporating their positive payment history into your credit report. Ensure that the card issuer reports authorized user activity to the credit bureaus.

5. Open New Credit Accounts Wisely

While it’s important to diversify your credit mix, it’s crucial to be cautious at this stage. Once you have improved your payment history with a secured card, consider exploring other types of credit, like a credit builder loan or a retail credit card. Use these accounts responsibly to continue building a positive credit history.