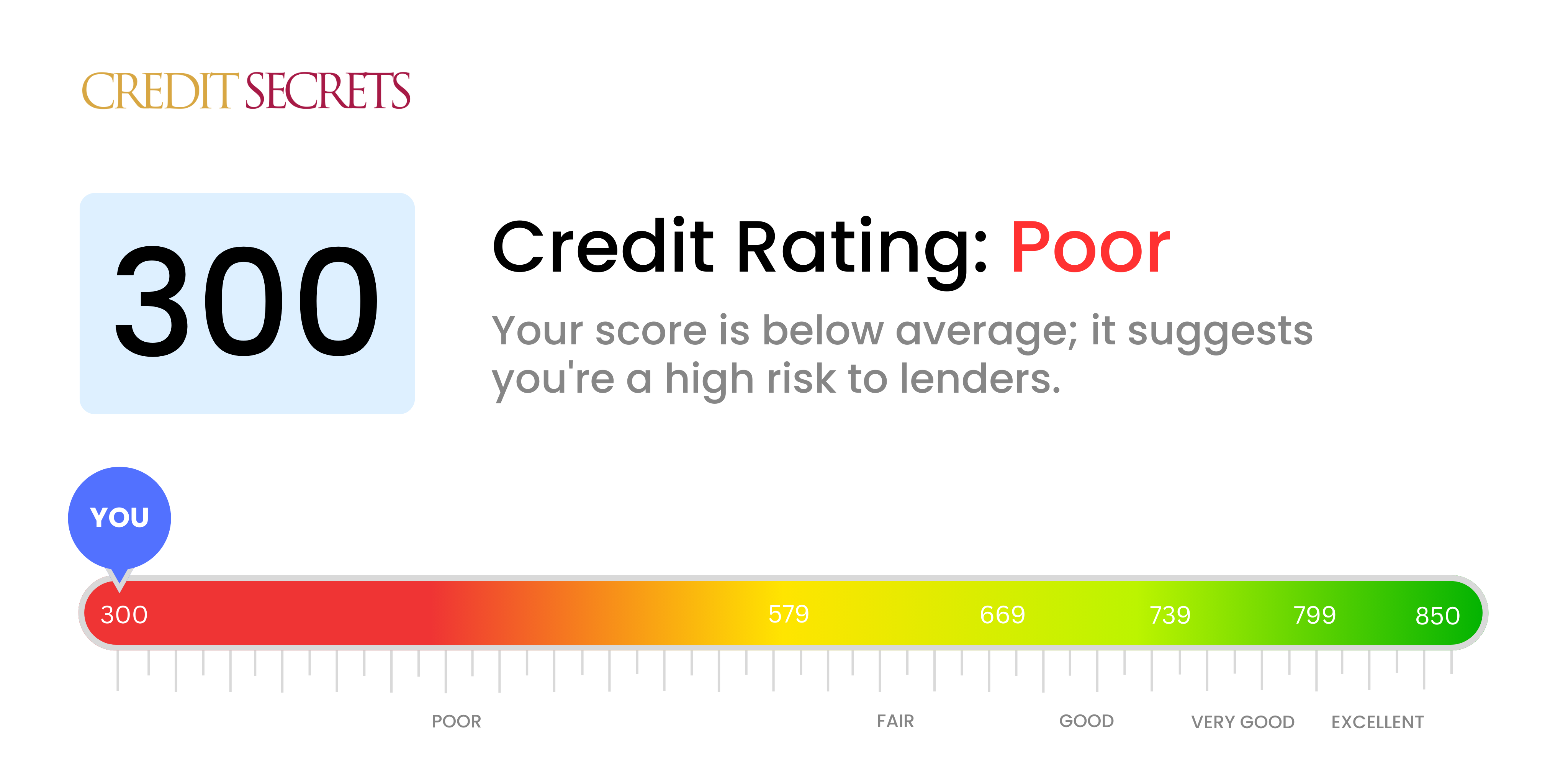

Is 300 a good credit score?

A credit score of 300 is considered a poor credit score. With this score, you can likely expect difficulty when it comes to obtaining credit, such as loans or credit cards, as well as higher interest rates if you are approved. It may be challenging to qualify for favorable financial opportunities and you may face limitations in accessing credit or securing favorable terms for financial products.

Can I Get a Mortgage with a 300 Credit Score?

Can I Get a Credit Card with a 300 Credit Score?

With a credit score of 300, it is highly unlikely that you will be approved for a credit card. Lenders generally see this as a very low score, indicating a history of financial challenges or poor credit management. While this news may be disheartening, it is essential to approach it with a realistic understanding of your credit situation.

Given the difficulties associated with such a low score, there are alternative options to consider. One option is a secured credit card, which requires a deposit that serves as your credit limit. These cards can be easier to obtain and can help you rebuild your credit over time. Additionally, you may want to explore the possibility of having a co-signer or exploring prepaid debit cards as viable alternatives. Although these options won't instantly solve your credit situation, they can be valuable tools in your journey towards financial stability.

It is important to note that interest rates on any credit available to individuals with such scores tend to be significantly higher. This reflects the higher perceived risk for lenders. While developing a better credit profile is an ongoing process, being knowledgeable about your credit status is the first step towards taking control of your financial future.

Can I Get a Personal Loan with a 300 Credit Score?

A credit score of 300 is extremely low and falls well below the range that traditional lenders typically consider acceptable for approving a personal loan. This score suggests a high level of risk in the eyes of lenders, making it highly unlikely for you to be approved for a loan under standard terms. We understand that this news may be disheartening, and it's important to face the reality of what this credit score means for your borrowing options.

If traditional loans are not available to you at this time, there are still alternatives to explore. Secured loans, where you provide collateral, or co-signed loans, where someone with better credit vouches for you, may be viable options. Additionally, peer-to-peer lending platforms sometimes offer more lenient credit requirements. However, it's important to note that these alternatives often come with higher interest rates and less favorable terms, as they reflect the increased risk for the lender.

Can I Get a Car Loan with a 300 Credit Score?

With a credit score of 300, obtaining approval for a car loan can be extremely difficult. Lenders typically require scores above 660 for favorable terms, and a score below 600 is generally considered subprime. Unfortunately, your score falls into this subprime category, making it challenging to secure a car loan. This is because a lower credit score indicates a higher risk to lenders, suggesting potential difficulties in repaying borrowed money.

However, don't lose hope just yet. Some lenders specialize in working with individuals who have lower credit scores. Take caution, though, as these loans often come with significantly higher interest rates. Lenders charge more to protect their investment due to the perceived risk involved. While the road may be full of obstacles, careful consideration and thorough exploration of loan terms could still make it possible for you to secure a car loan and take a step closer to your car ownership dreams.

What Factors Most Impact a 300 Credit Score?

Understanding a credit score of 300 is crucial for navigating your path towards financial improvement. It's important to identify the factors that contribute to your current score and address them to pave the way for a healthier financial future. Remember, everyone's financial journey is unique and offers opportunities for growth and learning.

Payment History

Your payment history has a significant impact on your credit score. Late payments or defaults may be key factors in your low score.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on any missed or delayed payments that may have affected your score.

Credit Utilization

High credit utilization can have a negative impact on your score. If your credit cards are close to their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are your balances near or at the limits? Aim to keep your balances low compared to the credit limits for improved credit utilization.

Length of Credit History

A shorter credit history can negatively influence your score.

How to Check: Assess your credit report to determine the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened any new accounts.

Credit Mix and New Credit

Having a variety of credit types and responsibly managing new credit is essential for a good score.

How to Check: Evaluate your mix of credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Also, consider whether you have been applying for new credit sparingly.

Public Records

Public records such as bankruptcies or tax liens can significantly impact your score.

How to Check: Thoroughly examine your credit report for any public records. If you find any listed items, it's crucial to address them and take necessary steps for resolution.

How Do I Improve my 300 Credit Score?

A credit score of 300 is considered extremely poor, but don’t lose hope! There are actionable steps you can take to start improving your credit score today. Here are the most impactful and accessible strategies for your current score:

1. Address Delinquent Accounts

If you have any accounts that are delinquent or in collections, it’s crucial to address them immediately. Start by contacting your creditors or collection agencies to negotiate payment arrangements or settlements. Taking action on delinquent accounts can prevent further damage to your credit score.

2. Start Rebuilding with a Secured Credit Card

Since traditional credit cards might be difficult to obtain right now, consider applying for a secured credit card. With a secured card, you’ll need to provide a cash deposit as collateral. Use the card responsibly, making small purchases and paying off the balance in full each month. Over time, this can help establish a positive payment history and improve your creditworthiness.

3. Mindful Credit Utilization

Even though your credit limit might be low initially, it’s essential to keep your credit utilization ratio as low as possible. Aim to use no more than 30% of your available credit. For example, if your credit limit is $500, try to keep your outstanding balance below $150. Keeping this ratio in check demonstrates responsible credit usage.

4. Dispute Inaccurate Information

Regularly review your credit reports from the major credit bureaus for any errors or inaccuracies. If you find any discrepancies, file a dispute with the respective credit bureaus to have them investigated and removed if they are incorrect. This simple step can help improve your credit profile.

5. Stay Current on Payments

Going forward, prioritize making all your payments on time. Late payments can have a significant negative impact on your credit score. Set up reminders or automatic payments to ensure you stay current with all your financial obligations.

Remember, building credit takes time and patience, but by following these steps, you can start on the path to credit improvement. With perseverance and a commitment to responsible financial habits, you can achieve your goals and improve your credit score.