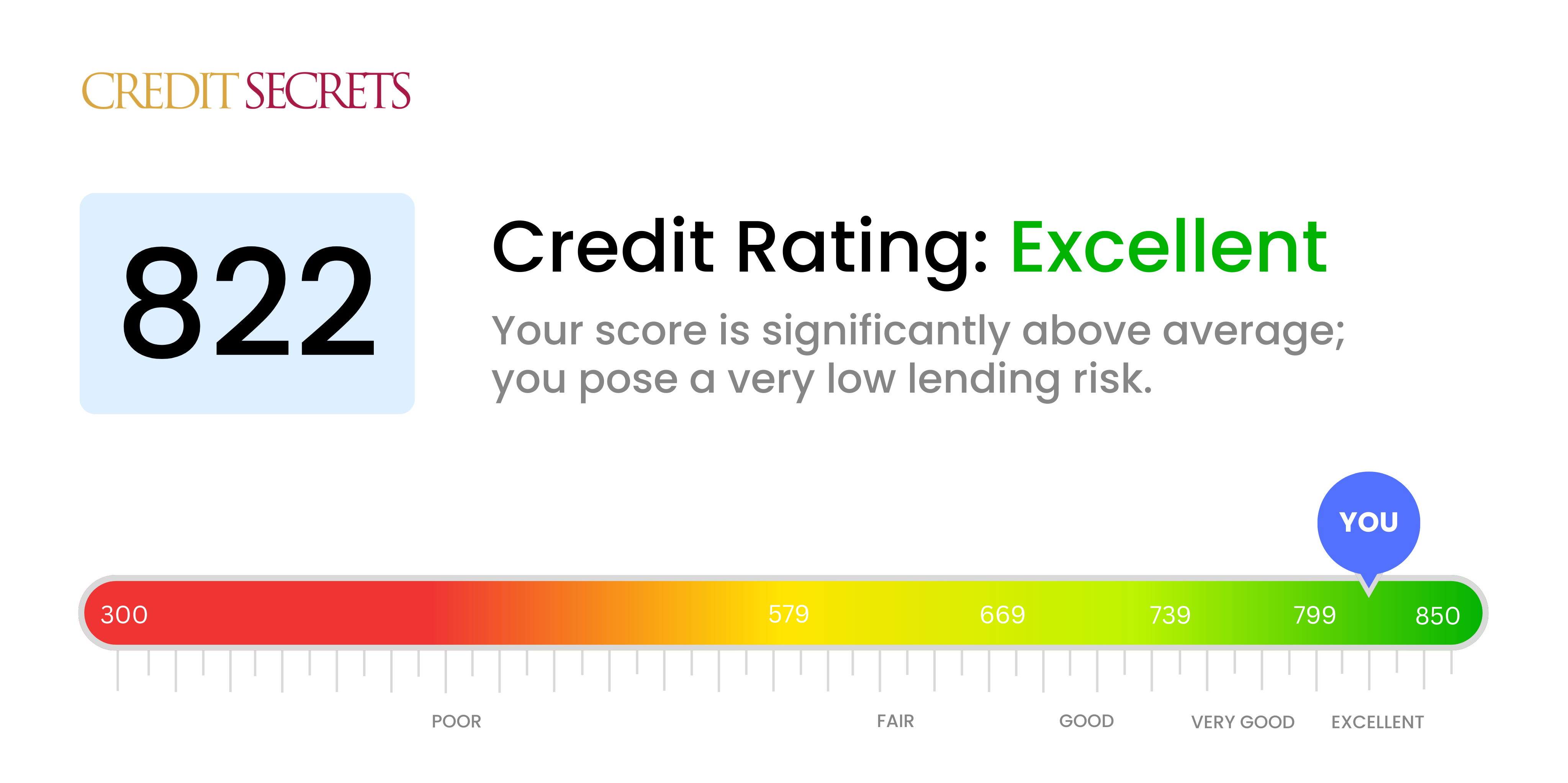

Is 822 a good credit score?

With a credit score of 822, you're holding a place in the top bracket of credit excellence. This is no small thing and it is an indication of your responsible credit behavior, demonstrating a commitment to managing your financial obligations well.

Having a score in this range generally indicates to lenders and creditors that you represent a very low risk. You can expect to have access to some of the best available credit offers with attractive interest rates. From elite credit cards to favorable mortgage terms, the financial world is essentially your oyster. However, remember to continue your responsible credit habits to maintain or even improve this excellent score.

Can I Get a Mortgage with a 822 Credit Score?

Boasting a credit score of 822 is a commendable financial feat. This score gravitates towards the high end of the credit range, and it indeed paints a favorable picture of your creditworthiness for mortgage lenders. It is very likely that you will be approved for a mortgage, as your high credit score reflects a consistent track record of timely payment and responsible credit management. Note that each lender might have different criteria, but your score is generally well above the threshold.

Being on this end of the credit spectrum does come with its perks in the mortgage approval process. You can expect better terms and conditions, including potentially lower interest rates compared to those with lower scores. However, it’s important to remember that credit score is not the only factor. Lenders will also evaluate your income, existing debts, and other financial obligations. But with a score of 822, you're well-positioned for a favorable outcome.

Can I Get a Credit Card with a 822 Credit Score?

With a credit score of 822, most lenders would likely consider you an exceptionally low-risk borrower. This rating suggests that you've been managing your finances responsibly and consistently, so lenders would likely feel confident in your ability to repay any debt. It's a tough task to achieve such a high rating, but your hard work and financial discipline has put you in a prime position when pursuing new forms of credit.

Given your excellent credit score, you would likely be eligible for premium credit cards offering significant rewards or benefits. These could include travel cards, which often feature generous flight and hotel perks, or cash back cards for your everyday purchases. It's also important to understand that due to your excellent credit standing, you're in a prime position to benefit from lower interest rates available to low-risk consumers. While evaluating your options, remember to choose a card that fits well with your lifestyle and spending habits in order to maximize the associated rewards.

With a credit score of 822, you're in excellent financial standing. Most traditional lenders would typically look favorably upon this score, making it highly likely that you would be approved for a personal loan. Although various factors can impact your loan's terms and approval, a score of 822 usually piques the interest of lending institutions due to the low risk represented.

During your personal loan application process, you may anticipate a smoother, more straightforward experience. Your strong credit score demonstrates a solid history of responsible credit management, which could translate into favorable loan terms. You might enjoy lower interest rates due to your creditworthiness, which means that the overall cost of your loan could be less. While a strong credit score isn't a guaranteed pass for loan approval, your score of 822 puts you in a very positive position.

Can I Get a Car Loan with a 822 Credit Score?

With a credit score of 822, you are in a great position to be approved for a car loan. The credit score is well within the excellent range, which is typically anything above 800. This particular score distinguishes you as a responsible borrower in the eyes of lenders, significantly increasing your chances of loan approval.

That said, as you proceed with the car purchasing process, you can expect potential lenders to view your credit history favorably. This splendid score may offer the advantage of reduced interest rates on your car loan. This is because lenders see less risk associated with lending to you, leading to more favorable loan conditions. Your excellent credit history reflects your reliability in paying back borrowed money, making the car loan process a potentially smoother road to navigate. However, always remember to read the fine print on all loan agreements and understand your obligations before signing.

What Factors Most Impact a 822 Credit Score?

With a score of 822, you are well within the excellent credit range. You've managed to maintain a high score, which means you should understand what factors help keep it there.

Credit Card Utilization

Low credit card utilization is usually noted in high credit scores. This means you effectively manage the balance of credit you use and your total credit limit.

Double Checking: Scan your credit card statements. Are you using a small portion of your available credit? Aim to keep it that way!

Payment History

Timely payments are likely a part of your credit score history, this indicates financial responsibility.

Double Checking: Go over your credit report for a history of on-time payments. Continual timely payments contribute to maintaining a high score.

Credit History Length

With a score like 822, it's likely you have a long credit history indicating a proven track record of managing debt.

Double Checking: Review your credit report to gauge the lifespan of your oldest and newest accounts, as well as the average age of all your accounts.

Variety in Credit Types

Having a diversified mix of credit types, like credit cards, retail accounts, installment loans, and mortgage loans, reflects positively on your credit score.

Double Checking: Assess your different types of credit. Having a variety helps you maintain a high credit score.

Negative Information

Most likely, you have no recent collections or public records on your report, these can negatively impact your score.

Double Checking: Review your credit report for any negative items. If there are any, handle them promptly.

How Do I Improve my 822 Credit Score?

With a credit score of 822, you’re in an excellent position! But even top-tier scores have room for enhancement. Here are the most appropriate steps for your current situation:

1. Consistency Is Key

A score like yours indicates a strong credit history. Ensure you continue paying all debts promptly. Late or missed payments can significantly decrease your score.

2. Keep Credit Utilization Low

Maintain a low balance on your credit cards. Ideally, use less than 30% of your total credit limits. Keeping utilization low, can further strengthen your credit score.

3. Monitor your Credit Report

Maintain regular vigilance over your credit report. Quick detection and report of any discrepancies can protect you from possible identity theft or inaccuracies that could lower your credit score.

4. Don’t Close Old Credit Accounts

Preserve your oldest credit accounts, as they demonstrate a long history of credit usage, which is beneficial for your credit score.

5. Continue to Diversify

A diverse portfolio of credit types can positively impact your credit score. If you solely have revolving credit, consider adding an instalment loan, but only if it fits with your financial plans.

Remember, good habits and responsible financial management make the real difference in sustaining and enhancing your credit score.