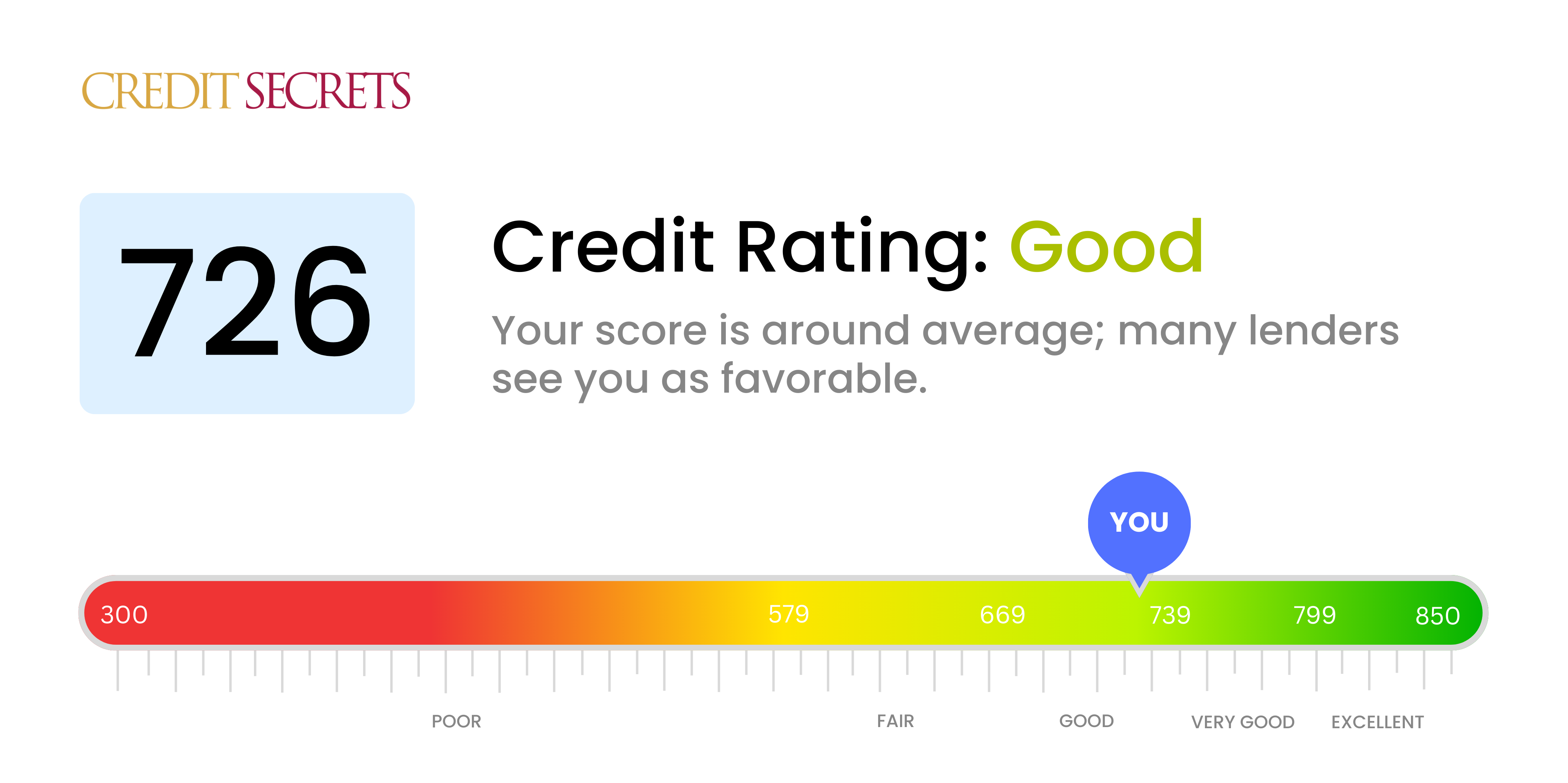

Is 726 a good credit score?

Your credit score of 726 is considered to be in the 'Good' range. With this score, you can reasonably expect to be approved for loans or credit at favorable interest rates, although the terms may not be as ideal as for those with 'Very good' or 'Excellent' credit. Additionally, this score indicates you've managed your credit responsibly in the past, but there's room for improvement in your credit habits.

Remember, credit scores fluctuate regularly based on financial activities such as opening new credit lines, making prompt payments, or carrying a balance. There are many ways to improve your credit score by staying diligent about your credit use, paying all bills on time, and ensuring you are not using too much of your available credit. Ultimately, having a 'Good' credit score is a promising foundation for achieving your financial goals.

Can I Get a Mortgage with a 726 Credit Score?

With a credit score of 726, the likelihood of your mortgage application being approved is high. This score sits well within the range considered as 'good' by most financial institutions, so it indicates a history of responsible credit use and timely payments. It suggests you've been doing quite a good job managing your finances and debt.

As you start applying for a mortgage, you may encounter some scrutiny as lenders assess your ability to repay the loan over the long term. They will look at your income, your debt-to-income ratio, and delve into your credit history to paint a comprehensive picture. The good news is that a high credit score like yours can afford you more favorable interest rates, potentially saving you thousands of dollars over the lifetime of your mortgage. Maintain your responsible credit behavior to keep your score in the 'good' range for optimum benefits.

Can I Get a Credit Card with a 726 Credit Score?

If your credit score stands at 726, you are in an advantageous position when it comes to getting approved for a credit card. This number indicates that you've been responsible with your credit, which makes credit card companies view you as a trustworthy borrower. Don't feel complacent though, maintaining this score requires ongoing financial discretion.

In terms of the types of credit cards that are suited to a score like yours, you might want to consider a mix of rewards, cash back, and premium travel cards. These types of credit cards typically offer perks and benefits such as airline miles, cash back on purchases, and access to exclusive events. However, remember that these cards usually come with higher interest rates, so take that into account when deciding. It's important to make sure that the benefits outweigh the costs, and that the card aligns with your spending habits and lifestyle.

With a credit score of 726, you're in good standing and likely to be approved for a personal loan. Lenders view a score in this range as an indication of reliable financial behavior, which puts you in a favorable position when it comes to borrowing. This trustworthiness is certainly commendable, further solidifying your chances of loan approval.

Your good credit score unlocks numerous possibilities during the loan application process. You're in a position to negotiate terms, potentially securing a lower interest rate and more manageable repayment schedule as a result of your exemplary credit history. Remember, lenders are looking for demonstrated financial stability, and your credit score of 726 is tangible evidence of this. However, keep in mind that while your credit score is a significant factor, approval also depends on other aspects of your financial profile like income and existing debt. Good job on maintaining a reliable credit standing!

Can I Get a Car Loan with a 726 Credit Score?

Having a credit score of 726 is good news for your car loan application. This score is within the range that most lenders classify as a 'good' credit rating. Similar to your financial habits, lenders interpret this score as an indicator of your responsibility and reliability. You have demonstrated a solid track record of managing credit and paying back debts on time.

As you move forward in the car buying process, you can expect lenders to view your application favorably. This generally translates into more competitive interest rates and favorable loan terms. Remember, your good credit score isn't just a number - it's a testament to your financial habits. As you navigate the car buying process, use this to your advantage and maintain your solid track record of sound financial decisions.

What Factors Most Impact a 726 Credit Score?

Understanding your credit score of 726 is your first step towards financial empowerment. Recognizing and addressing the key factors influencing your score sets you on the pathway to financial health. Remember, the journey is personalized and unique.

Credit Utilization

Your credit utilization rate could be impacting your credit score. Maintaining a balance that is too high relative to your credit limit can decrease your score.

How to Check: Review your credit card statements. Are you consistently utilizing a large percentage of your credit limit? Aim to keep your balance low in relation to your limit to help improve your score.

Payment History

Keeping a clean record of on-time payments impacts your credit score significantly. Even a single missed or late payment may affect your score.

How to Check: Check your credit report for any delayed or missed payments. Reflect on times you may have forgotten to pay or been unable to pay on time.

Length and Quality of Credit History

The length of your credit history matters. Having a longer track record of good credit use can boost your score. Also, the quality of that history—how consistently you've been able to manage credit—can play a role.

How to Check: Review your credit report and identify the ages of your oldest and newest accounts, as well as the average age of all your accounts. An account opened recently could have lowered your average credit age.

Public Records

Any public records like bankruptcies or tax liens can significantly impact your credit score.

How to Check: Detail through your credit report for any public records listed. These items may need your immediate attention.

How Do I Improve my 726 Credit Score?

With a credit score of 726, you’re on your way to achieving exceptional financial standing, but there could still be room for refinement. Here are impactful and achievable ways for you to continue gaining momentum:

1. Maintaining Consistent Payments

Ensuring you don’t miss any payments is very important at this level. Stay cautious about all of your due dates. Setting up automatic payments could help you maintain this consistency.

2. Mind Your Credit-to-Debt Ratio

Keep track of your credit utilization ratio. It’s ideal to keep it below 30% and strive for a lower percentage where possible. Consider paying off small balances on various cards to ease this ratio.

3. Consider Increasing Credit Limits

Request a credit limit increase on your credit card. This can enhance your credit utilization ratio, improving your score. However, use this power responsibly. The goal isn’t to spend more, but to reduce your ratio percentage.

4. Limit Hard Inquiries

With your score, you’ll likely have no problems qualifying for new credit, but don’t get trigger happy. Too many hard inquiries can negatively impact your score. Apply for new credit sparingly.

5. Monitoring Your Credit

Keeping an eye on your credit reports allows you to spot and fix inaccuracies in a timely manner. Contact credit bureaus if you notice any errors. A clean credit report will help maintain your progress.

Remember, maintaining and improving a credit score is not a sprint but a marathon. Patience and consistency are essential in this journey.