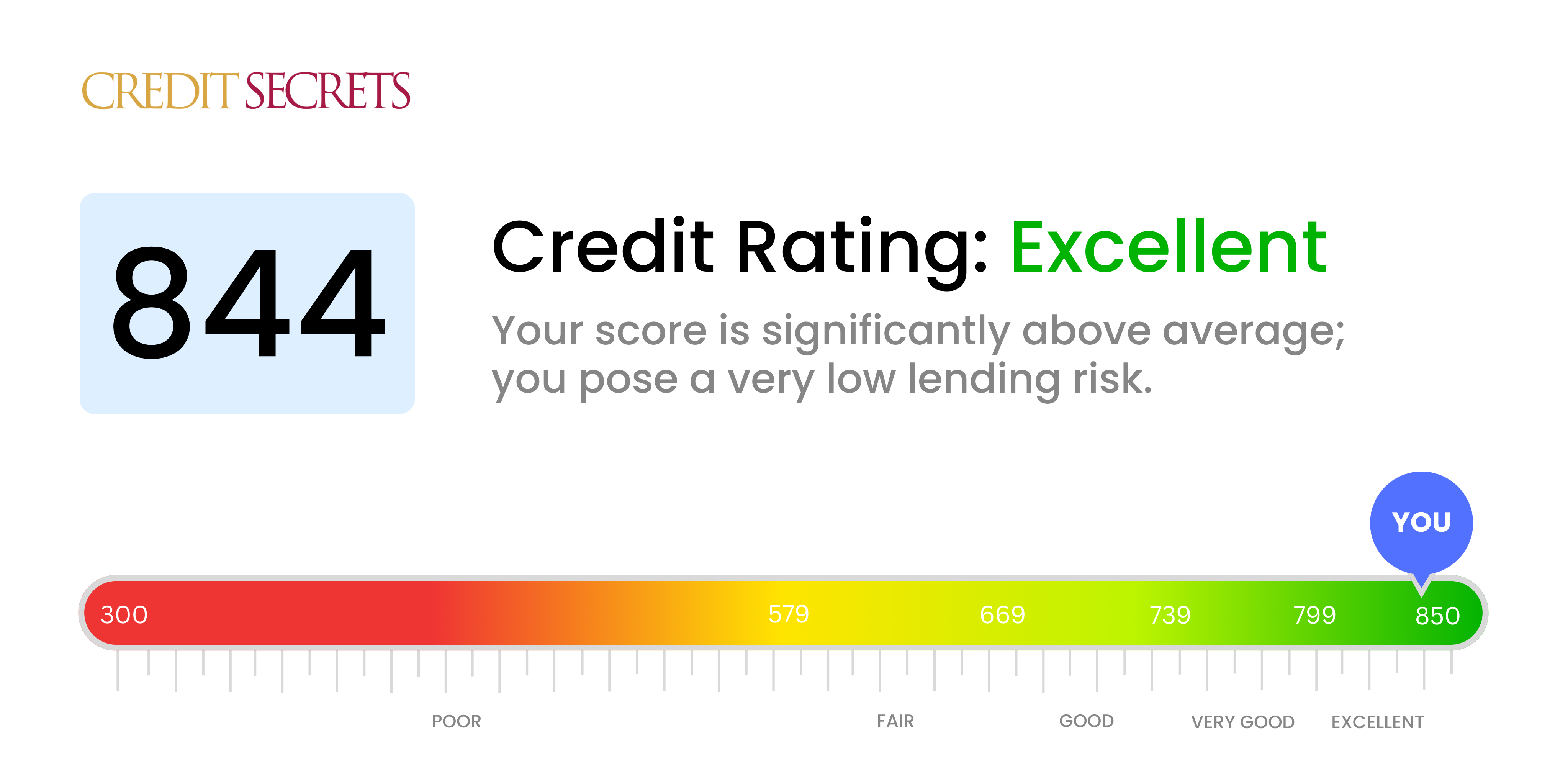

Is 844 a good credit score?

With a credit score of 844, you're in excellent territory according to the credit score range. This gives you an advantage when it comes to financial opportunities, like qualifying for the best interest rates and terms on loans and credit cards, or getting approved for a mortgage.

Achieving such a high score shows that you've been managing your finances effectively, and lenders are likely to see you as someone who is very responsible with credit. Keep on practicing the same responsible financial habits to maintain or even further improve your credit score, and you'll continually reap the benefits of an excellent credit score.

Can I Get a Mortgage with a 844 Credit Score?

With a remarkable credit score of 844, your chances of being approved for a mortgage are exceptional. This score reflects a consistent track record of punctuality on payments, optimal use of credit, and responsible financial management. Lenders see this as a strong assurance of your ability to fulfill a mortgage commitment, making them more likely to approve your application.

As you proceed with the mortgage approval process, you may find it smoother and faster. A high credit score such as yours often expedites the loan underwriting process, providing an efficient experience leading to quicker approval times. Additionally, due to your outstanding creditworthiness, you may be offered attractive interest rates. This is because lenders typically provide better terms to applicants who pose less risk, reassuring you that maintaining a strong credit score truly pays off in your financial journey.

Can I Get a Credit Card with a 844 Credit Score?

With a credit score of 844, you're in an excellent position to be approved for a credit card. A score at this level stands as testament to a history of responsible financial management. It's important though, not to rest on the laurels of past success, but to focus on maintaining and continuously improving your fiscal stability.

At this credit score range, numerous credit card options open themselves to you. Secured and starter cards may not be necessary. Instead, you may want to consider premium travel cards or cards with lucrative reward programs. With your high credit score, lenders see you as a low-risk borrower, which may translate into lower interest rates and more favorable terms. Remember, however, that each credit card offer is unique, and you should carefully consider factors such as annual fees, cash back percentages, and rewards programs before making a decision. Maintaining your high credit score means continuing to make wise financial decisions, and choosing the right credit card is a significant part of that process.

An 844 credit score is exceptional and puts you well within the top tier of credit scores. With such a high score, you are very likely to be approved for a personal loan. This score shows lenders that you've been responsible with your credit and consistently make your payments on time. It's clear that your careful financial decisions are paying off.

With an 844 score, the personal loan application process should be relatively smooth. Due to your excellent credit history, you may be eligible for lower interest rates, which could save you significant money over the term of your loan. You're in an enviable position; lenders will see you as a trustworthy and reliable borrower. While every application process is different, your high credit score should open the doors to a wide range of lending opportunities.

Can I Get a Car Loan with a 844 Credit Score?

With a credit score of 844, you're in a strong, attractive position to be approved for a car loan. This exemplary credit score is substantially above the benchmark score of 660 which is typically favored by lenders. Your impressive credit score suggests to lenders that you're reliable and unlikely to default on proposed loan terms.

Given your high credit score, you can anticipate positive outcomes for your car loan application. This may entail lower interest rates and flexible loan terms, lending to your advantage. A credit score like yours demonstrates a history of responsible money management to lenders, and it's likely to pave the way for smoother negotiations and attractive loan packages. However, regardless of your credit score, it's always important to review all the loan terms and conditions and to fully understand what's on offer. An informed decision is always a prudent one when undertaking any financial commitment.

What Factors Most Impact a 844 Credit Score?

Deciphering a score of 844 is integral to solidifying your present financial standing and shaping your future endeavours. Considering the factors influencing this score will assist you in maintaining a robust financial profile. Remember, your financial expedition is exclusively yours, filled with moments of growth and self-education.

Impeccable Payment History

The payment history significantly influences your credit score. With a score of 844, you probably have a flawless payment history, free from defaults or late payments.

How to Check: Revisit your credit report for any late payments or defaults. If none, maintain this standard in all future dealings.

Optimal Credit Utilization

Low credit utilization enhances your score. It is likely that your credit card balances are significantly lower than their limits.

How to Check: Scrutinize your credit card statements, ensuring your balances stay considerably lower than your credit limits.

Longstanding Credit History

A longstanding credit history is beneficial for your score. Your lengthy credit history likely boosts your 844 score.

How to Check: Analyze your credit report, ensuring the age of your newest and oldest accounts and the average age of all accounts is lengthy.

Diversified Credit and Judicious Use of New Credit

Expertly managing a diverse credit mix and handling new credit responsibly contribute to your excellent score.

How to Check: Review your various credit accounts and ensure you're avoiding unnecessary credit applications.

Clean Public Records

Public records without any derogatory information like bankruptcies or tax liens are essential for your high score.

How to Check: Look over your credit report for any public records. Ensure there are no pending issues needing resolution.

How Do I Improve my 844 Credit Score?

A remarkable credit score of 844 positions you near the very top range, generally considered ‘exceptional credit.’ Nonetheless, maintaining or improving your score at this level is predicated on precision and diligence. Here are the most crucial steps you could take for a superb score such as this:

1. Maintain Current Payments

Be extraordinarily punctual with your credit payments. For those with such high scores, even a single late payment could cause a meaningful drop. Set automatic payments if not done already to ensure you never miss a due date.

2. Keep Old Accounts Open

Length of credit history significantly affects your score. Resist the temptation to close old, unused credit cards as they contribute to your overall credit age.

3. Monitor Your Credit Report

Remember, errors or fraudulent activities on your report could erode several points. Regularly review your report for any inaccuracies or unexpected changes and dispute them promptly.

4. Limit New Credit Inquiries

At this level, a hard credit inquiry can negatively impact your score. Apply for new credit sparingly and strategically.

5. Keep Debt-to-Income Ratio Low

Your debt-to-income (DTI) ratio may influence a lender’s decision. Aim to keep this ratio as low as possible by either increasing income or reducing debt.