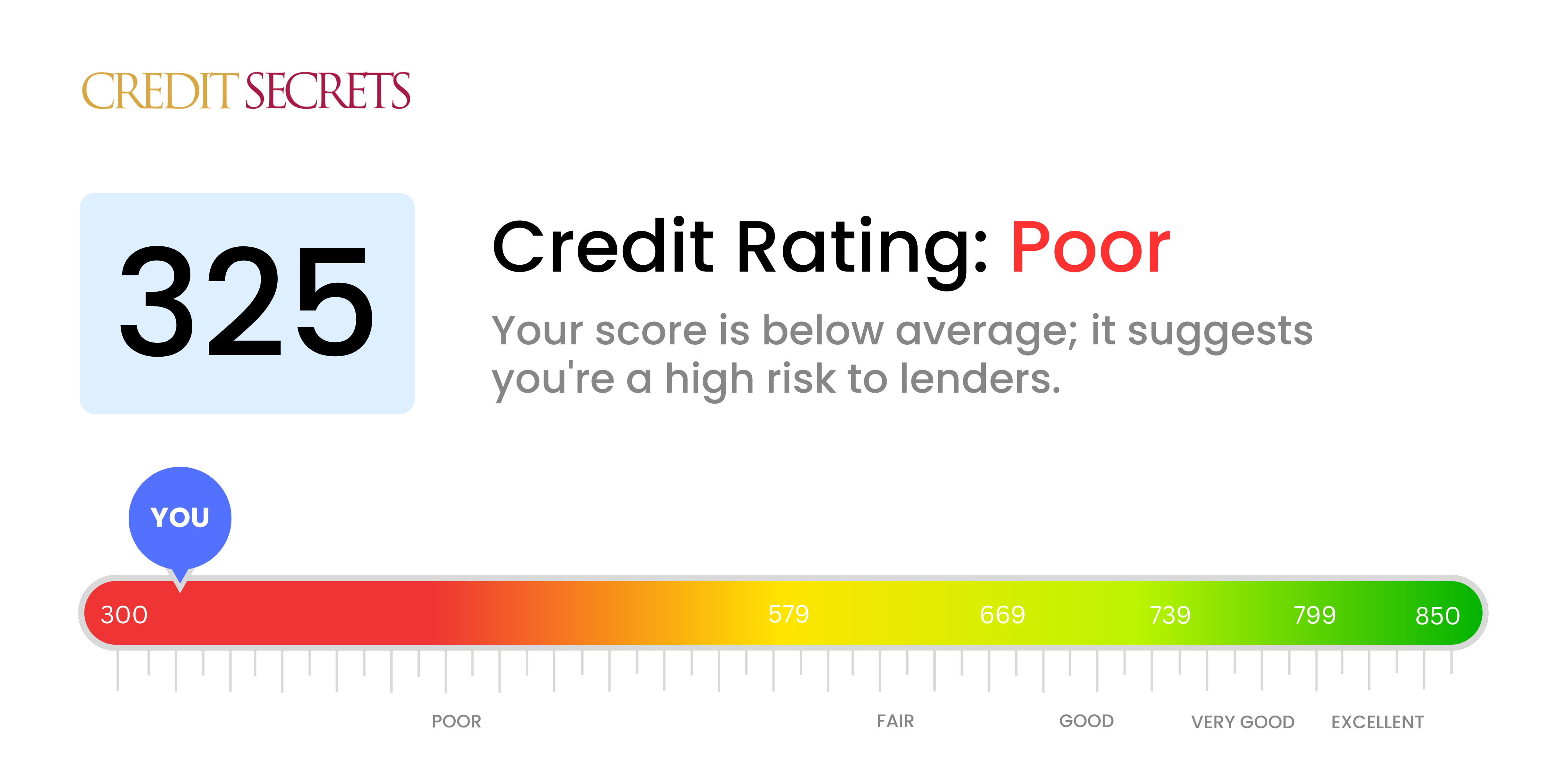

Is 325 a good credit score?

A credit score of 325 falls in the "Poor" range on the standard 300-850 scale. Individuals with this score can expect to encounter significant challenges when attempting to secure credit, such as loans or credit cards.

If you have a score of 325, it is crucial to take immediate action to improve your financial health. Focus on paying your bills on time, reducing your debt, and resolving any negative items on your credit report. By actively working towards improving your credit, you set yourself up for better financial opportunities in the future.

Can I Get a Mortgage with a 325 Credit Score?

Can I Get a Credit Card with a 325 Credit Score?

Can I Get a Personal Loan with a 325 Credit Score?

A credit score of 325 is significantly below the standard range that most traditional lenders consider acceptable for approving a personal loan. In the eyes of a lender, a score this low represents a high level of risk, making it unlikely that you would be approved for a loan under conventional terms. The situation is undoubtedly challenging, but it's important to face the reality of what this credit score implies for your borrowing options.

If traditional loans are off the table, you might consider alternatives like secured loans, where you provide collateral, or co-signed loans, where someone with better credit vouches for you. Peer-to-peer lending platforms are another option, as they sometimes offer more lenient credit requirements. However, it's crucial to understand that these alternatives often come with higher interest rates and less favorable terms, reflecting the higher risk to the lender.

Can I Get a Car Loan with a 325 Credit Score?

What Factors Most Impact a 325 Credit Score?

Payment History

Your payment history has a significant impact on your credit score. Late payments or defaults may be key contributing factors to your current score.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on any delayed payments, as these could have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are close to their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are the balances near the limits? Aim to keep balances low compared to the limit to benefit your score.

Length of Credit History

A shorter credit history can influence your score negatively.

How to Check: Review your credit report to assess the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened new accounts.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are essential for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you have been applying for new credit sparingly.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Examine your credit report for any public records. Address any listed items that may need resolution.

How Do I Improve my 325 Credit Score?

A credit score of 325 is considered very poor, but don’t lose hope! With targeted steps, you can start improving your credit score. Here are the most impactful and accessible strategies for your current situation:

1. Address Past-Due Accounts

If you have any accounts that are past due, it’s crucial to bring them current. Start by focusing on paying off the most overdue accounts first, as they have the most significant negative impact on your credit score. If needed, reach out to your creditors to negotiate a payment plan.

2. Reduce Credit Card Balances

High credit card balances relative to your credit limit can greatly affect your credit score. Aim to reduce your credit card balances to below 30% of your credit limit, with a long-term goal of keeping them below 10%. Prioritize paying down the cards with the highest utilization rates first.

3. Secured Credit Card

Given your current score, qualifying for a regular credit card might be challenging. Consider applying for a secured credit card, which requires a cash collateral deposit that serves as the credit line for that account. Use it responsibly by making small purchases and paying off the balance in full each month to build a positive payment history.

4. Become an Authorized User

Ask a family member or a friend with good credit if you can be added as an authorized user on their credit card. This can help improve your credit score by incorporating their positive payment history into your credit report. Just make sure the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

A diverse mix of credit accounts can contribute to improving your credit score. Once you have established a good payment history with a secured card, explore other types of credit, such as a credit builder loan or a retail credit card, and manage them responsibly.

Remember, improving your credit score takes time and effort, but it is achievable. By taking these steps and staying committed to responsible financial habits, you can start rebuilding your credit and achieving your financial goals.