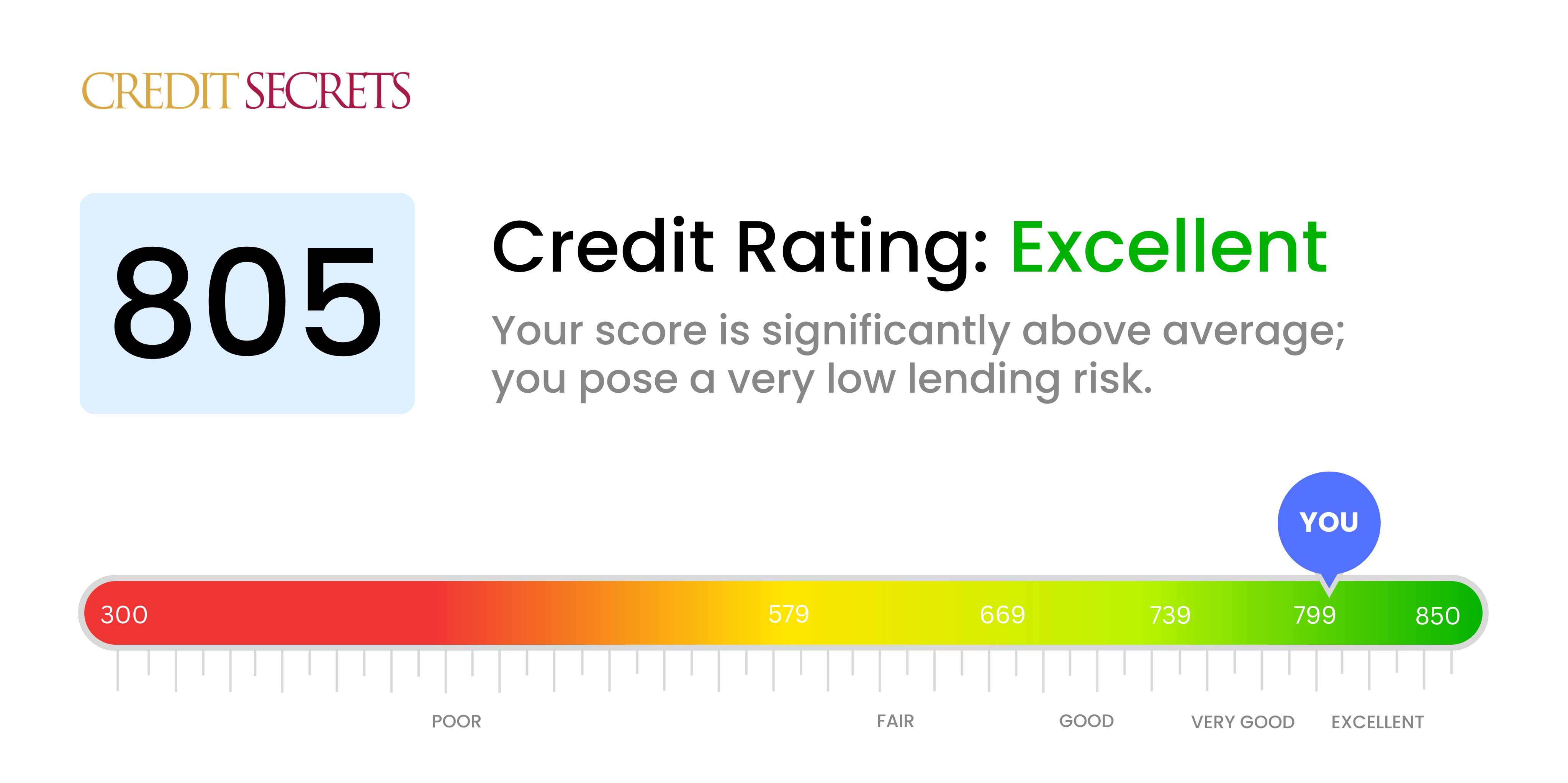

Is 805 a good credit score?

With a credit score of 805, you are in the excellent range. This high rating demonstrates to lenders that you are extremely reliable when it comes to repaying your debts, and it can offer you the advantage of lower interest rates and better terms on loans. You're positioned well for future financial decisions.

Being in the excellent credit range typically comes with more financial opportunities, such as being approved for credit cards with higher limits and loans with reasonable interest rates. Keep up your good work maintaining this score. Continue to pay bills on time, keep your credit card balances low and manage your credit wisely to keep your score high.

Can I Get a Mortgage with a 805 Credit Score?

If you have a credit score of 805, the likelihood of you getting approved for a mortgage is considerably high. This score indicates an excellent credit history with consistent fulfillment of financial obligations, making you a preferred candidate for lenders.

With such a high credit score, you can expect smoother proceedings in the mortgage approval process. Lenders recognize you as a reliable borrower, leading to potentially faster approval times. Moreover, a score of 805 can also open doors to lower interest rates, which would considerably reduce the overall cost of your mortgage. Remember, the higher your credit score, the more financial opportunities become available to you. However, ensure you maintain this level of financial discipline to keep your score in the excellent range. This proactive approach will continue to make future financial ventures more accessible and more affordable.

Can I Get a Credit Card with a 805 Credit Score?

A credit score of 805 is an excellent score and denotes strong financial stability and responsibility. Usually, it's implying that obligations have been consistently met and handled with care. With a score like this, being approved for a credit card is highly likely, as it reflects a low risk to the lender. This shows that a well-thought-out and sustainable financial plan is in place, leading to a positive credit history.

As someone with such a high score, it's possible to consider premium travel cards or cash back cards, which typically come with competitive interest rates and exclusive rewards. A premium travel card can offer benefits like travel insurance, access to airport lounges, and points for purchases. Cash back cards, on the other hand, can bring in rewards in the form of money returned on qualifying purchases. It's also worth noting that some of these cards may come with hefty annual fees, but the perks may outweigh these costs, given your current financial standing. Always be sure to carefully read and understand any contract before commitment.

With a credit score of 805, you are well above the average range and are therefore highly likely to be approved for a personal loan. This does not only signify your exceptional credit management skills but also places you in a class of borrowers that lenders find the most attractive owing to the minimal risk associated with lending you money. As such, you are considered a creditworthy borrower.

When applying for a personal loan with a credit score like yours, you might expect a smoother and faster approval process. Given your strong credit history, lenders may also offer you lower interest rates compared to those with lower credit scores. Remember, the lower the interest rate, the less you have to pay back. It's also important to consider that each lending institution has its terms and conditions, so make sure to shop around and choose the best offer that suits your financial needs. It's your credit, and you've worked hard for it - make sure it works hard for you too.

Can I Get a Car Loan with a 805 Credit Score?

Having a credit score of 805 is an excellent position when looking to secure a car loan. Lenders typically view scores in the high 700s and 800s as prime, and your score of 805 is certainly in that ballpark. This doesn't only maximize your chances of loan approval, but also plays a crucial role in enabling better loan terms.

You can anticipate lower interest rates because your high credit score reduces the risk seen by lenders. Since your exceptional score reveals a history of responsible credit usage and timely payments, lenders may be pleased to provide you with their best terms. Even so, remember to fully understand the terms and conditions of your car loan before proceeding. Even though your score opens doors to prime interest rates, maintaining this advantage requires continual responsible credit activity.

What Factors Most Impact a 805 Credit Score?

Achieving a credit score of 805 is an impressive feat that reflects strong financial responsibility. Here are some probable causes of such a high score:

Credit Utilization Ratio

You're likely keeping your credit utilization low, which is crucial for your score. This ratio represents how much of your available credit you're actually using, with a smaller ratio being better for your score.

How to Check: Look over your credit card statements. Is your card usage significantly less than your available credit? If so, that's excellent for your credit score.

Lengthy Credit History

You probably have a long credit history that reflects a long-term commitment to financial responsibility.

How to Check: Review your credit report for the age of your oldest account, the age of your youngest account, and the average age of all accounts.

Positive Payment History

Your payment history is likely flawless, with timely payments that indicate creditworthiness.

How to Check: Go through your credit history and check if it reflects consistent, on-time payments.

Good Credit Mix

You likely have a diverse credit mix which shows your ability to manage different types of credit accounts simultaneously.

How to Check: Evaluate your credit report for a balanced mix of credit cards, retail accounts, installment loans, etc.

No Negative Public Records

You probably don't have any negative public records such as bankruptcy, tax liens, or civil judgements against you.

How to Check: Scan your credit report for any public records. If there are none, this would definitely contribute to your high score.

How Do I Improve my 805 Credit Score?

Having a credit score of 805 is considered excellent, placing you in an advantageous position for lenders and creditors. Continual improvement and maintenance of your score, though, is crucial to keep up this pristine credit health:

1. Keep Utilization Ratio Low

Maintaining low balances on your credit cards is pivotal. Aim to keep your utilization below the 10% line of your combined credit limit, this will underline your impressive credit management skills.

2. Continue Timely Payments

Keep up your timely payments, as they play a significant role in maintaining good credit health. No bill should go unpaid or late as consistent, on-time payments are crucial to sustaining a top-tier credit score.

3. Limit Hard Inquiries

Limit the amount of hard inquiries on your credit report. Each time you apply for new credit, a hard inquiry registers on your report and can ding your score. Being judicious about where you apply for credit can keep your score high.

4. Credit Diversity

Having a mix of credit types, such as a mortgage, instalement loan, or credit card, contributes positively to credit score calculations. However, be careful not to apply for credit you don’t need just to diversify your credit mix.

5. Monitor Your Credit

Regularly keep an eye on your credit reports. This will help you spot any errors that may negatively impact your score and will enable you to rectify them swiftly. Your diligence can aid in upholding your creditworthiness.