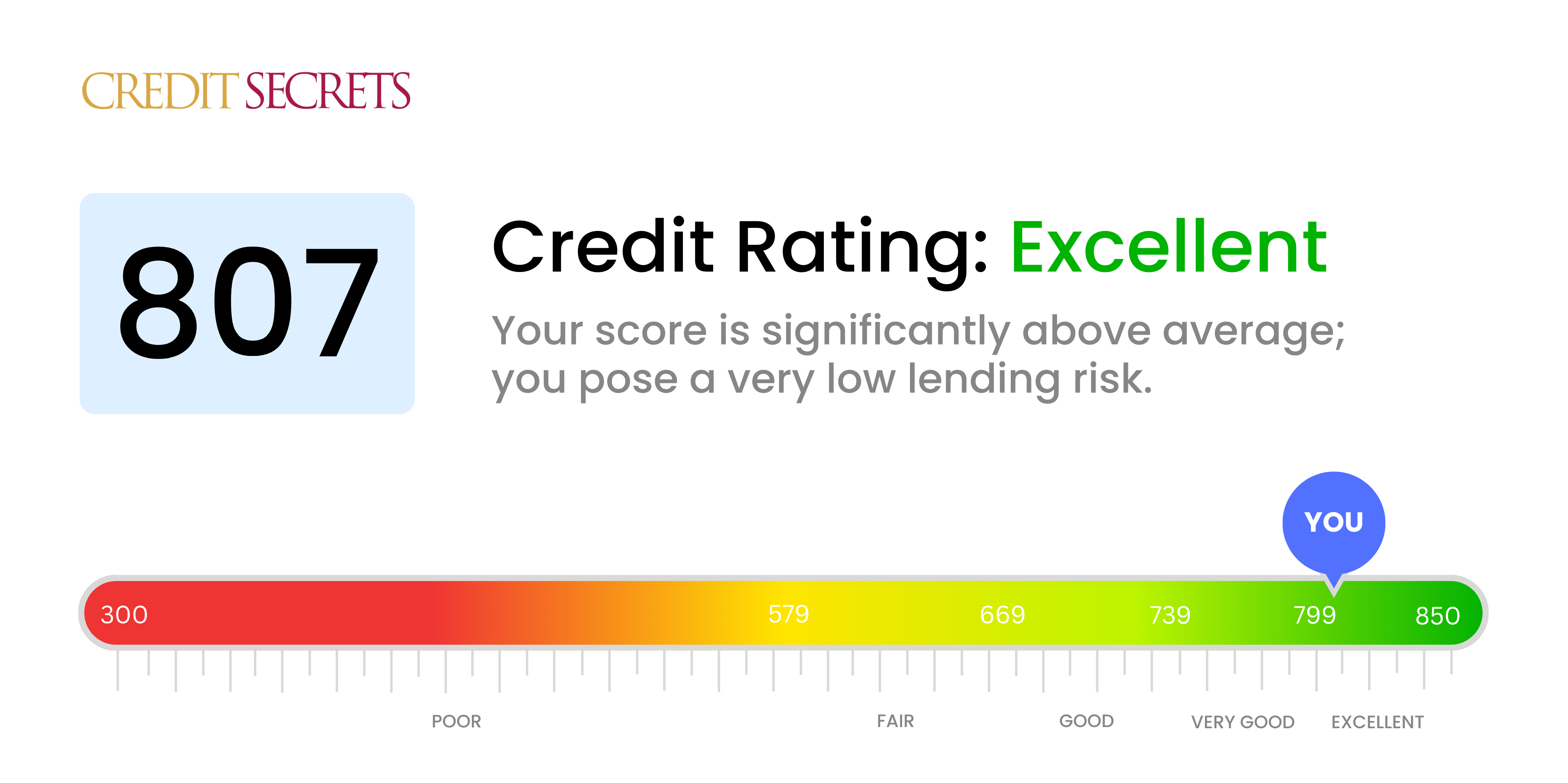

Is 807 a good credit score?

With a credit score of 807, you're in the "excellent" range. This is a strong position and usually means you can expect to secure loans and credit card approvals with attractive interest rates more easily.

Keep in mind, however, that other factors beyond your credit score matter to lenders as well. For instance, your debt-to-income ratio, the type of loan you're applying for, and your income stability can also play a role. But worry not, having an excellent credit score like 807 places you in a favourable position in your financial journey. Remember, maintaining good financial habits is key to keeping your score up.

Can I Get a Mortgage with a 807 Credit Score?

A credit score of 807 is considered to be exceptional and it greatly increases your chances of getting approved for a mortgage. This high score signifies a history of responsible credit management and making payments on time. You have certainly worked hard to maintain your financial health, and it shows.

During the mortgage approval process, lenders will be more comfortable lending you substantial funds given your high credit score. This may also mean you can secure lower interest rates compared to someone with a lower credit score. It's a reflection of the trust and confidence that lenders have in your ability to repay your mortgage in a timely manner. However, remember that while a credit score is a key factor, lenders do consider other aspects such as income, employment history, and the size of the down payment. Maintain continued diligence on your financial regimen to continue to enjoy great perks of a stellar credit score.

Can I Get a Credit Card with a 807 Credit Score?

With a credit score of 807, you're likely to be approved for a credit card. A score in this range implies financial responsibility and reliability. Lenders see you as a low risk, and this could open the door to a variety of credit opportunities. Despite the serious nature of credit scores, it's important to view this circumstance with a sense of optimism - your responsible financial habits have paid off.

Based on your high credit score, premium credit cards could be a suitable option for you. These cards often come with substantive rewards, including travel points, cash back, and other desirable perks. They typically offer lower interest rates compared to credit cards intended for people with lower credit scores. However, you might want to consider the annual fees associated with these premium credit cards as you weigh your options. Applying for credit should be an informed decision, and your impressive credit score has put you in a position to take advantage of these premium options.

Having a credit score of 807 is exceptional and it highly increases your chances of being approved for a personal loan. Lenders consider individuals with such high scores to be low-risk borrowers, which means they're confident you'll repay the loan on time. This sets a positive stage for your personal loan application process.

When applying for a personal loan with this credit score, you can expect smoother processes and better terms. You're likely to receive lower interest rates due to your creditworthiness, making the repayment cheaper in the long run. However, always bear in mind that approval isn't solely based on your credit score; your income and other debt obligations are usually also considered. Nevertheless, a credit score of 807 is an impressive achievement that puts you in a strong position when seeking a personal loan.

Can I Get a Car Loan with a 807 Credit Score?

Having a credit score of 807 brings you into a favorable zone when it comes to getting approval for a car loan. Lenders often see scores at this level as an indication of a responsible borrower. This makes you a lower risk, so approval is more likely than with lower scores. However, don't assume this means the car purchasing process will be a breeze, this is merely a reflection of your reliability in terms of credit repayment.

As you move forward in your car purchasing journey, it's essential to maintain your good credit habits. Continue paying all your bills on time and managing your debts wisely. Your impressive score can potentially aid in securing more competitive interest rates, which in turn lessens the overall cost of the loan. Still, it's crucial to shop around before committing. Finding the right lender can still save you a substantial amount over the life of your car loan.

What Factors Most Impact a 807 Credit Score?

If you have a credit score of 807, it indicates you have been handling your financial responsibilities excellently. Yet, understanding what holds your score at this level is still important to sustain and improve it further.

Payment History

Punctual payments, void of delinquencies or defaults, greatly impact your high score.

How to Check: Access your credit report and confirm there are no late payments that may be overlooked.

Credit Utilization

Maintaining low balances on your credit cards plays a significant role in your score. A low credit utilization ratio is usually a positive sign for your credit health.

How to Check: Scrutinize your credit card statements to ensure your balances are significantly below their limits.

Length of Credit History

An extended credit history has likely contributed to your high score, showing consistent financial behavior over time.

How to Check: Look over your credit report to ensure your oldest accounts are still open as they are increasing your credit age.

Credit Mix and New Credit

Your score probably reflects a balanced mix of various credit types and a cautious approach to acquiring new credit.

How to Check: Look at your report and note the different types of credit you hold. If you have a few inquiries, this reflects responsible handling of new credit.

Public Records

The absence of public records such as bankruptcies, tax liens, or collections is expected with a score in this range.

How to Check: Inspect your credit report to make sure no public records are mentioned to maintain your high score.

How Do I Improve my 807 Credit Score?

With a credit score of 807, you’re already in excellent territory. However, that doesn’t mean you can’t take measures to secure your financial health even further. Here are a few tailored suggestions:

1. Maintain Low Credit Utilization

Your current score indicates responsible usage so continue to keep your overall credit utilization—a ratio of balances to limits— low. Aim to keep it under 10%, which is notably lower than the generally suggested 30%, to help uphold your exceptional credit score.

2. Keep Accounts Open

Keeping your older credit accounts open contributes to the age of your credit history—a positive credit scoring factor. So, even if you aren’t actively using a particular card, don’t be too quick to close it.

3. Automation is Your Ally

Set up automatic payments where feasible to keep your repayment habits on track. Timely payments continue to reinforce your excellent credit, protecting your score.

4. Diverse Credit Mix

While maintaining existing credit is key, introducing a diverse mix of credit responsibly can further demonstrate your ability to manage various types of credit. Examples of this could be installing a car loan or a home mortgage if applicable and the debt is manageable.

5. Regular Monitoring

Stay aware of changes and potential inaccuracies impacting your score by regularly reviewing your credit report. It’s one of the most proactive steps you can take to maintain your excellent credit health.