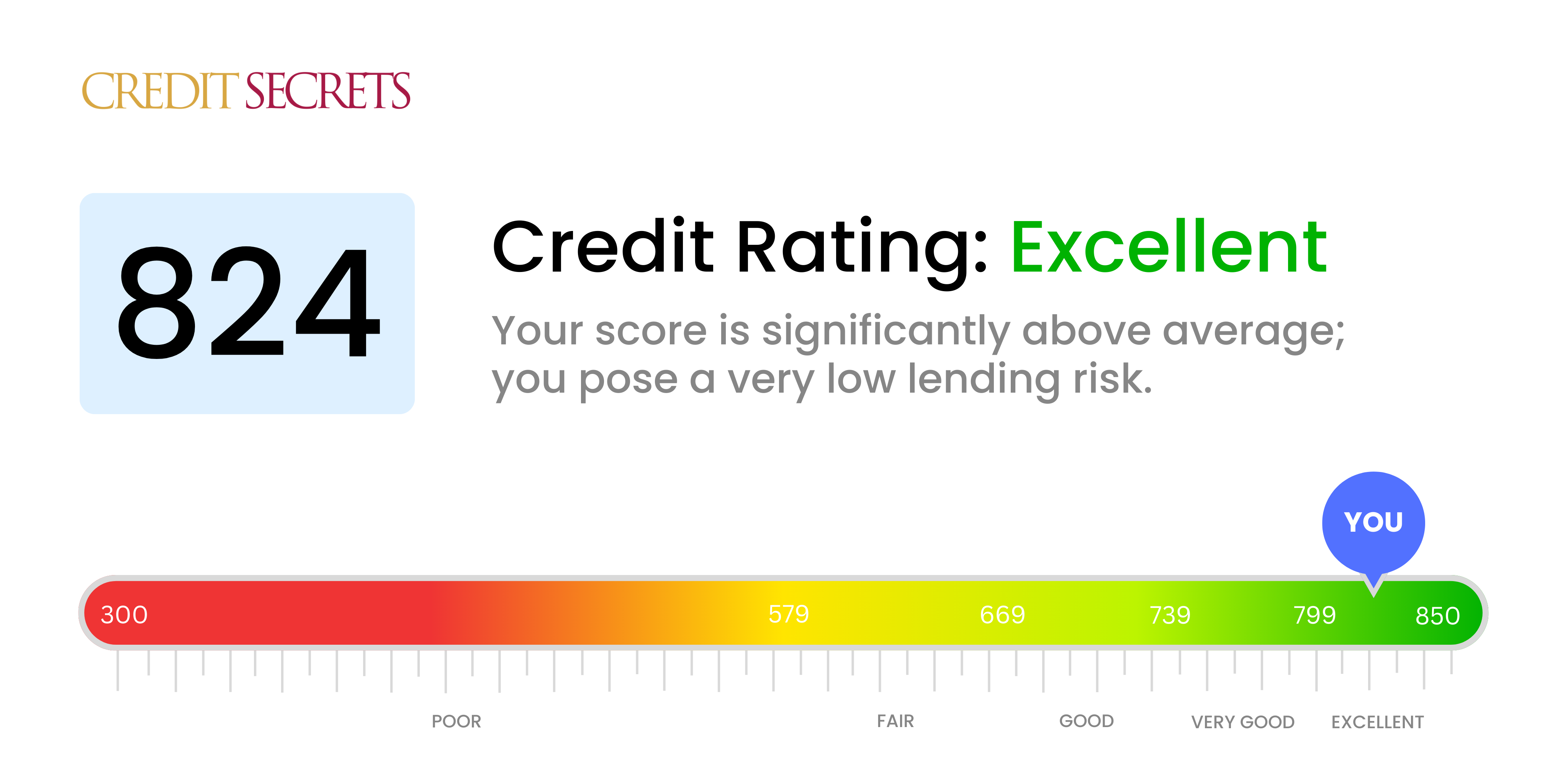

Is 824 a good credit score?

With a credit score of 824, you're inside the 'excellent' credit score range. This means lenders will see you as low risk, enabling access to the best loan and credit card offers with lower interest rates, along with easier approvals for rentals, cell phone contracts and utilities.

While this score reflects responsible financial habits, remember that maintaining it requires ongoing management, like regular payments, low credit utilization, and minimal hard inquiries. Venturing further into the excellent score range can not only provide financial security, but also more opportunities for leveraging credit in key life moments.

Can I Get a Mortgage with a 824 Credit Score?

With a credit score of 824, you're in a strong position when it comes to applying for a mortgage. This score is significantly above average, indicating a history of responsible credit use and consistent on-time payments. Lenders see this as a sign of reliability and are more likely to approve your mortgage application.

During the mortgage approval process, you can expect lenders to consider other factors in addition to your high credit score, such as income and employment stability. A credit score like yours also puts you at an advantage when it comes to interest rates. You're likely to be offered lower interest rates which can save you substantial amounts of money over the life of your mortgage. It's always a good idea to shop around for the best terms and conditions, as different lenders may offer different rates. While a high credit score is no guarantee, you're in a very good starting spot. Stay confident and remain diligent throughout the process.

Can I Get a Credit Card with a 824 Credit Score?

With a credit score of 824, approval for a traditional credit card is very likely. This stellar score reflects a history of responsible credit usage and on-time payments. It's clearly not an easy task to maintain such a high number, and your fiscal responsibility is reflected in this credit score.

Given such a strong score, you’re likely eligible for premium credit cards. These cards offer significant benefits like cash back, travel rewards, and low interest rates. Do your research to understand the terms and benefits of each card, and choose one that suits your lifestyle. And remember, even with a high credit score, it's still crucial to continue good financial habits like paying your balance in full each month to avoid interest charges. Just because you qualify for a higher credit limit doesn't mean you have to use it all. Showing restraint with your credit can only help to maintain or even improve your impressive score.

If you have a credit score of 453, I'm afraid it's below the interval that many traditional lenders deem acceptable for granting a personal loan. This score conveys a high degree of risk to lenders, and it's relatively unlikely you'll receive approval for a loan under normal conditions. Understandably, this may feel like a tough pill to swallow, but being aware of what your credit score means for your lending opportunities is key.

Despite the hurdles, other avenues do exist. You could explore options such as secured loans which require collateral or co-signed loans where another individual with a more favorable credit score endorses you. Additionally, peer-to-peer lending platforms sometimes have more modest credit requirements. Keep in mind, however, these alternatives typically carry higher interest rates and less attractive conditions due to the heightened risk incurred by the lender.

Can I Get a Car Loan with a 824 Credit Score?

With a credit score of 824, you stand in good stead when it comes to securing approval for a car loan. Lenders typically regard scores of 660 and above as favorable, and a score of 824 is well above this benchmark. This high score means you are seen as a low risk to lenders, indicating a history of successfully repaying borrowed money.

In all likelihood, the car purchasing process should go smoothly. An exceptional score such as 824 often leads to favorable loan terms and conditions, including potentially lower interest rates. Your high credit score reflects positively on your financial responsibility, making lenders more inclined to provide you with a loan. In fact, with a score of 824, you might have the freedom to negotiate better terms from a position of strength. Remember, being well-informed about the loan terms and comparing the available options can further enhance your car buying experience.

What Factors Most Impact a 824 Credit Score?

The credit score of 824 is a top-notch score that shows excellent credit management. A few influential factors most likely contribute to this high score and are worth knowing and maintaining.

Timely Payments

Being diligent with timely payments significantly impacts maintaining high credit scores like 824. Any late payments or defaults can adversely affect your score.

How to Check: Continue to monitor your credit reports and ensure that all your payments are being recorded accurately. Any late or missed payments can disrupt your current score.

Low Credit Usage

Your credit usage is also vital in maintaining high scores. High credit utilization can decrease your score.

How to Check: Regularly check your credit card balances. Aim to keep your balances low compared to your credit limits to ensure that your credit utilization remains under control.

Lengthy Credit History

Established credit history is likely a factor contributing to a score of 824. Longer credit history typically leads to better scores.

How to Check: Continue checking your credit report. Pay attention to the age of your oldest and newest accounts, along with the average age of all of your accounts.

Diversified Credit Portfolio

A diversified credit mix can positively impact your score, as it shows you can manage different types of credit responsibly.

How to Check: Review your mix of credit cards, retail accounts, installment loans, and mortgage loans. Keep handling various credits responsibly.

Clean Public Records

Absence of negative public records like bankruptcy or tax liens can be a significant factor boosting your score.

How to Check: Routinely review your credit report for any public records. Continually keep everything clear to sustain your top-notch credit score.

How Do I Improve my 824 Credit Score?

A credit score of 824 is impressive. However, maintaining and potentially improving your score requires diligent attention. Here are the most actionable steps for your specific situation:

1. Maintain Low Credit Utilization

With such a high score, it’s likely you already maintain low credit utilization. Continue keeping your balances relative to your credit limit under 30%, ideally under 10%, to keep your score healthy.

2. Regularly Check Credit Reports

Monitor your credit reports regularly for any errors or fraudulent activity. Quick action on discrepancies will prevent potential damage to your score.

3. On-Time Payments

Continue your trend of on-time payments. Consistent, timely payments show the reliability that lenders look for. Settle any accidentally missed payments immediately.

4. Long-Term Credit Management

Try not to close old credit accounts unless necessary, as an older credit age positively affects your score. Similarly, only apply for new credit when necessary, as frequent applications can trigger hard inquiries on your report.

5. Diverse Credit Portfolio

If you haven’t already, consider diversifying your credit types — a mix of credit card, mortgage, student loan, and auto loan credits, for example, can positively influence your score if managed responsibly.

Remember, slight fluctuations are normal — the goal is to maintain a consistently high credit score over time.