10 Financial New Year’s Resolutions: Setting Goals for a Prosperous Year

The New Year is a perfect time to hit the reset button. It is an ideal time to reflect on your life and financial well-being.

In fact, a recent study by Statistic Brain found that financial decisions are the third most popular resolutions after weight loss and life improvement.

Sadly, another survey found that only 8% of people who make New Year’s resolutions actually keep them.

Here are the ten ideas for you to consider.

Comparing Yourself to Others

Jealousy is part of life, and we all want to be better than our friends. We want to live in a better house, drive a better car, and have a better job.

We are all always trying to compare ourselves to other people even though we do not admit it.

This is a topic discussed at length by Rachel Cruz in her book, Love Your Life, Not Theirs which focuses largely on the issue of jealousy. It is also an issue that has been amplified by social media platforms like Instagram where people showcase their latest acquisitions.

In the coming year, try to appreciate what you have and be happy for what your friends have. If your friend buys a new better car, be happy for her. If she gets a new job with higher pay, be happy for her.

Remember that their new job could lead to a better opening for you. Also, remember that a candle loses nothing by lighting another candle.

Increase your Retirement Savings Marginally

If you are employed, the chances are that your employer has a retirement plan for you mostly through the 401K.

The percentage the employer has to submit to your retirement account varies. For example, if the employer submits just 5% and your annual salary is $100,000, this means that your monthly contributions are about $415.

If you add just 1%, the monthly contributions are about $500. This is not much, but it will go a long way in improving your retirement life.

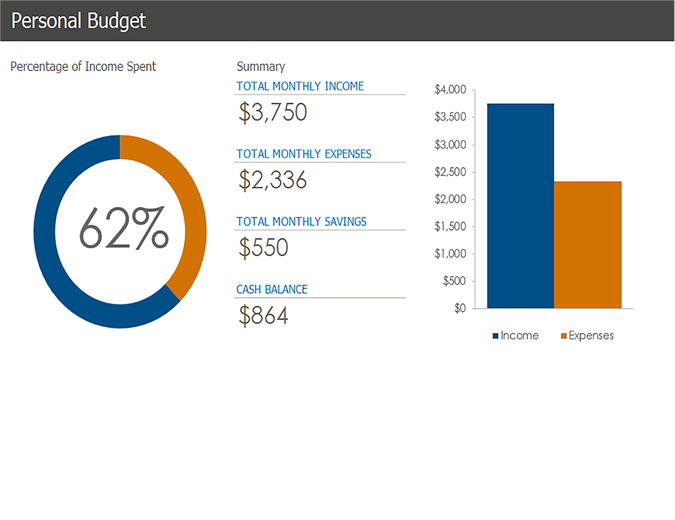

Automate your Budget

A common new year’s resolution is on budgets. People understand the role of budgets, and so they aim to become better at budgeting.

A recent study found out that while more than 80% of people make a budget, less than 20% of them stick to them.

Part of the reason is that most people do mental budgeting. They believe in their memory capability to remember all the aspects of the budget.

To solve this problem, you should decide to use automatic budgeting tools like Mint.com that are connected directly to your bank account. With such devices, you will receive notifications when you overspend.

You will also receive beautiful reports about your spending habits.

Cord Cutting

For decades, the television has been the main source of news and entertainment for many families. Still, it remains a valuable asset in every household.

But, the traditional model of television is broken. Providers charge high prices for services we rarely need. Why pay for 100s of TV channels you rarely watch?

Cord Cutting is an ideal cost-saving method of saving money on cable television. An excellent strategy is to use products like Roku, Sling TV, and YouTube that provides all the TV channels you need for a friendly fee.

You will not be alone. In the last quarter, more than 400K people ditched the cable. By doing this, the incremental savings in the long term will be huge.

Invest Your Pocket Change

In the New Year, you want to live your best. You want to be happy and have fun. So, you don’t want to burden yourself too much.

An ideal way to achieve all this while making meaningful investments is by investing your pocket change. A company called Acorns makes this possible. After registration, you link your account to your credit or debit card. After every purchase, the company rounds off your price and invests the figure. So, if you buy a product for $17, it will take $3 and invest it.

The company invests this change in a pool of stocks, bonds, and ETFs. Therefore, without you knowing, you will be making significant investments, which could change your life.

Just Stop Impulse Buying

A recent study found that 9 out of 10 millennials admitted to impulse buying. This is where you go to a shopping mall or visit an e-commerce website and then without a plan end up spending.

Impulse buying has led many to financial ruin. Yet, in many cases, you can live a good life without buying these products.

In the New Year, make a plan to stop this type of spending. An excellent way to achieve this is by carrying cash and leaving your cards at home.

Ask for a Raise

Recently, Washington passed a sweeping tax reform package that offers companies huge savings like a reduced corporate tax.

This means that companies will have more money than they had in the previous year. Therefore, it is not wrong for you to ask for a pay raise. In fact, most managers are always open to the idea of employees asking for a raise. Moreover, you cannot be fired for asking for a raise.

The key is to know how to go about it. This article explains the do’s and don’ts of asking for a raise.

Take an Online Course

Whether you are employed or in business, you should try this year to advance your skills. Additional skills will not only improve your life, but they could also help you climb the corporate ladder. In fact, most managers admit that they consider the level of training when looking at the people to promote.

A good way to do this is to take an online course from a good university.

Alternatively, you can take online courses from companies like Udemy, Skillshare, and Coursera.

To make this a reality, you should get the course you want, and pay for it at the beginning of the year. Doing this will give you a commitment to press on.

Invest in Your Health

Mainly, finances and health are related. A recent study found that most families do not have $400 for emergencies. Health issues are some of the most common emergencies in the country.

Sure, you cannot prevent some illness or emergencies, but you can do your part to reduces the risks. For example, exercising can help you reduce the chances of critical diseases. The same is true with healthier eating where avoiding junk can help you reduce chances of diabetes or heart failure.

Cut the Subscriptions

We are constantly bombarded with hundreds of subscription products. Consider this. More than 80 million people have subscribed to Amazon Prime while 53% subscribe to news.

These days, there are subscriptions for everything.

In the coming year, you can have a goal of cutting the unnecessary subscriptions or downgrading your subscriptions. Doing this can help you only pay for what you need and save money.

The Bottom-line

If you have not had a good year, the New Year presents an excellent opportunity for you to do a reset. It gives you a chance to put your finances in order. A new set of simple financial resolutions will help you achieve your goals for the coming year. The secret is to make simple resolutions and start working on them immediately when the year begins.

Also, ensure that at the end of every month, you have a meeting with yourself to assess the progress you are making on the resolutions.

Jenn Cartwright

What's Trending