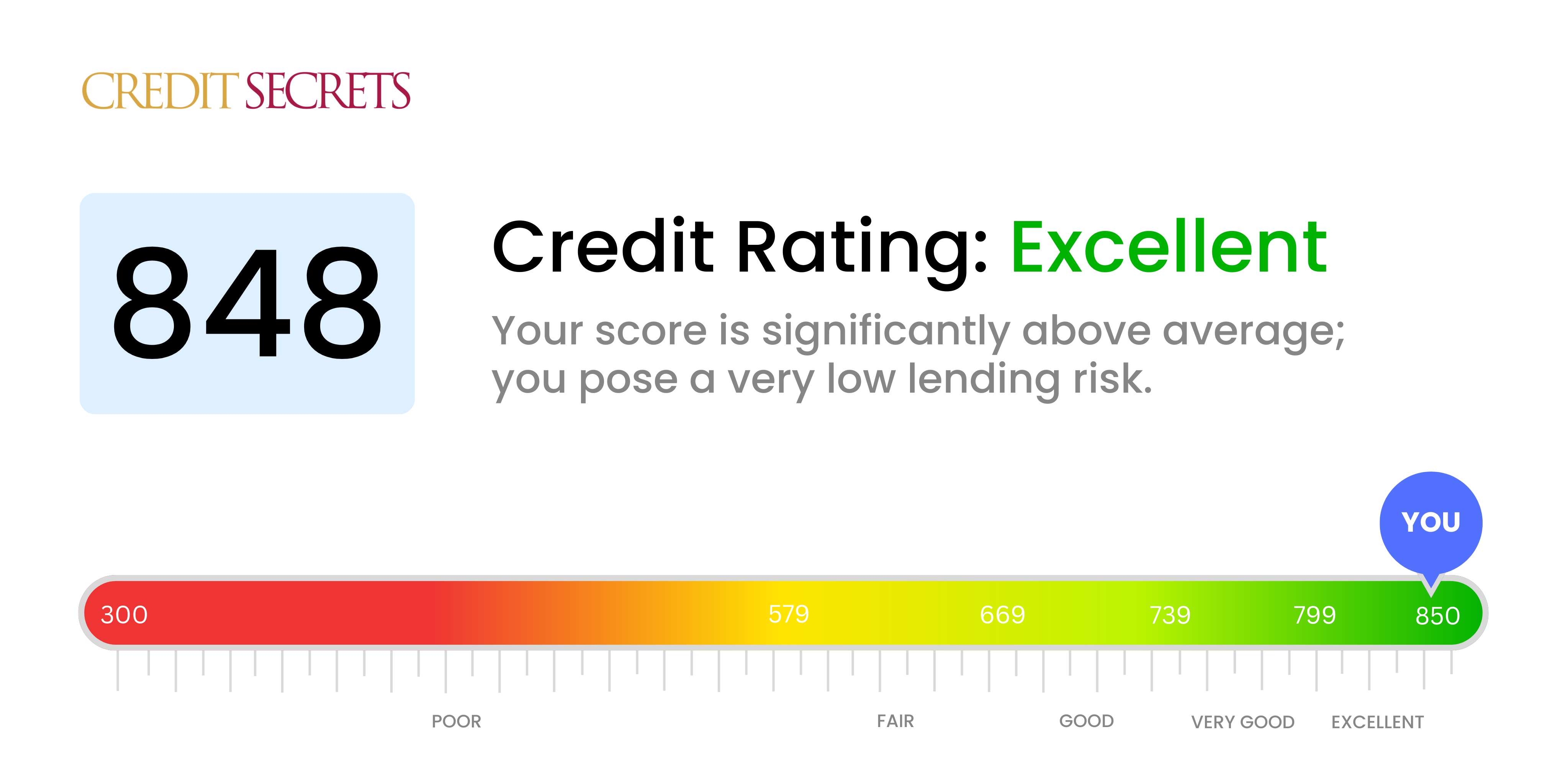

Is 848 a good credit score?

With a credit score of 848, you're in the 'excellent' category. This credit score reflects consistent responsibility in managing your credit, and you can expect to receive the best possible terms when it comes to loan interest rates and credit qualifications.

Being in this category means businesses and lenders see you as highly reliable and low risk. It's crucial to maintain this high standard by continuing to make payments on time, keep balances low, and apply for new credit judiciously. You're on a great path to financial health!

Can I Get a Mortgage with a 848 Credit Score?

With a credit score of 848, you are in an excellent position to be approved for a mortgage. This score is significantly above the average and indicates a strong history of responsible credit management and timely payments. Mortgage lenders view such a high score as a sign of strong financial responsibility.

During the mortgage approval process, you can expect your high score to work in your favor. Mortgage lenders may offer you lower interest rates, more favorable terms, and a wider range of loan options. However, remember, it's still important to shop around, compare rates, and make sure you find a mortgage that fits comfortably within your budget. Always be mindful that your mortgage, like any other credit, needs to be managed responsibly to maintain your high credit score. You're on track for excellent financial health. Keep managing your credit responsibly and you can expect to reap the rewards in future financial endeavours.

Can I Get a Credit Card with a 848 Credit Score?

With a credit score of 848, you are indeed in a strong position to be approved for a credit card. This score is seen as excellent in the eyes of lenders, indicating you have a history of responsible financial behavior. Taking this into account, it provides a sense of assurance and confidence. However, it's not a guarantee of approval as other factors are considered, too.

Your high credit score gives you the leverage to aim for premium credit cards that offer a wider range of perks and benefits. So, think about travel reward cards, cash-back cards, or retail reward cards that align with your spending habits. These cards typically come with perks like air miles, cash bonuses, and more. Despite these advantages, it's still crucial to make sure that the card you choose corresponds with your lifestyle needs and financial reality. Look at the annual fees, interest rates, and rewards expiry in order to make an informed decision. Remember, a good credit card should contribute positively to your financial health rather than pose unnecessary risks or burdens.

With a credit score of 848, your financial standing is impressive. This score is far above the average range and represents a low level of risk to lenders. You are most definitely in a favorable position for acquiring a personal loan. It's a clear reflection of your responsible credit behavior in the past.

In terms of what you can expect during the loan application process, your high credit score will likely be the golden ticket to favourable loan terms and lower interest rates. Lenders will view you as an attractive borrowing candidate because of your strong credit history. Additionally, your application process may be faster and smoother than usual, as lenders are generally keen to offer loans to individuals with high credit scores. However, keep in mind that lenders also consider other factors apart from your credit score, such as your income and debt-to-income ratio.

Can I Get a Car Loan with a 848 Credit Score?

A credit score of 848 is excellent and puts you in a great position when it comes to applying for a car loan. This high of a score shows lenders that you're a reliable borrower. You've demonstrated a long history of responsibly managing and repaying debt, which lenders appreciate as it lowers their risk.

Because your credit score is so high, you can expect to be given favorable terms during the car buying process. Lenders will likely offer you lower interest rates which can drastically reduce the overall amount you'll pay for your car loan over time. However, the interest rate is not the only factor to consider, so it's always a good idea to research and compare different loans. Remember, a credit score of 848 really highlights your credit worthiness and this puts you in a strong position to negotiate the best deals.

What Factors Most Impact a 848 Credit Score?

Achieving a credit score of 848 indicates excellent credit. It signifies an excellent credit standing and exceptional financial behavior. Several key factors have possibly played a role in pushing your score at this level.

Credit Payment History

Paying your creditors on time significantly contributes to the establishment of an excellent credit score. A long history of timely payments might be a major factor contributing to your current score.

How to Check: Delve into your credit report to see if any late payments are present. A lack of them can contribute to a high score.

Low Credit Utilization

Keeping your credit usage low is another crucial component of an excellent credit score. If your credit card balances are consistently low, this could be boosting your score.

How to Check: Review your credit card statements for low balances consistently. This undoubtedly proves your responsible credit usage.

Credit History Length

A longer credit history length can speak volumes about your creditworthiness. Your 848 score might be reflecting a longer, positive credit history.

How to Check: Look at your credit report to analyze the age and number of your accounts. A long-time credit user can be rewarded with a higher score.

Credit Mix

A diverse mix of well-managed credit, including revolving and installment loans, can showcase your ability to handle various types of credit responsibly.

How to Check: Diversify and look over the types of credit shown on your report. A good mix indicates well-rounded credit usage.

No Negative Public Records

Lack of negative public records such as bankruptcies or tax liens demonstrates financial stability which contributes to a high credit score.

How to Check: Review your credit report for any public records or collection items. Absence of such items can contribute to a top-notch score.

How Do I Improve my 848 Credit Score?

With a credit score of 848, you are in an advantageous position because this score is considered excellent. However, maintaining this score or attempting to increase it further requires prudent management of your finances. Here are some impactful and feasible steps tailored for your situation:

1. Regular Monitoring of Credit Report

Even with a high credit score, you should continue monitoring your credit reports regularly for any errors or discrepancies that could negatively impact your score. Ensure getting reports from all three credit bureaus, as the information reported could vary.

2. Keep Credit Utilization Low

While you might have a high credit limit, aim to keep your utilization below 10%. This displays your ability to responsibly manage a large credit line and has a positive impact on your credit score.

3. Consistently Pay Bills on Time

Late payments could significantly reduce your credit score. Ensure all your accounts are current by consistently paying your bills on time, even the ones that don’t seem relevant to your credit, like utilities, because unpaid bills could be sent to collections and impact your credit negatively.

4. Maintain Old Accounts

Even if you’re not using an old credit card, consider keeping the account open. Older accounts contribute positively to your credit history length, a factor credit bureaus consider when determining your score. Just ensure such cards are not tempting you into unnecessary expenditures.

5. Prudent Management of New Credit

Only apply for new credit if you require it. Numerous hard inquiries could cause a slight decrease in your credit score, while new accounts can lower your average credit account age, another scoring factor.