America’s Debt Situation: States Ranking & Global Comparison

America has been named the third most indebted nation of 2024, with consumer debt reaching 74.44% of its GDP and government debt at 123%. Shining a harsh light on the nation’s financial health, these numbers reveal a broader narrative of escalating debt across the U.S.

To address these concerns, we delved into public records using a comprehensive approach to examine state and national debts. Based on data from reliable sources like Experian and the IMF, our analysis applied specific weights on a simple 0-100 scale to rank U.S. states and economically advanced nations with the highest and lowest debt levels.

Colorado has the highest financial liabilities among U.S. states, with each resident’s personal debt averaging $154,481 and state debt at 12.76% of its GDP. California and Washington are close contenders, highlighting the need for robust debt management strategies.

Internationally, our comparison shows the U.S. alongside other heavily indebted countries like Japan (ranking 1st), with a government debt of 255% of GDP, and Canada (2nd), emphasizing that debt is a worldwide challenge.

Let’s dive into America’s debt situation, examining variations among states and gaining insights from global perspectives to better understand the complexities of our economic landscape.

Key Findings

- The United States ranks as the third most indebted country globally in 2024, with consumer debt at 74.44% of GDP and government debt reaching 123%, showcasing a major financial hurdle internationally.

- Colorado has the highest overall debt in America, with a consumer debt per capita of $154,481 and government debt at 12.76% of GDP.

- California, with the second-highest debt score, boasts a consumer debt per capita of $148,428 and a government debt ratio of 13.327%, while Washington closely follows with a consumer debt per capita of $150,462 and a government debt ratio of 11.159%.

- Mississippi ranks number 1 as the state with the lowest debt, with consumer debt per capita at $65,547 and government debt at 9.882% of GDP, indicating a stronger financial position among U.S. states.

- West Virginia secured the 2nd spot with a consumer debt per capita of $64,320 and a government debt ratio of 15.064%, followed by Oklahoma at 3rd, presenting a consumer debt per capita of $75,022 and a government debt ratio of merely 7.549%.

- Internationally, Japan and Canada rank highest overall debt levels, with Japan’s government debt soaring to 255% of GDP and Canada’s consumer debt at 102.39% of GDP and government debt at 106.4%, highlighting significant debt issues in top economies.

Switzerland has the highest consumer debt among the countries studied, with its consumer debt reaching 128.3% of its Gross Domestic Product (GDP), illustrating a society accustomed to high levels of personal borrowing.

State Ranking Table

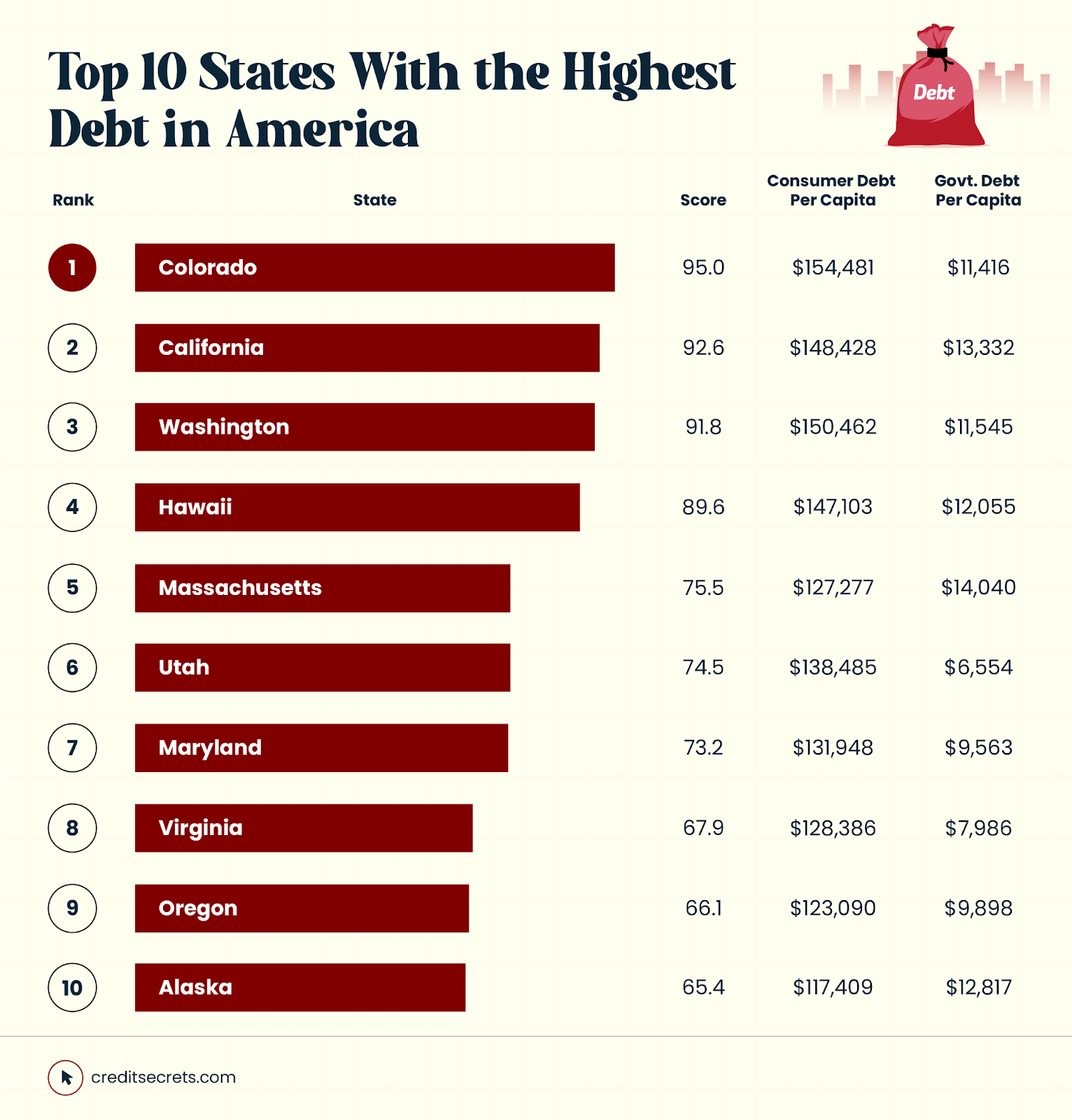

Top 10 States With the Highest Debt in America

1. Colorado

With the highest score of 95, Colorado’s residents face a steep financial climb, reflecting its citizens’ lifestyle and the impact of its booming real estate market. Each person carries $154,481 in personal debt, while the state’s government isn’t faring much better, with $11,416 debt per capita. This debt is 12.76% of Colorado’s GDP, highlighting the urgency of fiscal strategies to manage personal and state finances effectively.

2. California

In California, the allure of the Golden State comes with a hefty price tag. Each resident has a debt of $148,428, resulting in a score of 92.6. It is influenced by its status as a tech and entertainment hub, significantly driving up the cost of living.

The state’s environmental regulations and high taxes also shape its financial landscape, contributing to a high public debt of $13,332 per capita, carrying 13.327% of GDP, which is clearly affecting residents’ ability to save and manage personal debt.

3. Washington

Washington’s debt scenario is partially attributed to its no-state-income-tax policy, which places a greater reliance on other forms of taxation. Ranking third with a score of 91.8, Washingtonians carry $150,462 in personal debt per capita.

Meanwhile, the state’s debt for individuals reaches $11,545. These figures, reflecting 11.159% of the state’s GDP, call for a balance between fostering economic growth and ensuring financial sustainability.

4. Hawaii

Hawaii has the highest state debt-to-GDP ratio of 15.8% due to its high government debt per capita of $12,055, pointing out the need for fiscal policies that address the unique economic challenges of island life.

The state’s overall score of 89.62 reflects its isolated geographical position, leading to higher costs for goods and services, resulting in the average islander dealing with $147,103 in consumer debt.

5. Massachusetts

Massachusetts, at the 5th most indebted, has the highest state debt per capita of $14,040. The state received a score of 75.54, illustrating the cost of its rich academic landscape with an average personal debt of $127,277. The concentration of prestigious universities results in significant student loan debt.

The state’s commitment to healthcare and education has also led to higher government debt, accounting for 13.26% of its GDP.

6. Utah

Utah, ranked as the 6th most indebted state, showcases a notably efficient financial landscape with a state debt per person of $6,554. ‘The state’s strategic focus on sectors such as technology, tourism, and education contributes to its residents’ financial responsibilities yet maintains a lower government debt ratio of 8.144% of its GDP.

It scored 74.5, reflecting its balanced approach to managing debt, with an average personal debt of $138,485. This balance is achieved amidst its dynamic economic growth and investment in public services.

Utah’s model highlights a commitment to fostering a robust economy while keeping debt levels in check.

7. Maryland

Maryland has mixed financial health benefits and suffers from proximity to the nation’s capital, receiving a score of 73.2.

High-salary jobs in the federal government and related sectors drive up the cost of living and personal debt of $131,948 per head. State policies focusing on healthcare and education have similarly pushed government debt to 11.443% of GDP, amounting to $9,563 per capita.

8. Virginia

With a score of 67.9, Virginia’s debt picture is shaped by its dual economy: a northern region enriched by federal government spending and a rural south with different economic challenges.

Its residents grapple with $128,386 in debt per capita, The state’s $7,986 debt per capita, making up 9.763% of GDP, mirrors the broader challenge of managing historical wealth alongside modern financial obligations.

9. Oregon

Oregonians, facing $123,090 in personal debt each and the state’s debt of $9,898 per person (13.113% of GDP), are at a crossroads. Oregon’s environmental leadership, reflected in its score of 66.1, comes with investments in sustainable practices and green infrastructure, impacting its government debt.

The ranking suggests a need to harmonize its environmental leadership with strategies for sustainable economic health.

10. Alaska

Alaska, scoring 65.4, navigates through $117,409 in consumer debt per capita. Alaska’s unique financial situation stems from its reliance on oil revenues, which are subject to global market fluctuations.

This economic dependence has shaped its approach to public spending and contributed to its debt figures. Additionally, the high cost of living in remote areas significantly impacts residents’ debt. The state’s high debt of $12,817 per resident, constituting 13.890% of its GDP, reflects the challenges of managing resources and financial health in America’s final frontier.

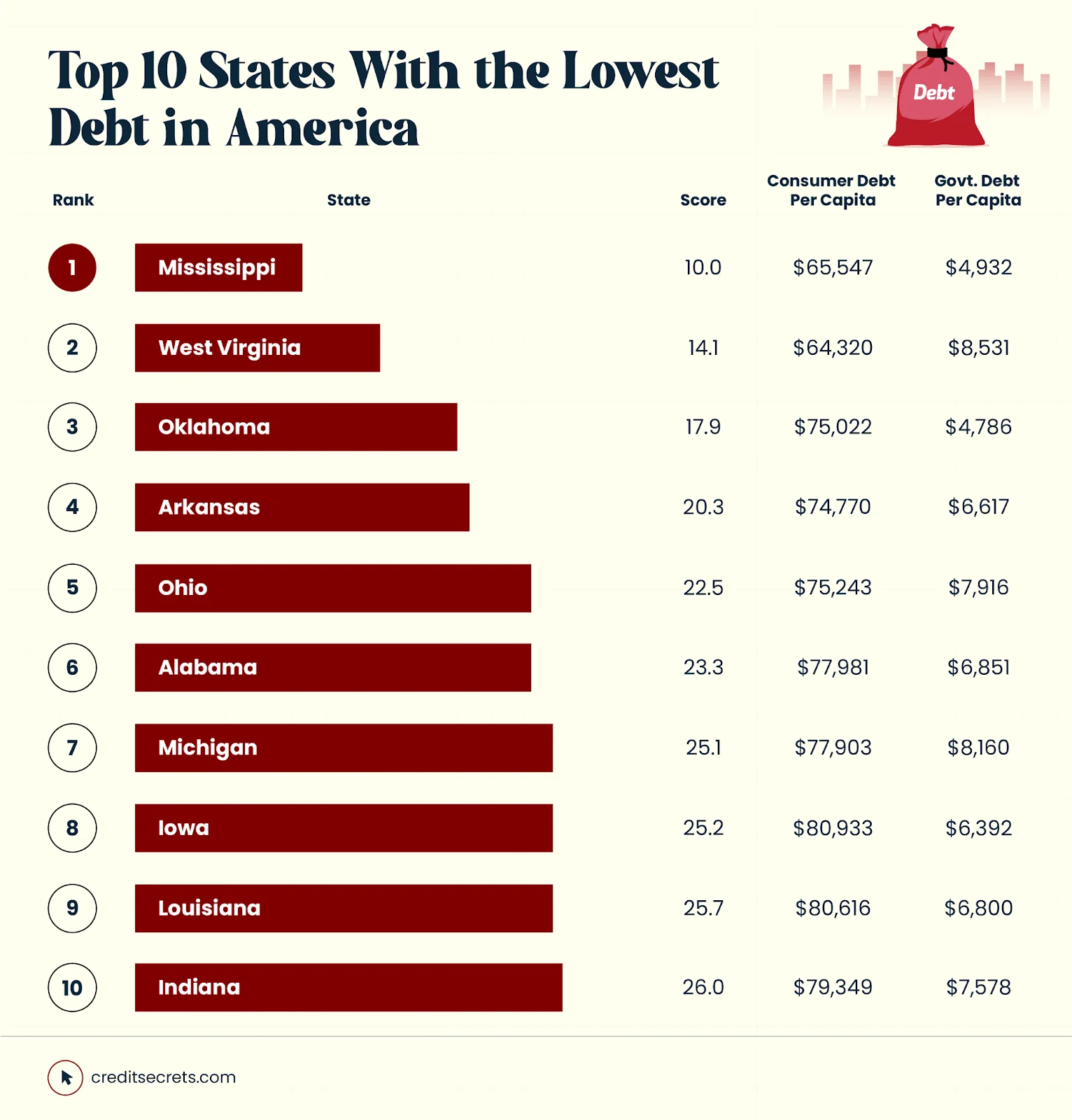

Top 10 States With the Lowest Debt in America

1. Mississippi

Mississippi stands out with a score of 10, showing resilience with $65,547 in consumer debt per capita. This figure illustrates the state’s battle with low salary packages and economic challenges.

Despite this, Mississippi’s government debt is relatively low at $4,932 per capita, marking 9.882% of its GDP. This reflects a careful balance between essential spending and maintaining fiscal health in a state often ranked at the lower end of economic metrics.

2. West Virginia

With a score of 14.1, West Virginia faces its economic realities head-on, carrying $64,320 in consumer debt per person. The state’s economic foundation, deeply tied to coal mining, faces transitions, impacting government and personal finance.

Government debt is $8,531 per capita, accounting for 15.064% of the GDP, showing the state’s efforts to navigate its economic restructuring.

3. Oklahoma

Oklahoma, scoring 17.9, manages $75,022 in consumer debt per capita, in a state where the energy sector’s boom-and-bust cycles significantly influence economic well-being.

With a government debt of $4,786 per capita (7.549% of GDP), Oklahoma’s financial health reflects its strategic investments and the challenges of balancing economic growth with fiscal responsibility.

4. Arkansas

Arkansas scored 20.3, showcasing a careful approach to debt, with residents owing $74,770 per person. The state’s agriculture-driven economy necessitates a careful balance, reflected in $6,617 debt per capita (11.477% of GDP), demonstrating Arkansas’ commitment to managing its resources wisely while addressing the needs of its residents.

5. Ohio

Scoring 22.5, Ohio navigates its industrial legacy with $75,243 in consumer debt per capita. The state’s manufacturing and agricultural sectors play a crucial role in its economic health, influencing its debt of $7,916 per capita, representing 10.592% of the GDP.

Ohio’s debt strategy reflects its efforts to innovate and grow while maintaining fiscal stability.

6. Alabama

Alabama earns the 6th spot for lowest debt, state-wise, scoring 23.3. It showcases a commendable fiscal stance with a government debt per person of $6,851, highlighting Alabama’s effective debt management, boasting an average personal debt of $77,981.

This reflects the state’s prudent financial planning and commitment to sustainable economic policies. Despite its modest government debt ratio of 11.578% of GDP, Alabama demonstrates a robust economic framework that supports its residents’ financial well-being and ensures a stable economic environment.

7. Michigan

With a score of 25.1, Michigan’s story is one of resurgence, owing $77,903 in consumer debt per capita. The automotive industry’s recovery and diversification efforts have shaped its state debt of $8,160 per resident, accounting for 12.326% of the GDP. Michigan’s economic strategies are a testament to its resilience and adaptability.

8. Iowa

Iowa, securing the 8th position as one of the least indebted states in the U.S., illustrates a strong financial discipline with a government debt per person of $6,392.

It achieved a score of 25.2, underlining Iowa’s adept management of its average personal debt, which stands at $80,933.

Furthermore, with a government debt ratio of 8.173% of GDP, Iowa exemplifies a sustainable financial model that promotes economic stability and supports the well-being of its residents.

9. Louisiana

With a score of 25.7, Louisiana faces unique challenges, carrying $80,616 in consumer debt per capita. Despite its rich cultural heritage and natural resources, Louisiana navigates through economic fluctuations, reflected in its state debt of $6,800 per capita, amounting to 9.926% of GDP.

The state’s fiscal policies aim to balance cultural preservation with economic development.

10, Indiana

Indiana, securing the 10th position as one of the least indebted states in the U.S., presents a solid financial profile with a government debt per person of $7,578. Achieving a score of 26.0, Indiana illustrates effective debt management with an average personal debt of $79,349.

Despite a government debt ratio of 10.374% of its GDP, Indiana demonstrates a resilient economic structure that supports the financial health of its residents and promotes a secure and thriving economic climate.

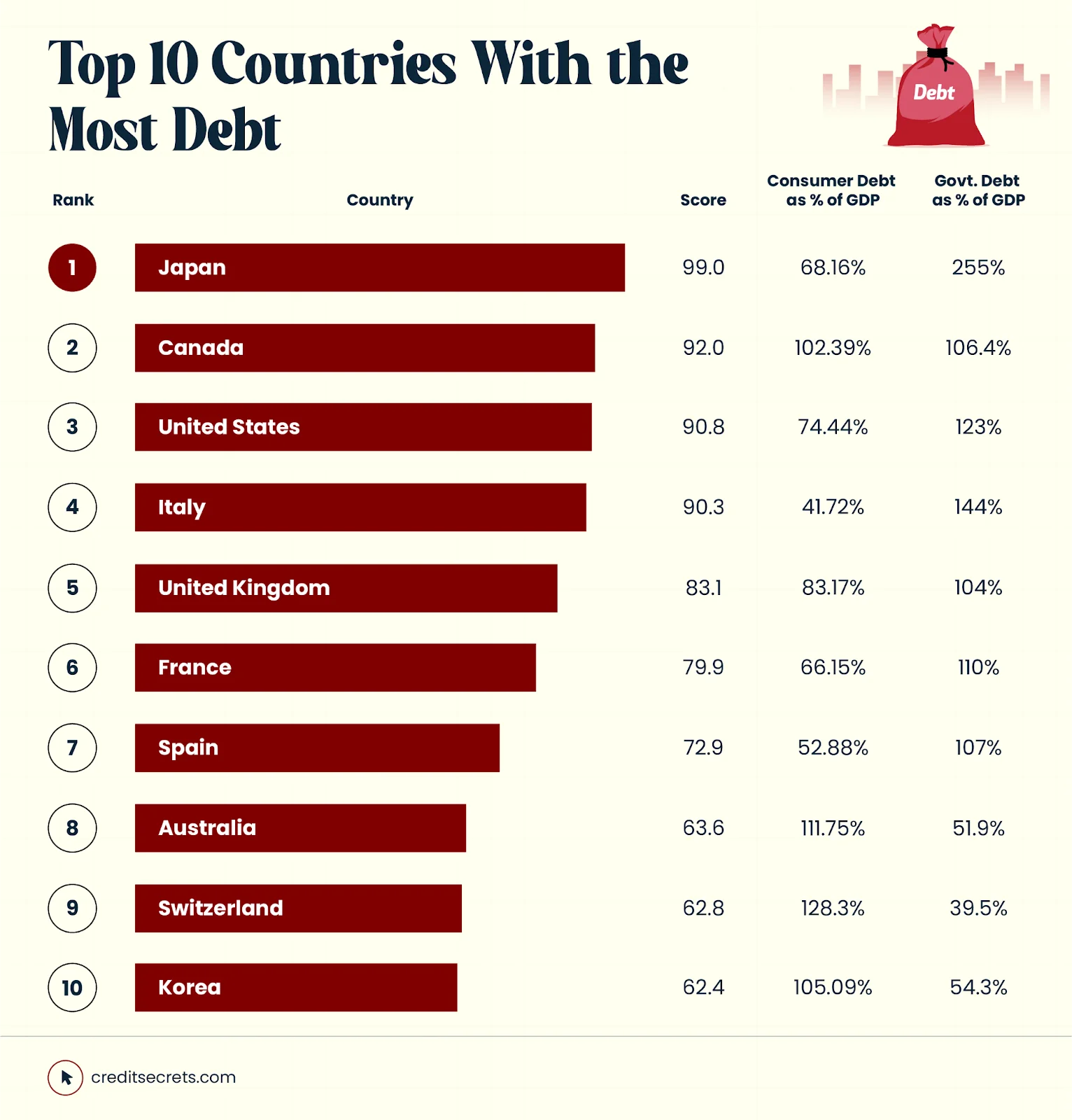

Top 10 Countries With the Most Debt

1. Japan

Japan scores 99, showing a big challenge with government debt soaring to 255% of its GDP, far above what its citizens owe. Japan’s government debt is partly due to decades of economic policies aimed at combating deflation and promoting growth, including vast public works projects and social spending to support an aging society.

This reflects Japan’s efforts to boost its economy and care for an aging population, highlighting a critical balance between economic growth and fiscal responsibility.

2. Canada

Canada’s economic strategy involves significant investment in social services and infrastructure, funded by government borrowing, reflecting its commitment to a strong social safety net and economic growth. A score of 92 shines a light on its strong consumer spending, where personal debt exceeds 102% of GDP.

The government is also borrowing heavily (over 106% of GDP), pointing to the need for careful economic planning to sustain growth without overburdening future generations.

3. United States

The United States, with a government debt-to-GDP ratio of 123% and a consumer debt-to-GDP ratio of 74.44%, achieves a score of 90.8. This highlights the nation’s substantial fiscal commitments alongside its vibrant consumer economy.

The contrast between personal and government debt levels illustrates the complexity of the U.S. economic environment, where consumer spending is a significant driver of economic activity.

Despite the challenges posed by its high public debt levels, the U.S. continues to leverage its diverse and innovative economic sectors to maintain growth and navigate toward fiscal sustainability.

4. Italy

Italy, with a government debt-to-GDP ratio of 144% and a consumer debt-to-GDP ratio of 41.72%, scores 90.3, reflecting its fiscal challenges and efforts towards stabilization.

The country’s moderate personal debt level contrasts with its significant public debt, underscoring Italy’s balancing act between stimulating consumer spending and managing fiscal responsibilities.

Despite its economic hurdles, Italy’s rich cultural and industrial contributions support its pursuit of economic resilience and stability.

5. United Kingdom

Post-Brexit economic policies and the response to the COVID-19 pandemic have significantly impacted the UK’s public finances, leading to increased borrowing to sustain the economy and social welfare systems. Resulting in a score of 83.1, the UK faces challenges with consumer debt at 83.17% of GDP and government debt at 104%.

These figures illustrate the UK’s efforts to sustain consumer confidence and navigate uncertain economic waters with strategic public investment and fiscal management.

6. France

France, achieving a score of 79.9, manages a delicate balance with consumer debt at 66.15% of GDP and government debt at 110%. The numbers show France’s approach to public debt includes significant expenditures on healthcare, education, and social welfare, reflecting its commitment to a comprehensive state-supported social model despite fiscal pressures.

7. Spain

Spain scores 72.9, highlighting its consumer debt at 52.88% of GDP against government debt of 107%, reflecting Spain’s efforts to recover from the financial crisis and high unemployment.

As a result, the country has led to increased public spending, with recent economic policies focusing on renewable energy and digitalization to drive growth.

8. Australia

Australia earned a score of 63.6, demonstrating consumer confidence through the second-highest personal debt ratio (111.75% of GDP) among the top 10 nations with the highest debt, while maintaining lower government borrowing of 51.9%.

The land down under’s relatively low government debt compared to consumer debt indicates a robust economy where consumer spending drives growth, supported by prudent government fiscal policies.

9. Switzerland

Switzerland’s low government debt and high personal debt reflect its strong financial sector, competitive tax rates, and policies promoting individual financial responsibility and savings. Scoring 62.8, Switzerland showcases the highest consumer debt ratio at 128.3% of GDP, contrasted with a lower government debt of 39.5%.

This unique financial landscape, supported by strong personal incomes and a solid banking system, illustrates Switzerland’s stable economy despite individual borrowing levels.

10. Korea

Korea, with a score of 62.4, highlights its economic model, with consumer debt reaching 105.09% of GDP and government debt at 54.3%. Korea’s economic policies, emphasizing technological innovation, export-led growth, and infrastructure development, have driven consumer spending while maintaining manageable levels of government debt.

Frequently Asked Questions (FAQ)

What is America’s consumer and government debt level in 2024?

America has significant consumer and government debt levels, with consumer debt reaching 74.44% of its GDP and government debt at 123%.

Which U.S. state has the highest debt?

Colorado has the highest debt, with each resident’s personal debt averaging $154,481 and the state debt at 12.76% of its GDP.

Which U.S. state has the lowest debt?

Mississippi has the lowest debt, boasting consumer debt per capita at $65,547 and government debt at 9.882% of its GDP.

Which country has the highest debt worldwide?

Japan is the most indebted country globally, with government debt soaring 255% of its GDP.

Where does the U.S. rank in the global financial landscape?

The U.S. is the third most indebted nation globally in 2024, with a consumer debt-to-GDP ratio of 74.44% and a government debt-to-GDP ratio of 123%.

Methodology

To evaluate and rank the debt levels of U.S. states and countries worldwide, our study incorporated a comprehensive analysis of several key financial metrics. Here’s how we approached the data:

For U.S. States:

- Consumer Debt: We assessed the total consumer debt figures sourced from Experian’s 2023 Q3 report. This data reflects the aggregated debt carried by individuals within each state, encompassing credit cards, auto loans, personal loans, and mortgages.

- Government Debt: State-wise government debt information was gathered from a verified public source to understand the fiscal responsibilities held by each state government.

- Average Salary: The average salary data for each state was obtained from Forbes Advisor, providing insight into the earning power of the residents.

- State GDP: Information on the Gross Domestic Product (GDP) by state was sourced from Wikipedia, offering a measure of the economic output of each state.

- Weighting and Scoring: Consumer debt was assigned a weight of 0.6, while government debt was given a weight of 0.4. These weights were applied to calculate a weighted score for each state, which was then scaled to 0-100 range for easier comparison.

For Countries:

- Household and Government Debt: Our analysis of countries began with data from the International Monetary Fund (IMF) 2023, detailing household and government debt as percentages of GDP. This provides a global perspective on how individual and public debt levels compare to the country’s overall economic output.

- Weighting and Scoring: For countries, we adjusted the weights to give more emphasis to government debt (0.6) over consumer (household) debt (0.4), reflecting the significant impact of government borrowing on a country’s financial health. The scores were then normalized to a 0-100 scale to effectively rank the countries according to their debt levels.

This methodology ensures a balanced and comprehensive view of debt levels across states and countries, considering individual and government liabilities relative to their economic capacities.