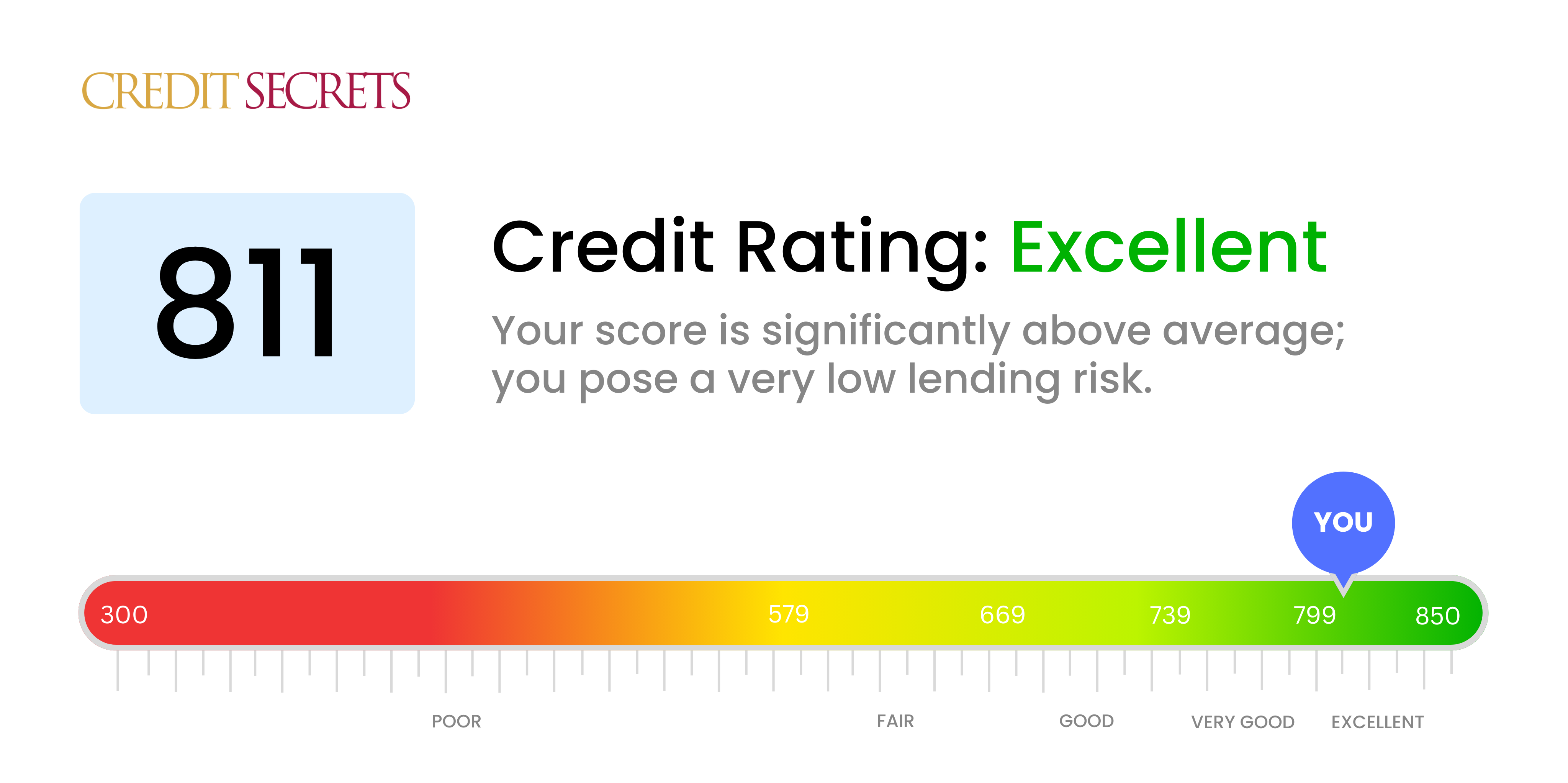

Is 811 a good credit score?

Having a credit score of 811 is outstanding—it's considered an excellent score. With such a robust credit score, you're likely to be seen as a very low risk by lenders and you can generally expect to receive the most favorable terms available, like the lowest interest rates on loans and highest credit limits on credit cards.

The hard work you've put into maintaining your credit has definitely paid off. Keep making timely payments, keeping your credit utilization low, and constantly monitoring your financial situation to maintain this excellent credit score. Perfecting your credit score requires consistent commitment, and you've proven you're up to the task.

Can I Get a Mortgage with a 811 Credit Score?

With a credit score of 811, you are in a strong position to be approved for a mortgage. This is an excellent score that demonstrates a consistent and responsible payment history, and it is well above the threshold most lenders require for home loans.

The mortgage approval process might be smoother for you because of your high score. Lenders see you as a low-risk borrower, meaning you're less likely to default on your loan. This could lead to you receiving more favorable terms, such as lower interest rates. Still, be prepared for potential hurdles; lenders also consider factors like income and debt-to-income ratio. But with a credit score of 811, you are on the right path to securing the mortgage you need for your home. Keep up the good habits that helped you achieve this high score.

Can I Get a Credit Card with a 811 Credit Score?

Having a credit score of 811 is quite an achievement. With this score, being approved for a credit card is very likely. Lenders see this as an excellent score, indicating a solid history of responsible financial management. This reflects positively on you and showcases your dedication to maintaining healthy financial habits.

With such a high score, you'll have access to an array of credit card options tailored towards your needs and circumstances, from secured cards and starter cards, to premium travel cards. Secured and starter cards are helpful for continuing to maintain good credit. Premium travel cards, on the other hand, often come with enticing benefits like airline miles and hotel points. Moreover, cards in this score range usually offer lower interest rates due to the less perceived risk for lenders. It's important to do your research and choose the card that fits best with your lifestyle and financial goals.

With a credit score of 811, you fall into the category of having excellent credit. This high score clearly exhibits your financial discipline and trustworthiness, making you an attractive candidate for personal loans. Lenders will see this favorable score as an indication that you pose a lower risk for lending, increasing your chances of loan approval.

As you embark on the personal loan application process, expect lenders to compete for your business due to your high credit score. You will likely be offered lower interest rates and more favorable loan terms as a result. Take your time and carefully compare different loan offers to find the one that best fits your financial needs. Although the process is serious, you can feel hopeful about the options available to you, thanks to your excellent credit score of 811.

Can I Get a Car Loan with a 811 Credit Score?

With a score of 811, your chances of getting approved for a car loan are very high. Lenders typically consider a score above 700 as excellent, and your score falls comfortably in that range. This excellent score signifies to lenders that you are a trustworthy borrower, having a long track record of timely loan payments. As a result, you can expect to be offered favorable terms on your car loan.

Having a high credit score like yours can open up a lot of possibilities during the car purchasing process. For example, you'll likely be offered lower interest rates, which means you'll pay less over the life of your loan. Additionally, lenders may be more willing to provide you with a larger car loan, giving you more choices when deciding what car to purchase. So enjoy the benefits that come with your high credit score, and remember that maintaining it can continue to open doors for your financial journey.

What Factors Most Impact a 811 Credit Score?

Understanding a credit score of 811 is integral to enhancing your financial stability. Recognizing the key factors influencing your score can lead to continued financial excellence. Keep in mind, everyone's financial path is exceptional and comes with its own potential for improvement.

Diligent Bill Payments

Consistent and timely bill payments leave a positive impression on your credit score. Your current score suggests a strong record of diligently paying bills.

How to Monitor: Regularly view your payment history on your credit report. Ensure all accounts are being paid on time to maintain your high score.

Low Credit Usage

Your credit score is likely influenced by low credit utilization. You're probably not maxing out your credit cards, which is excellent.

How to Monitor: Continually review your credit card statements. Try to keep your balances low in comparison to your credit limits to maintain a healthy score.

Long-Term Credit History

A lengthy credit history usually results in a higher credit score. Your score indicates that you've had credit accounts for a significant amount of time.

How to Monitor: Regularly review your credit report. Aim to keep older accounts open, as this improves the overall length of your credit history.

Diverse Credit Portfolio

Having a variety of credit products and managing them responsibly likely plays a role in your score. This indicates good financial habits in managing different types of credit.

How to Monitor: Check the types of credit that you have. Maintain a good balance between credit cards, retail accounts, installment loans, and mortgages.

Absence of Public Records

The absence of public records such as bankruptcies or tax liens on your credit report likely contributes to your high score.

How to Monitor: Regularly check your credit report for any public records. This will help you guarantee there are no inaccuracies negatively affecting your score.

How Do I Improve my 811 Credit Score?

With a credit score of 811, your financial integrity is clearly notable. Here are the most impactful steps to further enrich your credit picture from where you stand:

1. Maintain Existing Credit Accounts

While your score is impressive, it’s still important to regularly use your credit accounts and consistently pay them off in full. Dormant accounts may be closed by your credit card issuer, and this could potentially impact your credit utilization rate, as well as the length of your credit history.

2. Keep Up with Your Payment History

Remember, timely payments contribute to 35% of your credit score. Consistently meet payment deadlines, and never skip a month. Auto-pay features can be particularly helpful to ensure never missing a payment.

3. Avoid Excessive Hard Inquiries

While having a diverse credit portfolio is great, making too many credit applications over a short period could lead to multiple hard inquiries on your credit report, which can lower your score. Only apply for new credit if absolutely necessary.

4. Monitor Your Credit

Regularly review your credit reports for inaccuracies or potential fraudulent activity. While you have a healthy score, it’s possible for wrong information or identity theft to negatively impact it. Quick detection can prevent long-term damage.

5. Keep Credit Utilization Low

Even at your high score, maintaining low credit utilization is critical. Aim to keep your balance relative to your credit limit at or below 30%, as high utilization can indicate risk to potential lenders and could decrease your score.