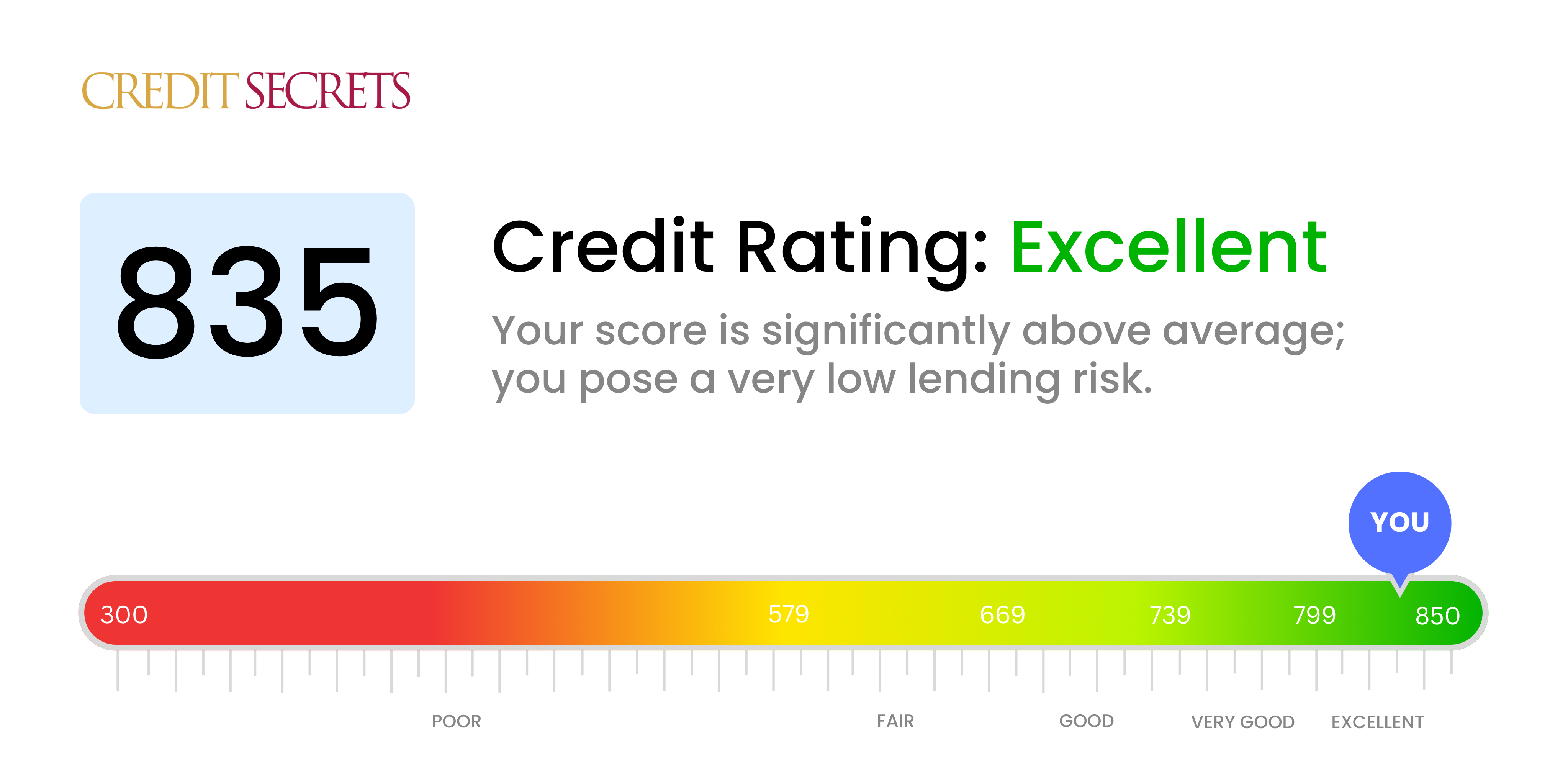

Is 835 a good credit score?

With a credit score of 835, you're in a top-tier financial position, as this score is in the 'excellent' category. This high mark not only reflects a history of responsible credit habits, but also provides you with access to the best interest rates, the most favorable lending terms, and other financial benefits that many others may not be eligible for.

Having this score means lenders, rental agencies and even potential employers may see you as a highly credible individual, likely to meet financial obligations and agreements on time. However, remember that while this is a strong score, the financial landscape can change swiftly, so it’s essential to maintain good financial habits and to keep an eye on your credit status.

Can I Get a Mortgage with a 835 Credit Score?

A credit score of 835 is not just good, it's exceptional. This score signals to lenders that you have a history of responsible credit usage and on-time payments, making you a very low risk borrower. It's highly likely that you will be approved for a mortgage if you apply.

As someone with such an excellent credit score, you can also look forward to some welcome benefits during the mortgage approval procedure. Lenders will likely offer you their most favourable interest rates, which can save you significant money over the lifetime of the loan. However, bear in mind that while a high credit score is a key factor in mortgage approval and terms, lenders also take into account other factors such as your income, employment history and total debt. Therefore, ensure all your financial dealings are in good order to enjoy a smooth mortgage process.

Can I Get a Credit Card with a 835 Credit Score?

Carrying a credit score of 835 will most likely lead to you being approved for a credit card. In the world of credit, this score is considered excellent and signifies that you've done a remarkable job managing your finances responsibly. This is undoubtedly a hopeful scenario and underscores the importance of maintaining a solid credit history.

With such a high credit score, you might qualify for some of the best credit cards on the market. These include premium credit cards that offer significant rewards like travel points, cash back, and luxury perks. Also, these cards often come with lower interest rates making it easier for you to manage your credit card expenses. The key is to continue managing your credit wisely to maintain or even improve your already superior score. Remember, having a good credit score opens the door to many valuable financial opportunities.

With a credit score of 835, you are significantly above the average credit rate and considered an exceptional borrower. This implies that you exhibit responsible credit behavior, and lenders typically regard you as a low-risk candidate. Hence, you are likely to be approved for a personal loan with this credit score.

During the personal loan application process, you can generally expect smoother and quicker approvals. Due to your high credit score, lenders might be willing to offer favorable interest rates and terms. Remember, having a high credit score might also give you some room for negotiation on the loan terms. Always ensure to understand the terms and conditions of the loan agreement completely before proceeding.

Can I Get a Car Loan with a 835 Credit Score?

Having a credit score of 835 means you're in an exceptional position when it comes to being approved for a car loan. This credit score is well above average and is considered top tier, indicating that you've consistently shown responsible credit behavior. Most lenders would see you as a low-risk borrower, and that's advantageous for you.

As a result of your excellent credit rating, you can expect favorable terms when applying for a car loan, such as lower interest rates and flexible repayment terms. Your high score could potentially save you thousands of dollars over the life of your car loan, compared to someone with a lower credit score. However, it's still crucial for you to shop around to find the best deals. Different lenders may offer varying interest rates, so it's important to compare them and read the terms thoroughly. Even with a stellar credit score, being knowledgeable and vigilant can open the doors to even better opportunities.

What Factors Most Impact a 835 Credit Score?

Grasping a score of 835 is essential to maintaining your financial stability. Keeping a close watch on factors that potentially contribute to this superior score helps ensure your credit health.

Credit Usage

Your credit utilization ratio possibly plays a key role in preserving your top-notch score. A low ratio of credit card balances to your overall credit limit contributes to a high credit score.

How to Check: Analyze your credit card balances. Are they significantly lower than your credit limits? Strive to keep your balances well below your limits for optimal scoring.

Repayment Consistency

On-time payments significantly influence a high score of 835. Being consistent and punctual with all your bill payments helps in achieving this score.

How to Check: Look over your payment history on your credit report. If there are no late payments, this means you're maintaining your credit splendidly.

Credit Longevity

A long credit history, involving multiple accounts opened several years ago, can boost your credit score.

How to Check: Examine your credit report. See the age of your oldest account, your newest account, and the average age of all accounts. A lengthier credit history demonstrates financial stability.

Credit variety

A diverse mix of credit, including credit cards, personal loans, and mortgages, could be a factor in your high credit score.

How to Check: Review your credit report. A wide range of credit types shows lenders that you can manage various credit products responsibly.

Public Records

Having no public records such as bankruptcies or tax liens is key in maintaining a high credit score.

How to Check: Inspect your credit report for any public records. Ideally, there should be no such items listed on your report.

How Do I Improve my 835 Credit Score?

With a credit score of 835, you’re performing exceptionally well, indicating strong creditworthiness. This score is considered excellent, but there’s always room for continuous growth. Here are some practical steps uniquely tailored for your situation:

1. Maintain On-Time Payments

Your excellent score indicates a history of on-time payments. Consistency is key – continue to pay all of your bills on time as even a single late payment can cause a significant drop in your score.

2. Keep Credit Utilization Low

Although you’re likely already practicing this, continue monitoring your credit utilization ratio. Aim to use less than 30% of your available credit, even when the balances are paid off each month.

3. Evaluate your Credit Mix

With your high score, you likely have a diverse credit portfolio. While it’s not necessary to take out new credit lines just to diversify, if you’re contemplating a mortgage or car loan, your efficient management can boost your score further.

4. Avoid Unnecessary Credit Inquiries

Avoid unnecessary hard inquiries on your credit report by limiting loan and credit card applications. Each hard inquiry can slightly affect your score.

5. Regularly Check Your Credit Report

Ensure the accuracy of your credit report as mistakes can happen. Regular monitoring will allow you to quickly detect and rectify any errors.

Following these targeted strategies can help you maintain and even enhance your excellent credit standing.