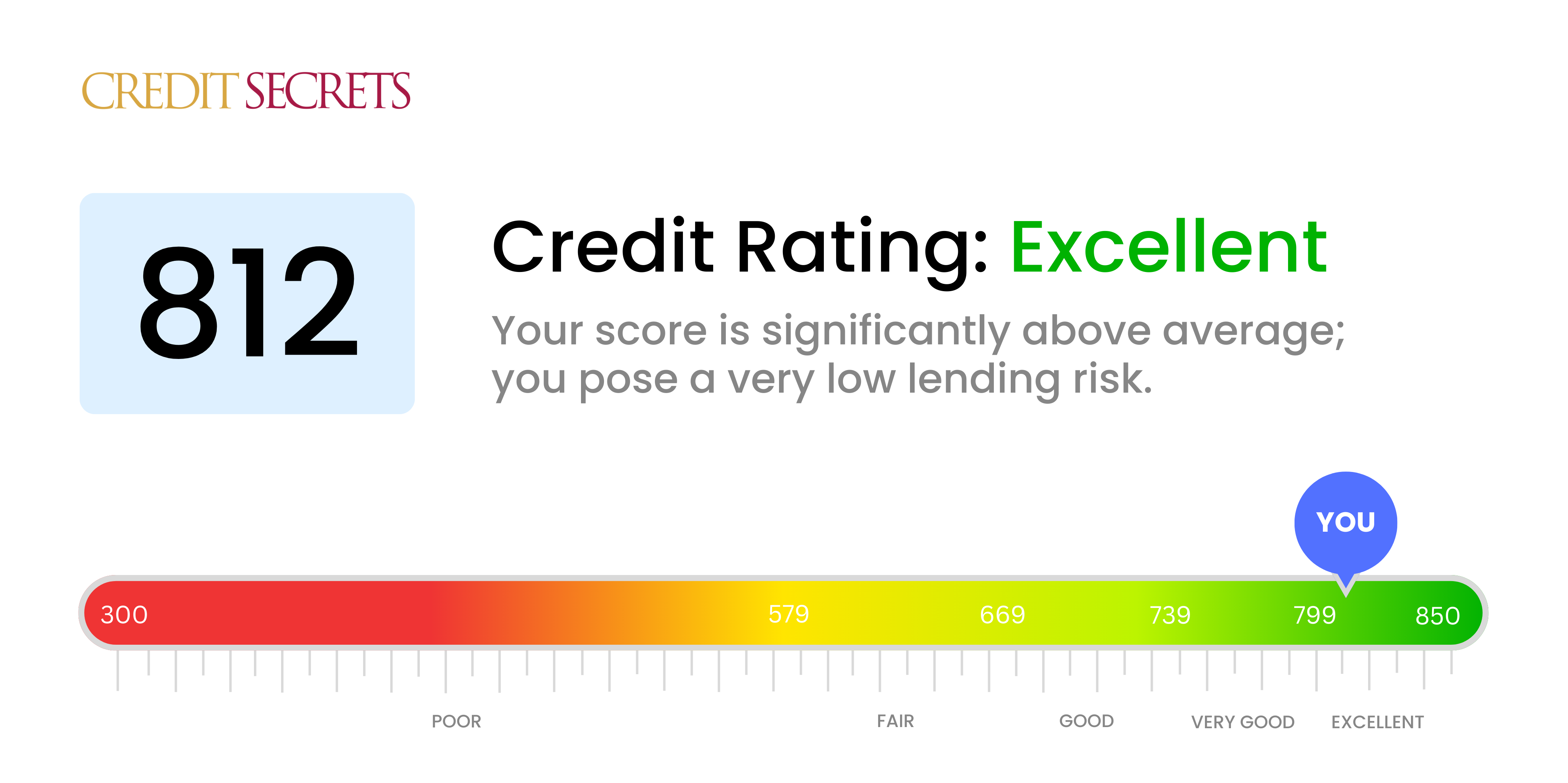

Is 812 a good credit score?

Holding a credit score of 812 means you're in the realm of excellent credit. With this rating, you're among the top credit users, which signifies the trust creditors have in your ability to repay them, enabling you to enjoy perks like better interest rates and loan terms as well as easy approval for loans and credit cards.

While this speaks highly of your financial habits, remember that maintaining this score would require continued practice of good credit habits like paying your bills on time, keeping your balances low and not applying for new credit impulsively. It's not about having a perfect score, but consistently showing that you're a responsible credit user.

Can I Get a Mortgage with a 812 Credit Score?

A credit score of 812 is viewed exceptionally by financial institutions and lenders. If you hold this score, you have an excellent credit rating, which translates into a high possibility of mortgage approval. Your credit score reflects a history of responsible financial management and timely payments which lenders look favorably upon.

As you navigate the mortgage approval process, you can expect potentially favorable interest rates and terms due to your high credit score. Lenders continue to factor in other considerations, such as income, employment stability, and debt-to-income ratio. However, your exemplary credit score plays a pivotal role in securing better terms. It signifies to lenders that you have displayed consistent financial responsibility, reducing their risk. Keep maintaining your financial habits to preserve your credit score, as this will be instrumental in your future financial endeavors.

Can I Get a Credit Card with a 812 Credit Score?

With a credit score of 812, it's highly likely to be approved for a credit card. That's a superb score and lenders see you as a very low risk. They trust you to manage your credit effectively. This great credit history puts you in a great position – allowing for more choice when it comes to selecting a credit card.

Given your healthy credit profile, a range of credit card options is available to you. Some might find premium travel cards or cash back cards beneficial, deriving additional perks and benefits from their regular spending. Or, the appeal of low-interest cards can be attractive if an aim is to decrease interest payments over time. Remember, whatever card you choose, it's important to continue with the same disciplined financial practices that lead to a high score. Continue to pay bills promptly, keeping credit card balances low. This will make your outstanding financial health helps keep your credit score strong.

If you have a credit score of 812, your financial health is in an excellent state. Lenders see this high score as an indication of a responsible borrower who is highly likely to repay their loans on time. Therefore, it's likely that you would be approved for a personal loan. However, remember that your credit score isn't the only factor lenders consider when assessing your loan eligibility. Personal income, job stability, and other financial parameters may also play a role.

With your strong credit score, you can expect benefits during the loan application process. Lenders often offer competitive interest rates to borrowers with high credit scores, as the risk of default is perceived to be lower. So, you may find yourself eligible for lower interest rates, reducing the overall cost of your loan. In addition, the approval process could be smoother and faster for you. However, it's still important to shop around, compare loan terms, and make sure you're getting the best deal possible.

Can I Get a Car Loan with a 812 Credit Score?

With a credit score of 812, you're in a great position for approval on a car loan. That score is above average, and it demonstrates to lenders that you are a reliable borrower, who pays back debt on time. When deciding on loan approval, a high credit score like 812 plays heavily in your favor.

When it comes to the car buying process, your credit score of 812 will likely result in lower interest rates. Lenders see you as low-risk, which typically leads to better terms and potentially a better choice of lenders. Remember to take your time reviewing everything before settling on a car loan, as loan terms can still vary even with excellent credit scores. Managing your financial commitments wisely will help you keep that impressive credit score intact.

What Factors Most Impact a 812 Credit Score?

Establishing where a credit score of 812 stands in your financial journey is vital towards maintaining and improving your fiscal health. Recognising the significant factors responsible for your score will help guide your credit-related decision making.

Length of Credit History

A credit score of 812 is indicative of a long-standing credit history. Remember, lengthier credit histories often reflect positively on your score.

How to Check: Evaluate your credit report, focusing on the age of your oldest and newest accounts, as well as the average age of all your accounts. Too many new accounts may impact your score negatively.

Credit Mix

With a score of 812, your credit mix is likely diverse. Having various types of credits - credit cards, retail accounts, installment loans, mortgage loans - can positively affect your score.

How to Check: Analyze the variety of credit types listed on your credit report. A balanced mix of credits is a positive indicator.

New Credit Applications

Applying for new credit sparingly suggests to lenders that you are not overly reliant on credit, which is possibly reflected in your high score.

How to Check: Review your recent credit inquiries. Frequent new applications could lower your score.

Public Records

Given your high score, there are likely no significant negative public records like bankruptcies or tax liens on your credit report.

How to Check: Inspect your credit report for any public records. Ensuring there are no unsettled items is crucial.

How Do I Improve my 812 Credit Score?

A credit score of 812 is considered excellent, and maintaining this score requires diligent credit management. Here are some useful strategies tailored specifically to your current score:

1. Monitor Your Credit Report

Regularly check your credit reports to ensure all information is accurate. If you notice any errors, dispute them immediately. Accurate credit reports are crucial to maintaining a high credit score.

2. Maintain Low Balances

Despite your high credit limit, it’s still important to keep your credit card balances low. Aim to utilize less than 10% of your credit limit.

3. Don’t Close Unused Credit Cards

Unless the cards carry high fees or you find them difficult to manage, keeping unused credit cards open can contribute to your overall credit history length and lower your credit utilization ratio, both key components of a high credit score.

4. Continue Paying Bills On Time

One vital aspect of a robust credit score is the consistency of on-time payments. Continue to pay all your bills and debt payments promptly to maintain your high score.

5. Diversify Your Credit Responsibly

You already have a varied credit mix in your portfolio, but remember, any new credit should be handled responsibly. Always think strategically when taking on new types of credit, and never borrow more than you can afford to pay back in a timely manner.