How to Retire Before 50: 5 Important Habits for Early Retirement

In life, we all want the same things. We want happy families, good friends, good homes, and financial freedom. We want to travel the world, have the best medical care, and above all, enjoy our golden years. We want to retire early.

But, a recent report suggests that many retirement age Americans are not hanging up their work clothes, and sleeping in. A report by the American Bureau of Labor Statistics showed that more seniors are still working than in the past 55 years.

In this article, I go over a few tips you could use if you are interested in retiring by the time you celebrate your 50th birthday.

Create a Financial Plan

To achieve a goal of retiring early, you need a well-defined financial plan as early in life as possible. This plan should encompass your short and long-term goals and everything you want to achieve. While you can create the financial plan yourself, I recommend that you get services from an expert financial planner.

An experienced financial planner will look at your career, your current salary, and your ambitions and suggest a sound plan.

In the past, financial planning services were expensive and unaffordable to many Americans. Some planners charged more than $300 per hour to offer these services. That can be out of reach for some people early in their careers with young families to take care of.

Today, some companies like Learnvest have democratized the financial planning industry by offering remote planners at a lower fee. While some might not want to invest the money, research has shown that financial planning helps.

Start Early

To aid your quest in retiring early, I recommend that you start saving as early as possible. If you are a college student, perhaps consider doing side jobs, especially if it is something you enjoy doing. For example, if you love the spoken word, you raise money for events or Patreon. If you love graphic design, you can do it using platforms like 99Designs and Crowdspring.

Take some of that extra income, and put it in a high yield savings account.

Then, after college, when you get a job, start saving according to your financial plan.

Quick Notes

- It pays to ask your boss for a raise especially after working for a long time in the firm.

- Save the amount of money that you are comfortable with.

- Respect your savings account.

Be Prepared to Take Calculated Risks

You can take calculated risks early in life. For example, you can take the risk of starting a business.

If you look at some of the most successful people in the world, you will see the theme of taking risks. Bill Gates, Mark Zuckerberg, and Steve Jobs were in the best universities and had the potential of working with top companies like IBM. But, they took the risk of doing what they loved and started their businesses.

Even if you are employed, you can still take the risk of starting your own business. First, start the business as a side gig and only quit your job if the business seems promising. Second, be respectful to your boss and ask for a good recommendation, because you never know what the future holds. Third, start a business that you are passionate about. Finally, have enough savings to fall back to if the business fails to work out.

Make Extra Income from Side Gigs

There are hundreds, if not thousands, of opportunities to have simple side gigs to make extra income. Some of the tasks you can do are even enjoyable. For example, if you drive to work, you can make a few dollars by driving another person by becoming an Uber driver. If you have an extra room, you can make money by renting it out using Airbnb. In your free time, you can make a few dollars by answering questionnaires using Inbox Dollars. As you take an evening walk, you can make money by walking your neighbor’s pet using Wag.

You will be surprised at the amount of money you can make every month by doing some of these simple things. You can decide to use this money for your daily expenses or save it.

Quick Notes

- Always, give maximum priority to your main job.

- Always offer the best service to your customers.

- Build your brand by asking for quality reviews and ratings.

- Remember to pay the necessary taxes.

Passive Income

Another idea to earn extra income is by finding passive income ideas that will keep giving you an extra income with little effort. For example, you can invest in a handful of quality, dividend yielding stocks like Microsoft, P&G, and Boeing. I recommend that you do a lot of research to find quality companies and regularly monitor their performance. Alternatively, you can distribute money in several mutual funds, low-cost ETFs, and Robo Advisors.

Alternatively, you can write a book on a subject you are best at. Aim to be an authority in that field which will give you revenue in book sales and conference invitations.

Another option is to invest in real estate. For example, if you can afford it, you can build rental houses which will give you good money in retirement.

Simple Sacrifices

Sometimes, the best way to save is to think twice about big purchases. For example, the iPhone X was just released by Apple. Instead of rushing to be the first to buy the phone, you can wait for a while. By doing that, you will save some money because the price tends to fall a few months or so after launch.

Another sacrifice you can make choosing a sensible vehicle. Instead of buying a posh expensive car, or the newest SUV, you consider buying a quality used car for much less.

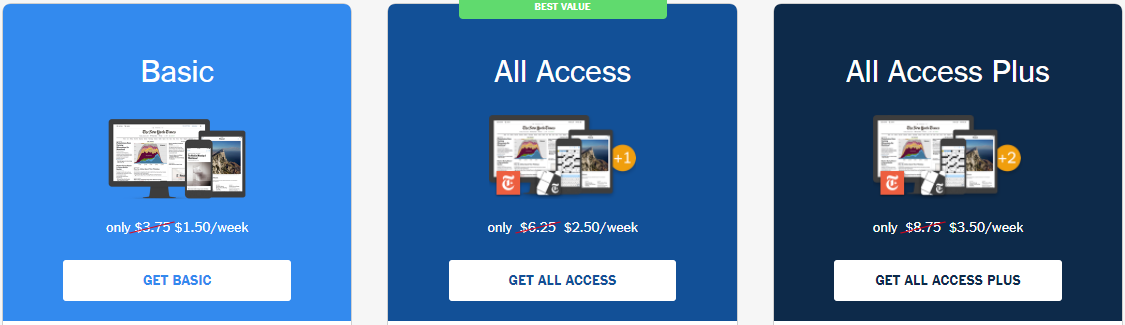

Another way to limit your spending is to assess your subscriptions and cancel those that are unnecessary. For example, if you are an avid New York Times reader, you might opt out of the All Access and the All Access package and go basic.

If you move from the All Access Plus and go Basic, you will save more than $2000 in 20 years.

In addition, when you subscribe to a product or service, always opt out when you no longer need it. For example, if you subscribe to a service that charges you $10 a month, that means in 20 years, the company will make $2,400 from you.

This recommendation does not imply that you buy inferior and low-quality products. It suggests that some less expensive products are usually better than expensive ones. By doing this, you can save a lot of money.

Final Thoughts

It is possible to retire early regardless of your current financial position. All it takes is a good financial plan, discipline, and simple sacrifices. These sacrifices should not make your life boring. In fact, you should live your life to the fullest and enjoy every little part of it. Just keep your eye on the end prize: retiring by the time you are 50!