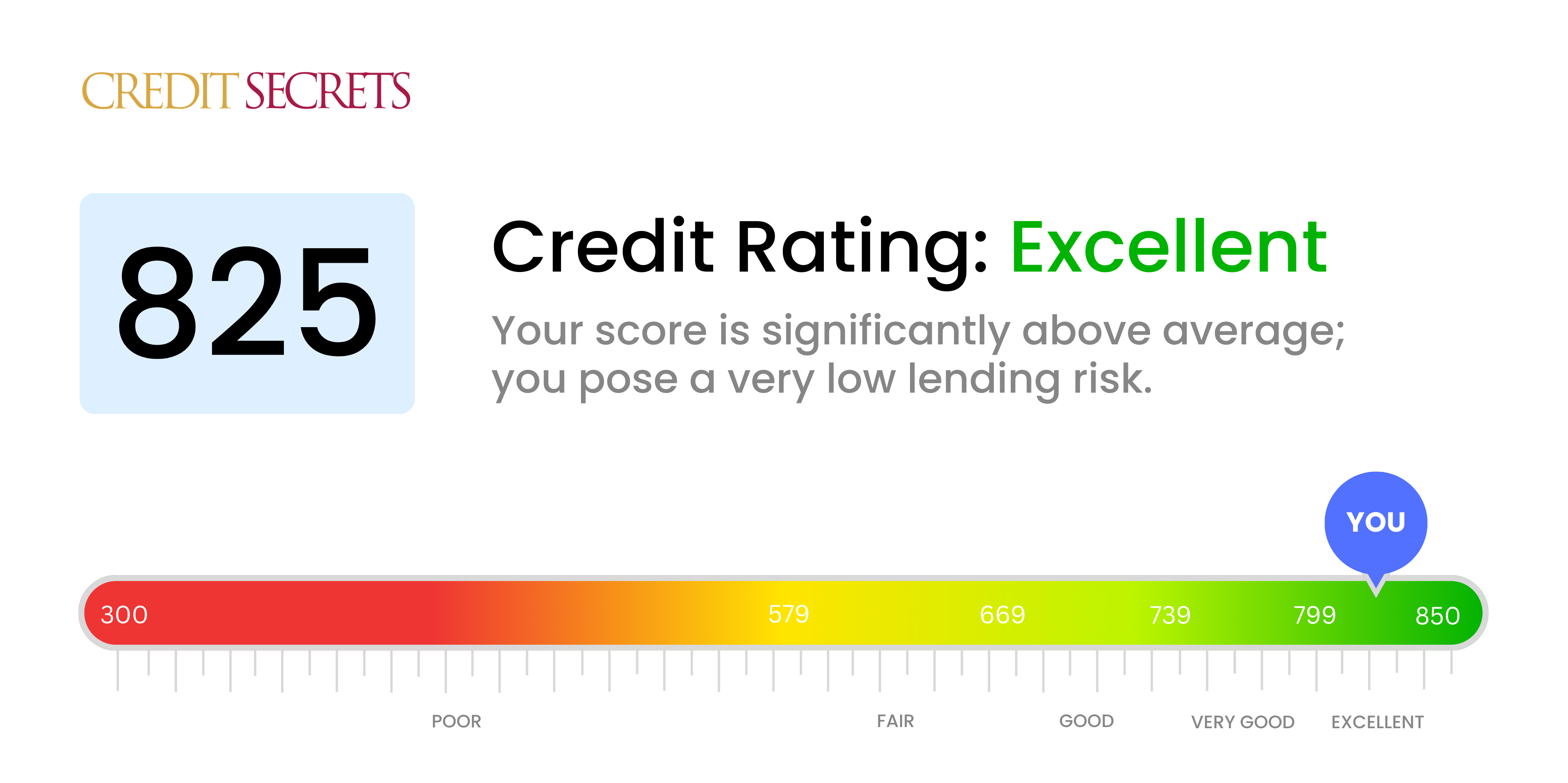

Is 825 a good credit score?

With a credit score of 825, you're navigating the financial world from an excellent vantage point. This score indicates a strong track record of reliability and responsibility, which opens doors to the most competitive interest rates, easier approval for loans and lines of credit, as well as more favorable terms from lenders and insurers.

Managing such a high credit score takes dedication, showing that you have consistently made payments on time, kept balances low, and maintained a diverse mix of credit. Remember, maintaining this fantastic score also requires ongoing diligence. So, continue to monitor your credit regularly, avoid new debt if possible, and keep making on-time payments to experience a continued financial journey with numerous benefits.

Can I Get a Mortgage with a 825 Credit Score?

If you have a credit score of 825, you're in a very strong position to be approved for a mortgage. This score is well over the threshold that lenders typically look for, reflecting a solid history of credit management, on-time payments and responsible borrowing. This is not a guarantee, as lenders consider other factors, but with such a high score, the odds are certainly in your favor.

Expect the mortgage approval process to involve a detailed examination of your financial situation, including your employment status, income, debt-to-income ratio, and down payment. Because of your high score, you may be offered preferable loan terms - this can mean a lower interest rate, which can significantly reduce the amount of interest you'll pay over the lifetime of your mortgage. Nevertheless, still review several options before committing to a lender to make sure you're getting the most beneficial deal for your circumstances.

Can I Get a Credit Card with a 825 Credit Score?

Holding a credit score of 825 is an excellent position to be in. This credit score is seen by lenders as extremely low risk and showcases you as someone who manages their finances responsibly. This high standing marks the likelihood of being approved for a credit card as exceptionally high.

Because of the high score, you could look into premium or travel credit cards that typically come with a high credit limit and special perks, such as points or air miles. You could also explore cards offering lower interest rates, as this score indicates to companies that you are a trustworthy borrower. Remember, choosing a credit card is a personal decision based on your unique needs, spending habits, and financial management style. Never the less, your credit score of 825 certainly offers an array of appealing possibilities.

A credit score of 825 is not just good, it's exceptional. With a score in this range, you're viewed as an extremely low risk to lenders, which means you're very likely to be approved for a personal loan. Financial institutions often reserve their best terms for customers like you - with high credit scores - because they're confident in your ability to pay back the loan responsibly. This essentially opens the door for you to secure a loan under favorable terms.

Now, when it comes to the loan application process, you can expect it to be relatively smooth. Lenders are inclined to fast-track applications with high credit scores like yours. Also, you'll probably be offered the best available interest rates due to your low risk profile. On the downside, don't let this high score create complacency. Continue your responsible credit practices to maintain or even improve this excellent score. Be sure to thoroughly review any loan agreements to ensure you understand all terms and conditions before signing.

Can I Get a Car Loan with a 825 Credit Score?

With a credit score of 825, you are in an excellent position to get approved for a car loan. Lenders usually look for scores above 660, but a score of 825 puts you well above this threshold. This high credit score reflects a history of responsible borrowing and timely repayment and it can be an asset to you when buying a car.

Since your credit score is impressive, lenders are more likely to offer you favorable terms on a car loan, and you can expect lower interest rates. The purchasing process should be smoother for you due to your creditworthiness. Remember, lenders see you as a low-risk borrower, which works to your advantage when negotiating loan terms. Ensure to review all your loan options and terms thoroughly in order to make a well-informed decision. Always be certain you can manage the repayments comfortably with your current financial situation before finalizing the loan.

What Factors Most Impact a 825 Credit Score?

An 825 credit score is an excellent achievement, placing you in the high end of the credit score spectrum. Maintaining and potentially enhancing this score revolves around fine-tuning key influencing factors.

Payment History

Your payment history most likely shows consistent, timely payments. Regular check-ins on your credit report are beneficial in keeping this record impeccable.

How to Check: Periodically go through your credit report for delayed payments or defaults. Even one late payment could slightly decrease your high score.

Credit Utilization

Considering your score, your credit utilization is presumably low. Keeping an eye on your usage can help maintain your score.

How to Check: Survey your credit card statements. Ensure that your balances are well beneath your limitations; the lower your utilization, the better.

Length of Credit history

Your extensive credit history plays a significant role in your high score. Be cautious about closing your oldest accounts which could shorten your credit history's length.

How to Check: Review the age of your accounts on your credit report. Take careful stock of your longest active account, as well as the average age of your accounts.

Credit diversification

Your 825 suggests a healthy mix of different credit types, indicating credit versatility.

How to Check: Evaluate your credit report to identify the different types of credit you currently manage. It could include retail accounts, installment loans, mortgage loans, and credit cards.

Public Records

Your public records are presumably clear of any detrimental items, such as bankruptcies or tax liens.

How to Check: Inspect your credit report for any public records. Keep an eye out for any listed items that could potentially negatively impact your score.

How Do I Improve my 825 Credit Score?

With a credit score of 825, you’re ahead of the game. Your credit health is almost perfect. Nevertheless, there’s always a way to improve. Here are the most effective steps to strengthen your financial health at this score level:

1. Maintain Excellent Payment History

Your payment history accounts for roughly 35% of your credit score. Continue paying your bills and loans in full and on time. A single delayed payment may tend to affect your high credit score.

2. Keep Credit Utilization Low

Your credit utilization ratio should stay around or below 30%. By keeping this ratio low, you demonstrate that you are able to manage credit responsibly. Even though you have a high credit score, it’s still important to keep an eye on your spending habits.

3. Longevity is Key

The longer your accounts have been open, the better. So think twice before closing any old credit card accounts, even if you do not use them regularly. These can contribute to your credit age and overall credit health.

4. Diverse Credit Portfolio

Consider diversifying your credit portfolio. A mixture of installment loans and revolving credit will showcase your capability to manage different types of credit. But remember, only obtain new credit as needed.

5. Regular Credit Report Check

Ensure to regularly check your credit report. Monitoring your credit report can help identify any mistakes or inconsistencies earlier, which could potentially impact your high credit score negatively.