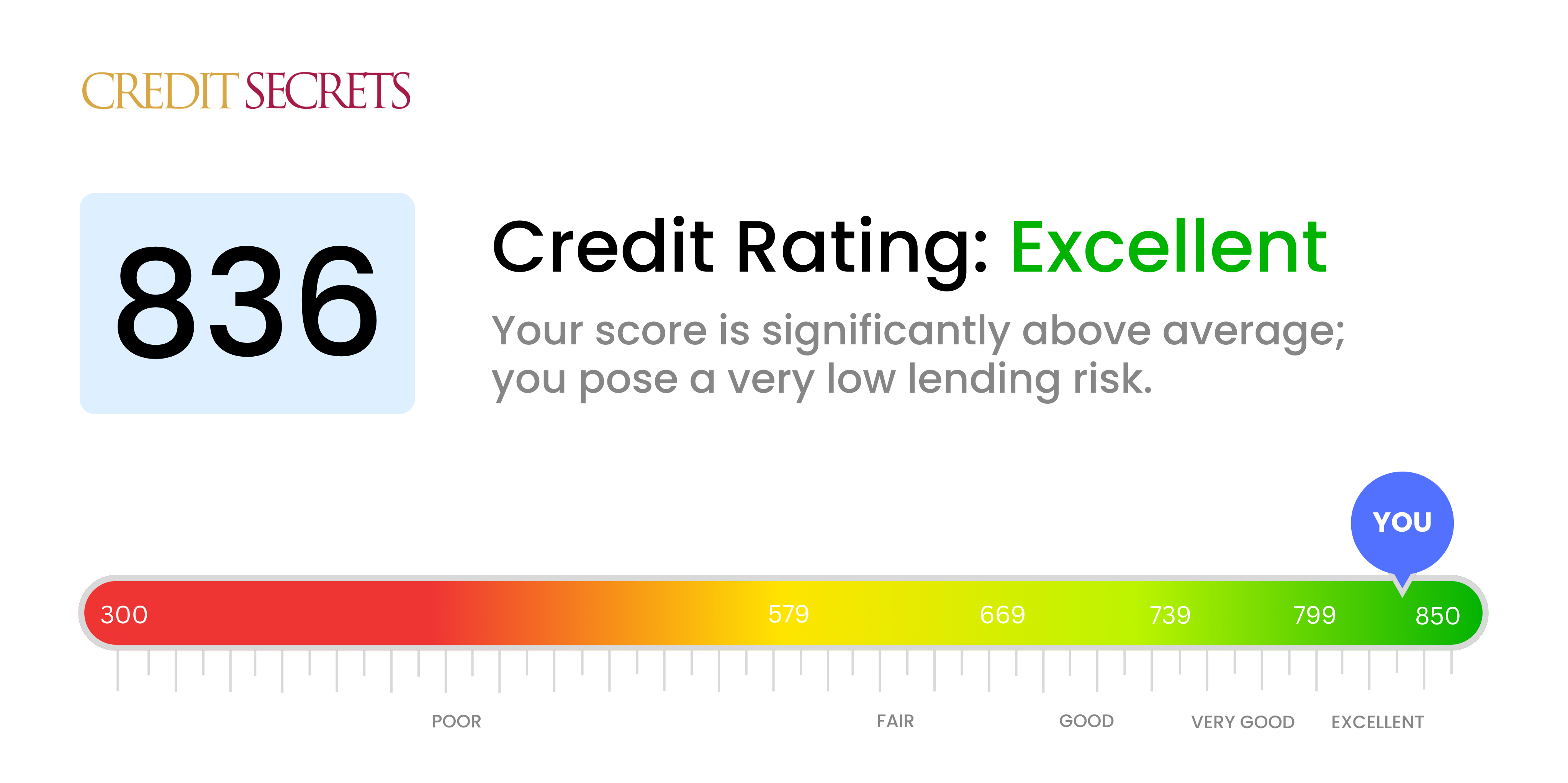

Is 836 a good credit score?

Your credit score of 836 speaks volumes about your creditworthiness and financial discipline. This is an excellent score and sets you in good stead amongst creditors, revealing your impeccable record of managing credit responsibly.

With this score, you're likely to be looked upon favorably by lenders, often resulting in you being offered the best interest rates and terms on loans and credit cards. It's important to maintain this level of credit health through timely repayments, low credit utilization, and avoiding any debt pitfalls to continue enjoying these prime advantages.

Can I Get a Mortgage with a 836 Credit Score?

Boasting a credit score of 836 puts you in an excellent position when it comes to mortgage approval. This score signifies an exceptional history of financial responsibility and trustworthiness. Most lenders will view this positively, as it indicates a low level of risk and a strong likelihood of you fulfilling your mortgage obligations.

As you move forward in the mortgage approval process, you can likely expect better terms and conditions due to your high score. This should reflect in the interest rates offered to you, which are typically lower for individuals with outstanding credit. Keep in mind that while your high credit score improves your chances significantly, lenders also consider other factors like your income and employment stability. But with your stellar credit score, you are already a few steps ahead in the game. It's crucial to continue managing your finances responsibly to maintain your position.

Can I Get a Credit Card with a 836 Credit Score?

With a credit score of 836, you're in an excellent position to be approved for a credit card. This credit status reflects responsible financial behaviour and trustworthiness, and lenders will see you as a low-risk candidate. While having a high credit score like this is certainly rewarding, it also carries a responsibility to maintain this level of creditworthiness.

Given your current standing, you could consider premium credit cards such as travel or rewards cards that offer perks in return for your loyal usage. Also, with your high score, you could potentially qualify for lower interest rates compared to the average cardholder. Regardless, it's essential to continue being diligent with your credit management. Always pay bills on time, stay well below your credit limits and keep your overall credit profile healthy. It's not just about enjoying the good standing, but also about preserving it.

With a credit score of 836, it is highly likely that you will be approved for a personal loan. This score is well above average, demonstrating to any potential lender that you have a solid history of managing your credit responsibly. The good news doesn't stop there. Because of your outstanding credit standing, the loan application process is likely to be smooth with less necessary documentation compared to those with lower scores.

Furthermore, due to your high credit score, lenders are more likely to offer you more favorable terms including lower interest rates. This is because your score signals to the lender that you are a lower risk borrower. In essence, lenders will compete for your business which positions you reasonably to shop around to find the best possible terms. However, choosing the right personal loan should not just be about term favourability but also the right financial partner that aligns with your lending needs.

Can I Get a Car Loan with a 836 Credit Score?

With a credit score of 836, you are in a very good position when it comes to applying for a car loan. Most lenders consider scores above 700 to be prime, and your score is well within that realm. This indicates to lenders that you have a strong history of responsibly managing your credit, and are very likely to repay any amount you borrow.

Because your credit score is so high, you can expect a smoother process in the car purchasing procedure compared to those with lower scores. The most significant advantage may be the favorable interest rates that are likely to be offered to you. Given your excellent credit history, lenders may compete for your business, enabling you to secure a loan with low interest. Remember, shopping around will help you find the best terms. Do read all the terms and conditions carefully before signing the final loan agreement.

What Factors Most Impact a 836 Credit Score?

Deciphering a credit score of 836 is key for maintaining your robust financial health and reaching even higher scores. The factors influencing your score can provide insight into your financial habits. Understand that every individual's financial journey is different, filled with opportunities for growth and learning.

Maintaining Payment History

An impressive payment history likely plays a significant role in your 836 credit score. Always ensuring your payments are made on time can contribute greatly to your current score.

What to Do: Continue to review your credit report, keeping an eye out for any late payments, as these could negatively affect your score.

Credit Utilization

Your credit utilization, which may be on the lower side, is another important contributing factor to achieving a score like 836. Efficiency in managing your credit limits can significantly boost your score.

What to Do: Monitor your credit card statements regularly to ensure your balances are well within the limits. Strive to keep a low credit utilization ratio.

Length of Credit History

A long and positive credit history can greatly contribute to your high score. Managing old and new credits responsibly surely adds to your strong credit profile.

What to Do: Check your credit report regularly to stay informed about the age of your accounts and handle new credits with caution.

Carefully Monitored Credit Mix

Having a mix of credit types and managing them responsibly can be a pivotal factor in your score of 836.

What to Do: Regularly review your mix of credit accounts. Diversity in credit types helps demonstrate your financial reliability.

Public Records

The absence of negative public records like bankruptcies or tax liens is vital to maintaining a high score.

What to Do: Regularly check your credit report for any public records. Acting promptly on any discrepancies helps keep your records clear, boosting your score.

How Do I Improve my 836 Credit Score?

With a credit score of 836, you’re already in an excellent credit range. But, there’s always room to fine-tune and solidify your financial standing. Here are tailored suggestions for this score range:

1. Maintain a healthy credit utilization ratio

Keep an eye on your credit card balances relative to your overall credit limit. Strive to maintain your usage under 10% of your available credit, setting yourself apart as a diligent user.

2. On-time payments

Your payment history significantly influences your credit score. Ensure that you make all your payments on-time, every time–even those seemingly minor ones. This showcases a strong commitment to responsibility.

3. Consider long-term loans

Having a mixture of credit types can help score points. If you don’t have any current long-term loans such as a mortgage, you might consider this as an option. Just ensure it fits into your financial planning and that payments can be comfortably met.

4. Regularly check your credit reports

Minor errors in your credit reports could tarnish your otherwise stellar score. Regularly checking and addressing any discrepancies promptly will prevent this.

5. Avoid new unnecessary credit

While having a good credit mix can improve your score, too many new accounts may indicate risk to lenders. Only open new accounts when necessary and avoid sudden changes like aggressive credit card applications.