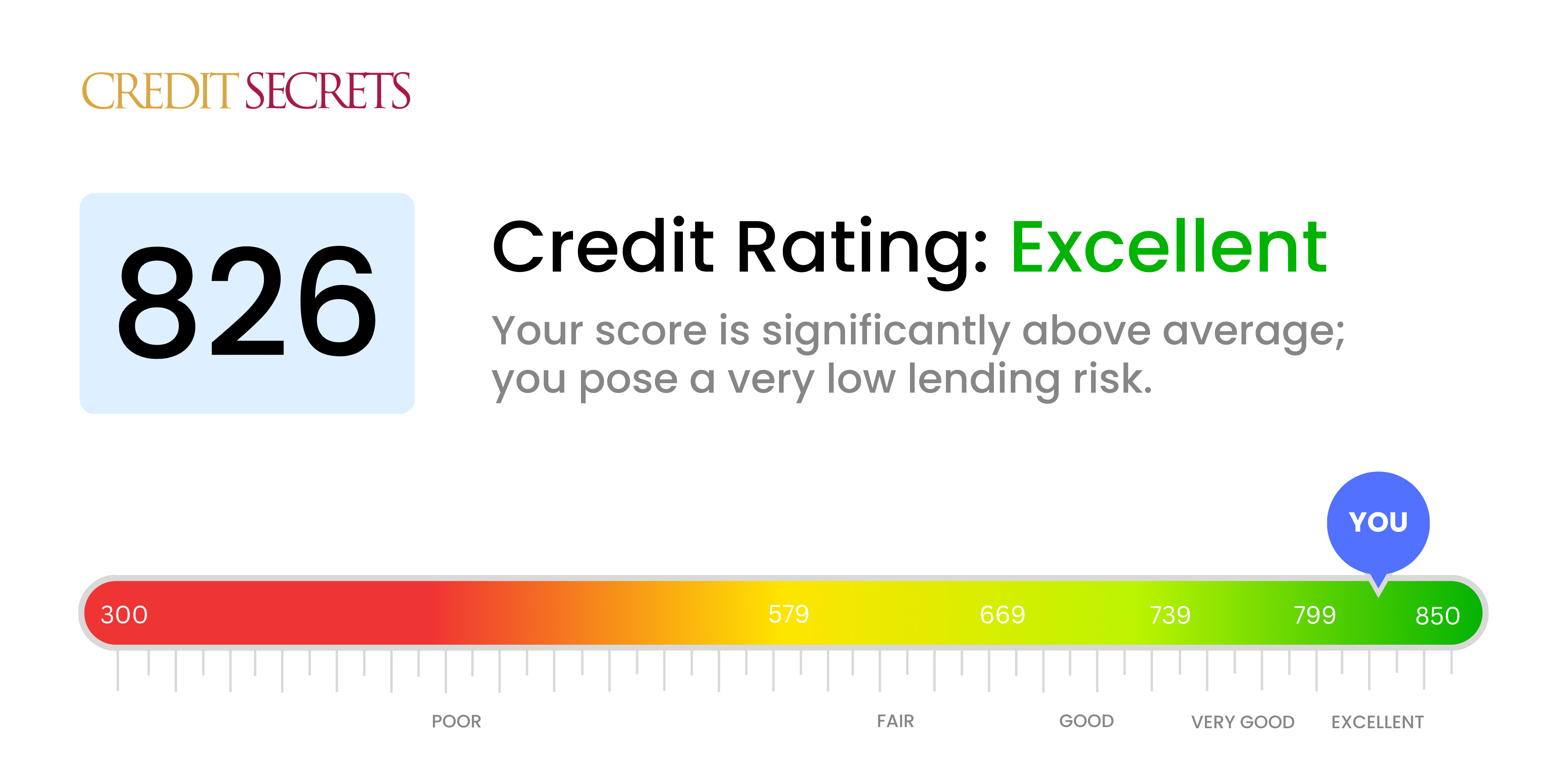

Is 826 a good credit score?

Your credit score of 826 definitely falls in the 'excellent' range. This high score speaks volumes about your financial discipline and creditworthiness, opening up avenues to the best interest rates and terms when it comes to credit cards, loans and other financial products.

With this score, you can expect lenders to view you as a desirable customer. You're likely to be approved effortlessly for most types of credit. However, remember that while your score is a major factor, lenders also consider other aspects like income and employment stability. Keep up the good work, maintain your financial habits, and your future is looking bright.

Can I Get a Mortgage with a 826 Credit Score?

With a credit score of 826, you have a high likelihood of being approved for a mortgage. This score is significantly above the minimum required by most lenders and demonstrates a stellar record of managing your debt responsibly. It is reflective of consistent, on-time payments and a prudent use of credit. This should put you in a very advantageous position when applying for a mortgage.

Despite this, it's important to bear in mind, that while a high credit score improves your chances, it's not the only factor that lenders consider. Your income, job stability, and debt-to-income ratio are also crucial. However, having such a high credit score typically means you can expect comparatively lower interest rates on your mortgage, as lenders see you as less of a risk. Remember, while this is a very promising situation to be in and you should feel confident in the benefits this score provides, it's always good practice to discuss your options thoroughly with your mortgage advisor or lender.

Can I Get a Credit Card with a 826 Credit Score?

If you have a credit score of 826, you're in a very strong position to be approved for a credit card. This score reflects that you have an excellent credit history, demonstrating timely payment habits and responsible use of credit. Lenders are likely to see you as a low-risk borrower, which puts you in a favorable position when applying for credit.

Given your high credit score, you're likely to be eligible for premium credit cards, which could include perks such as travel rewards, cash back benefits, and lower interest rates. You might also be considered for credit cards with high credit limits. Nevertheless, it's important to continue managing your credit wisely, ensuring you only borrow what you can afford and always paying your bills on time. Remember, the privilege of having access to premium financial products comes with the responsibility of managing them effectively. Make sure to consider this when selecting a credit card that suits your lifestyle and financial goals.

With a credit score of 826, you are well above the typical acceptable range for approval of a personal loan from standard lenders. This impressive score reflects a strong history of responsible financial behavior, which lenders view favorably. You certainly have a solid footing when it comes to your borrowing options, a position that should be of great reassurance.

Applying for a personal loan should be a fairly straightforward procedure with your credit score. Keep in mind that while your favorable score enhances your chances of approval, it can also mean a lower interest rate, which significantly benefits you in the long term. In terms of the overall process, lenders may still need to verify your income level and employment status to ensure your ability to repay the loan. However, with a credit score of 826, you're considered a low-risk borrower which should make obtaining a loan an achievable goal. Stay confident and well-informed as you navigate through this process.

Can I Get a Car Loan with a 826 Credit Score?

If you have a credit score of 826, chances are high that you will be approved for a car loan. The reason being, lenders see scores like yours as a strong indication that you handle borrowed money with responsibility. This exceptional credit score is well above the average figure that lenders consider good, typically anything above 660. Therefore, with your score, lenders are more likely to offer you a loan with favorable terms.

When purchasing a car, hardly anything can go wrong with a credit score like yours in the background. You are in a powerful position to negotiate for better interest rates from your lender due to the low financial risk you present. However, it remains crucial to compare offers from different lenders to clinch the best deal. Your impressive credit score should help to smooth out a lot of hitches common in the car purchasing process, making the journey less stressful for you.

What Factors Most Impact a 826 Credit Score?

Understanding a credit score of 826 is integral to maintaining an excellent financial profile. Emphasizing the key factors influencing your high score will equip you with the tools for sustained financial health. Like fingerprints, every financial journey is distinct, peppered with moments of growth and learning.

Credit Age

Aging credit lines impact your high score favorably. It demonstrates a long and responsible credit usage history to potential lenders.

How to Check: You can determine the age of your credit by examining your credit report and noting the establishment date of your oldest credit account.

Credit Utilization Ratio

Despite a high score, it's essential to monitor credit utilization. Keeping your usage low in relation to your limits contributes significantly to maintaining your high credit score.

How to Check: Regularly review credit card statements to ensure the balances aren't nearing the limits.

Punctuality in Payments

Timely, consistent credit payments underscore reliability and reflect positively on your high score.

How to Check: Cross-check payment dates against credit reports to ensure no payments were delayed or missed.

Diversified Credit Portfolio

A variety of credit types, such as retail accounts and installment loans, shows you can manage different forms of credit responsibly, contributing to your high credit score.

How to Check: Software in the public domain can help you evaluate your credit mix and check for any changes that might affect your score.

How Do I Improve my 826 Credit Score?

With a credit score of 826, you’re in an excellent position. However, maintaining and potentially even improving upon this score requires ongoing care. Here are the steps you should take:

1. Review Your Report Regularly

While your score is high, it’s critical to regularly review your credit report for any discrepancies or unrecognized activity. Spotting and handling these issues quickly will prevent potential future damage to your credit score.

2. Stay Below Your Credit Limit

Despite having a great credit score and likely a substantial credit limit, endeavor to keep your credit utilization below 10%. This shows lenders you’re not overly dependent on credit, despite having access to it.

3. Keep Your Accounts Open

If you have a number of credit accounts, you might be tempted to close some. However, keeping your accounts open, especially those with a long history, is positive for your credit scoring as it demonstrates dependability and adds to your total available credit. Just ensure you manage them responsibly!

4. Limit Hard Credit Inquiries

When you apply for new credit, a “hard” inquiry is made and this can temporarily impact your credit score. With your current score, you’re likely to be approved for most credit offerings so consider applications carefully to limit the impact of inquiries.

5. Maintain a Mix of Credit Types

Having a diverse portfolio of credit types, like a car loan, home loan, and credit cards, shows lenders you can effectively handle different types of credit. Continue managing these responsibly to enhance your creditworthiness.