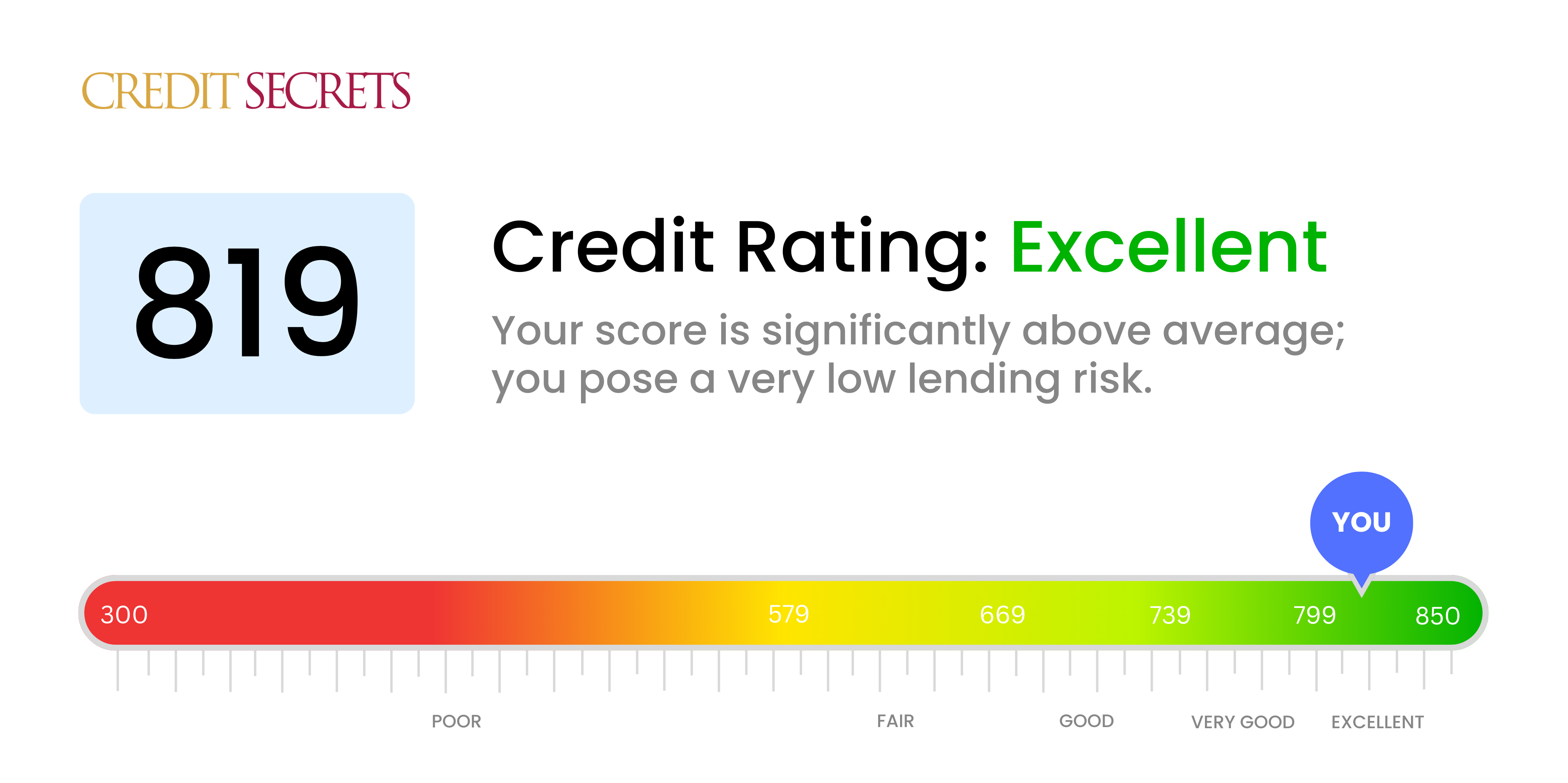

Is 819 a good credit score?

Your credit score of 819 falls into the 'Excellent' category. This outstanding credit rating generally means that lenders can offer you very favorable rates and terms due to the low level of risk associated with you. It's something to be genuinely proud of, as your exceptional management of credit reflects a high level of financial responsibility.

With a score such as yours, you can expect to have little to no trouble when applying for new credit. Whether you're looking to finance a car, a home, or even seeking personal loans, your credit score of 819 should open doors to the best possible deals from most lenders. Keep up the good financial habits that got you this score to maintain and even potentially improve it.

Can I Get a Mortgage with a 819 Credit Score?

Having a credit score of 819 places you in an excellent credit range. Such a high score indicates a history of sound financial management and responsible credit use. Accordingly, in most cases, you should expect to be approved for a mortgage. This score not only signifies trustworthiness to potential lenders, but it is also significantly above the average credit score most lenders require for mortgage approval.

During the mortgage approval process with this score, you can expect to have access to some of the best interest rates available. Lenders view borrowers with high credit scores as low risk, which often translates to lower borrowing costs. While approval and interest rates are never guaranteed and are subject to additional factors like income and existing debts, an 819 credit score significantly increases your likelihood of a favourable outcome in the mortgage approval process.

Can I Get a Credit Card with a 819 Credit Score?

Having a credit score of 819 is an excellent achievement. This score showcases how someone is responsible and diligent with their financial matters. It's a strong indication of trustworthy credit behavior, making such an individual a prime candidate for approval for most credit cards. This accomplishment shouldn't be taken lightly as it carries significant weight when it comes to financial opportunities.

This positive credit score isn't just a ticket to almost guaranteed approval, but it's also a passport to the best kinds of credit cards - those with the most desirable features and benefits. Be it high reward cards, premium travel cards, or exclusive cash-back cards, all these options are open. It's important to carefully select a card that aligns well with financial goals and spending patterns. Additionally, credit cards offered to individuals with this high standing score often come with very competitive interest rates, reflecting lenders' confidence and trust in such a creditworthy individual.

With a credit score of 819, you stand on solid ground when it comes to applying for a personal loan. A score this high sends a strong signal to lenders that you are a low risk borrower, responsible in managing your finances, and consistently meet your obligations in a timely fashion. It's a commendable achievement that highlights your disciplined financial habits.

As your application proceeds, you can anticipate a smooth process with this kind of credit score. You are likely to receive positive responses from lenders, potentially access higher loan amounts and likely to secure lower interest rates. Your high credit score often translates to more bargaining power when it comes to negotiating the terms of your loan. However, remember that while your credit score plays a significant role, lenders may also consider other factors such as your income and existing debts. Ensure to read all terms before signing any loan agreement.

Can I Get a Car Loan with a 819 Credit Score?

With a credit score of 819, the potential to be approved for a car loan is high. Lenders use credit scores as one of the key factors in determining whether to approve a loan or not. An excellent score like yours typically signifies an individual with a history of responsible debt management, which is appealing to lenders.

Your excellent credit score not only suggests a high probability for loan approval but can also open doors to more favorable loan terms. This often includes lower interest rates, which may lead to significant savings over the life of the car loan. Remember, lower interest rates result in lower monthly payments, and a shorter timeline to pay off the loan. This is good news as it can make the car purchasing process easier, more affordable, and a lot less stressful.

What Factors Most Impact a 819 Credit Score?

Navigating your finances with a credit score of 819 is an advantageous position to be in. By understanding the components that shape this score, you can not only maintain but potentially improve your credit standing.

Previous Payment Patterns

With a score of 819, it's likely that you have a consistent history of making payments on time. It is crucial to continue this habit.

How to Check: Evaluate your personal financial management system to make sure you are continuing to make full on-time payments.

Credit Utilization Rate

Keeping your credit utilization rate low has likely contributed to your high score. This means not maxing out your credit limits and maintaining a balance significantly lower than your total available credit limit.

How to Check: Continued analysis of your credit usage on all accounts each month can ensure you maintain this balance.

Length of Credit History

Chances are, your lengthy and diverse credit history has had a positive impact on your score. Long-established credit accounts demonstrate financial reliability to lenders.

How to Check: Review your credit report to see the age of your oldest accounts and average age of all accounts. Keep older accounts open, if possible.

Type of Credit

Your score suggests a diverse mix of credit types—like credit cards, auto loans, and mortgages, which implies responsible credit management.

How to Check: An evaluation of the variety of your credit types can help maintain a healthy credit mix.

No Negative Public Records

For a score of 819, it's likely that there is an absence of derogatory marks such as bankruptcies or tax liens on your credit report.

How to Check: To ensure no inaccurate negative items sneak onto your report, consistent monitoring of your credit report is vital.

How Do I Improve my 819 Credit Score?

With a credit score of 819, you’re in an excellent position. Still, there are some fine-tuning steps you can take to maintain and potentially improve your credit even more.

1. Stay Vigilant with Payments

Even at this high score, late payments can cause a dip. Ensure you continue making all your payments on time. Using automatic payments or reminders can help stay on track.

2. Keep Old Credit Lines Open

Don’t close old credit cards, even if you’re not using them. The length of your credit history plays a role in your score, so keeping those old lines of credit open can help maintain it.

3. Monitor Your Credit

Regularly monitor your credit reports for errors or signs of fraud. Promptly addressing any discrepancies can prevent unwarranted score dips.

4. Limit New Credit Applications

Try not to apply for too many new lines of credit in a short period. Multiple inquiries can negatively impact your score.

5. Maintain a Balanced Credit Mix

Having a variety of credit types – installment loans, retail accounts, credit cards, and mortgage loans – can benefit your credit score. Though not required, it shows lenders your ability to manage diverse forms of credit responsibly.